1 Introduction

There are fundamentally two theories explaining immigrants’ location choices. First, it is well known that immigrants tend to move to cities or regions that are thriving. One reading of this evidence is that immigrants may be particularly important for “greasing the wheels” of the labor market by arbitraging away labor market opportunities across locations, explored theoretically by Borjas (2001) and empirically by Cadena and Kovak (2016). At the same time, this has also been the most important concern when trying to estimate the effect of immigration on labor market outcomes by comparing high- to low-immigrant locations as in Altonji and Card (1991), Borjas et al. (1997), and Card (2001) among many others. If immigrants’ primary motive for choosing particular cities or regions is that those areas are thriving, then it is likely that there is a spurious correlation between labor market outcomes and immigrant settlement patterns.

Second, many authors emphasize that immigrants tend to move where previous immigrants settled (Munshi 2003). Former immigrants help newer ones both in migrating and in finding jobs and suitable neighborhoods for their new life in the host country. This idea has been the basis for the networks instrument, the most widely used instrument in the migration literature. Simply stated, past stocks of immigrants are usually a good predictor of future flows, which, in the absence of serially correlated outcomes, provides exogenous regional variation in immigrant inflows.

In this paper, we provide a completely new look at immigrants’ location choices, which we argue has important implications for host economies. Immigrants tend to spend large fractions of their income in their home country. Many send remittances to their families, plan on returning, or simply spend their leisure/vacation time at home. This means that they care not only about the prices of the city or location where they live, but also about the prices in their home countries. We argue that immigrants’ expenditure in the country of origin profoundly shapes their residential choices and wages, which, in turn, affects the distribution of economic activity across locations and the general equilibrium in the host economy.

In the first part of the paper, we use a number of different data sets to document four cross-sectional empirical regularities using data across metropolitan statistical areas in the United States.1In particular we use data from the US census, the March supplements of the Current Population Survey (CPS), the Consumer Expenditure Survey, the Matricula Consular, the New Immigrant Survey, and the World Bank’s International Comparison Program database. First, we report that immigrants concentrate disproportionately in large and expensive cities, where, as it is well known in the urban economics literature, nominal wages tend to be higher (Combes and Gobillon 2014; Glaeser 2008). Second, the gap in (composition-adjusted) earnings between natives and immigrants is largest in these cities. Third, we show that there is significant heterogeneity across immigrant groups both in location choices and relative wages. We use cross-origin and arguably exogenous within-origin variation in real exchange rates to document that immigrants concentrate more and the immigrant-native wage gap is larger in large and expensive locations when the price of the country of origin is lower. We also use state-to-state migration flows data from Mexico to the United States to show that Mexican immigrants from the poorer Mexican states, where presumably price levels are lower, tend to disproportionately migrate to the richest and most expensive states in the United States. Finally, we provide evidence that immigrants consume less locally than natives by comparing housing and total expenditures of otherwise comparable native and immigrant households.

In the second part of the paper, we explain these four strong empirical regularities with a spatial equilibrium model in which choices on locations depend on origin-specific price indices. We first discuss the main results of the paper in a standard free mobility spatial equilibrium model, in which natives consume only locally, whereas immigrants also consume in their home country and therefore also care about price levels there.2Consumption in the country of origin can happen in various forms. It could be that immigrants spend a portion of their time in the home country, or that they send remittances to their relatives, or that they save for the future while intending to return to their country of origin. All these are equivalent from the point of view of the model. See Dustmann (1997) for savings decisions and return migration. Hence, an immigrant requires a lower compensation in nominal wages in order to settle into an expensive city. This implies that immigrants concentrate in expensive cities and that, if wages partly reflect the value of living in a city – which is the case in non-competitive labor markets – the native-immigrant wage gap is higher in high local price index locations.3In order to obtain this result, wage differences between workers cannot be competed away. This means that we depart from standard perfectly competitive models of the labor market and instead consider wage bargaining. See Becker (1957) and Black (1995). Some degree of substitutability between home and local goods allows this mechanism to be stronger for immigrants coming from cheaper countries, which is in line with the data both when we compare location and wage patterns across countries of origin and when we relate them to exchange-rate variation.

We argue that it is difficult to jointly explain all these empirical patterns with alternative mechanisms. For instance, the relationship between city size and native-immigrant wage gaps cannot be explained by immigrant networks. Controlling in our regressions for the size of the immigrant network does not change any of our results. Moreover, it is hard to argue that immigrant networks generate the heterogeneity across countries of origin that we observe in the data. Similarly, differences in human capital between natives and immigrants do not seem to explain our results, since our results hold even within narrowly defined education groups or when we control for immigrant-driven relative supply shocks across education groups. Imperfect immigrant-native substitutability does not explain our results either, given that our emphasis is on a gap in wages that is systematically related to city size and not just on a gap in the wages of natives and immigrants of similar skills. Finally, our results do not seem to be driven by the relative demand for immigrants across locations. First, we do not observe a systematic relationship between immigrant job opportunities and city size, and second, if the relative concentration of immigrants was driven by a relatively higher labor demand in larger cities, we would see higher – not lower – immigrant wages in these larger cities.

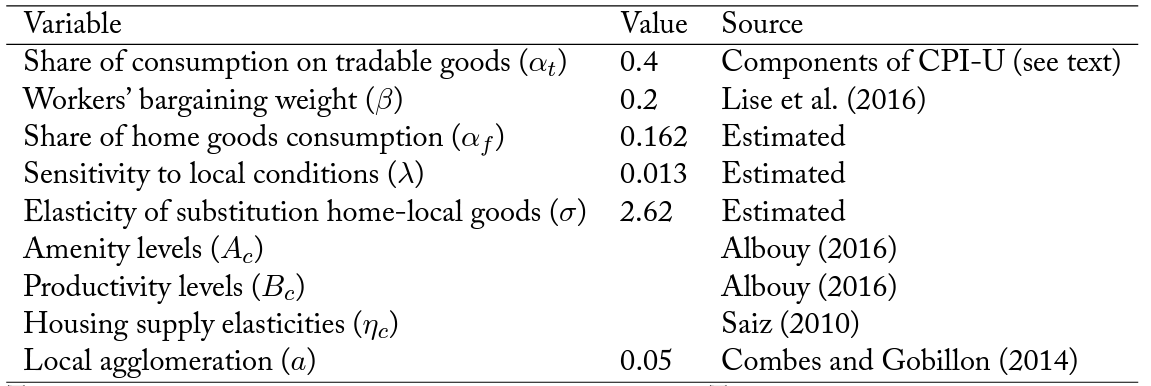

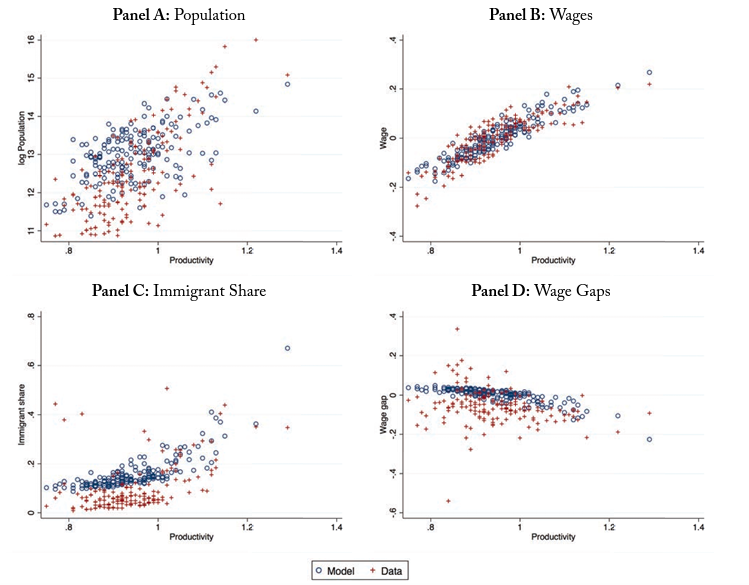

To assess the economic importance of the role of expenditures in the home country, in the third part of the paper we provide a quantitative version of the model and estimate the key parameters using heterogeneity across immigrants in origin price levels. We complement these estimates with parameters from prior literature to perform quantitative exercises. Specifically, we rely on Albouy (2016), Combes and Gobillon (2014), and Saiz (2010). Our baseline estimates, which are obtained only using labor market data, imply that immigrants’ average share of total expenditure for the home country is around 16 percent.4We also analyze how sensitive this estimate is to the various parameters that we borrow from the existing literature. Using a large number of alternatives, we obtain a range of estimates for the average share of consumption in home country that goes from 11 to 19 percent. This means that the distribution of immigrants across locations and their wages relative to those of natives is consistent with immigrants consuming around 16 percent of their income in their country of origin. This aligns well with the direct evidence provided using consumption data, which is not used when estimating the model. This magnitude suggests that the home country is economically important to immigrants and has a strong influence on where immigrants decide to settle and on their wages, which in turn has important consequences for the host country. In line with the observed heterogeneity by country of origin, we estimate an elasticity of substitution between consuming locally and in the country of origin of 2.6, consistent with the higher concentration and lower wages in large cities of immigrants from origins with lower price levels.5The range of estimates that we find for this parameter goes from 2.5 to 3. See previous footnote.

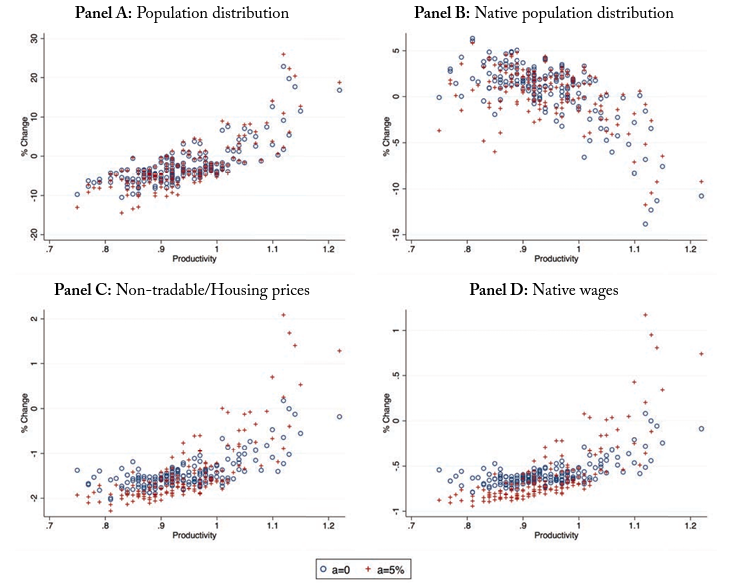

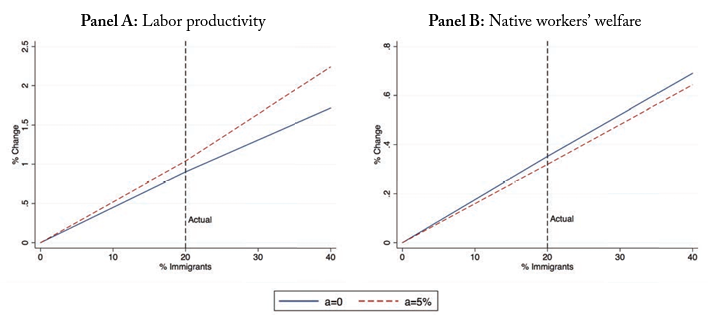

We use our estimated model to compute the counterfactual distribution of population, wages, and economic activity when immigrants do not care about consuming in their home country and therefore are identical to natives. This allows us to quantify how immigrant location choices affect host countries. Our main finding is that there is a significant redistribution of economic activity from small, unproductive cities to large, productive ones as a consequence of immigrants’ location choices.6Large, expensive cities are so, in the context of our model, because they are more productive. See Albouy (2016). In related work, Hsieh and Moretti (2017) show how housing constraints are responsible in part for the smaller than optimal size of the most productive cities. This paper shows that immigrant location choices reduce these constraints. On optimal city size see also Eeckhout and Guner (2014). With current levels of immigration, we show that low-productivity cities are around 10 percent smaller, while those with high productivity are around 15 percent larger compared to the counterfactual. This movement of economic activity towards more productive locations has aggregate implications. We estimate that this displacement of economic activity towards larger cities has increased the aggregate productivity of workers by around 1 percent.

We conclude our analysis by exploring how these changes in economic activity across space affect native workers’ welfare. First, immigrants move economic activity toward more productive locations, helping to expand tradable goods production. Second, they affect local consumption of non-tradables through two channels. On the one hand, given that part of what immigrants earn is spent in their countries of origin, each immigrant household (relative to a similar-looking native household) tends to have lower demand for and, hence, reduces prices of local non-tradable goods, which is positive for native workers’ welfare. On the other hand, many immigrants concentrate in large, expensive, and productive locations, which tends to increase the aggregate local demand for non-tradables in these cities. Combining all these forces we estimate that, at current levels of immigration, native workers’ welfare is around .35 percent higher as a consequence of immigrants’ location choices.

This paper extends the seminal work of Borjas (2001).7There are other papers with models that help to make arguments similar to the one made in Borjas (2001), such as Bartel (1989) and Jaeger (2007). According to Borjas (2001), immigrants “grease the wheels” of the labor market by moving into the most favorable local labor markets. Within a spatial equilibrium framework, this means that they pick cities where wages are highest relative to living costs and amenity levels. Thus, in this context, immigrants do not necessarily choose the most productive cities, or those with the highest nominal wages. Instead, in our model, migrants prefer high-nominal-income cities because they care less than natives about local prices. This is a crucial difference that has important consequences for both the distribution of economic activity across space and the general equilibrium. Moreover, this insight has also important implications for empirical studies that estimate the effect of immigration on the labor market by comparing metropolitan statistical areas (Card 1990; Altonji and Card 1991; Borjas et al. 1997; Card 2005; Lewis 2012; Llull 2017; Glitz 2012; Borjas and Monras 2017; Monras 2015b; Dustmann et al. 2017; Jaeger et al. 2018).8Dustmann et al. (2016) provide a recent review of this literature. In particular, it provides an explanation for the positive correlation between wage levels and immigrant shares across metropolitan statistical areas (MSAs), and, given the persistence in city size rankings (Duranton 2007), why immigrants keep settling in the same locations decade after decade.

This paper is also related to a large body of recent work on quantitative spatial equilibrium models, including Redding and Sturm (2008), Ahlfeldt et al. (2015), Redding (2014), Albouy (2009), Fajgelbaum et al. (2016), Notowidigdo (2013), Diamond (2015), Monras (2015a), Caliendo et al. (2015), Caliendo et al. (Forthcoming), and Monte et al. (2015), among others, who explore neighborhoods within cities, the spatial consequences of taxation, local shocks, endogenous amenities, the dynamics of internal migration, international trade shocks, and commuting patterns.9Redding and Rossi-Hansberg (Forthcoming) provide a recent review of this literature. However, only Monras (2015b), Piyapromdee (2017) and more recently Burstein et al. (2018) use spatial equilibrium models to study immigration. Relative to these papers, we uncover novel facts that we use to understand general equilibrium effects of immigration that were unexplored until now. In fact, much of the literature on immigration ignores general equilibrium effects. Many studies compare different local labor markets – some that receive immigrants and some that do not (Card 2001) – or different skill groups (Borjas 2003). Neither of these papers, nor the numerous ones that followed them, are well suited to exploring the general equilibrium effects of immigration, and only a handful of papers use cross-country data to speak to some of those effects (Di Giovanni et al. 2015). Within-country general equilibrium effects are, thus, completely under-explored in the immigration literature.

Finally, this paper also ties in with a significant amount of literature that investigates the effects of migrants on housing markets and local prices more generally. There is evidence that suggests that Hispanic migrants tend to settle in expensive MSAs and that they exert pressure on housing price(Saiz 2003, 2007; Saiz and Wachter 2011). Relative to these papers, we document broader patterns in the data that are in line with this evidence, and we provide a mechanism that can account for these facts and a quantitative spatial equilibrium model that highlights its importance. There is also some literature showing that price levels in high-immigrant locations may decrease relative to low-immigrant locations (Lach 2007; Cortes 2008). This is usually explained by the impact that immigration has on the cost of producing some local goods. We abstract from this mechanism in this paper, but we could easily integrate it into our model.

In what follows, we first describe our data in section 2. In section 3, we then introduce a number of facts describing immigrants’ residential choices, wages, and consumption patterns. In section 4, we build a model that rationalizes these facts. We estimate a quantitative version of this model in section 5 and use these estimates to study the contribution of immigration to the spatial distribution of economic activity. Section 6 concludes.

2 Data

For this paper, we rely on various publicly available data sets for the United States. For labor-market variables, we mainly use the US Census, the American Community Survey (ACS), and the Current Population Survey (CPS), all available on Ruggles et al. (2016) and widely used in previous work. For consumption, we combine a number of data sets that allow us to (partially) distinguish between natives’ and immigrants’ consumption patterns. These include the New Immigrant Survey and the Consumer Expenditure Survey. For country of origin data we use price levels estimated by the World Bank.10We have also used per capita GDP from the Penn World Tables to check that our results are robust to using GDP per capita instead of price indices in the home country. We describe these various data sets below.

2.1 Census, American Community Survey, and Current Population Survey data

First, we use CPS data to compute immigrant shares, city size, and average (composition-adjusted) wages. The CPS data are gathered monthly, but the March files contain more detailed information on yearly incomes, country of birth, and other variables that we need. Thus, we use the March supplements of the CPS to construct yearly data. In particular, we use information on the current location – mainly MSAs – in which the surveyed individuals reside, the wage they received in the preceding year, the number of weeks that they worked in the preceding year, and their country of birth. We only consider male wage and salary workers who are not in school and report positive weeks and hours worked in our sample, and we define immigrants as individuals born outside the United States. This information is only available after 1994, and so we only use CPS data for the period 1994-2011. To construct composition-adjusted wages, we use Mincerian wage regressions in which we include racial categories, marital status categories, four age categories, four educational categories, and occupation and MSA fixed effects. The four education categories are high school dropouts, high school graduates, some college, and college graduation or more.

Second, we use the census of population data for the years 1980, 1990, and 2000. These data are very similar to the CPS, except that the sample size is significantly larger – from a few tens of thousands of observations to a few million observations. After 2000, the US census data are substituted on IPUMS by the ACS. The ACS contains MSA information only after 2005, and so we use these data. Again, the structure of these data is very similar to the census and CPS data. Our treatment of the variables is identical in each case.

We also use these data to compute local price indices. To do this, we follow Moretti (2013) and apply his code to ACS and census data. From that, we obtain a local price index for each of the MSAs in our sample, which takes the variation in local housing cost into account.11We use the version of Moretti’s price index that is calculated as the weighted sum of local housing cost and the cost of non-housing consumption, which is assumed to be the same across areas. Local housing costs are measured as the average of the monthly cost of renting a two- or three-bedroom apartment in an MSA. The CPS does not contain a number of variables that are used for this computation – in particular housing price information – which explains why we cannot compute local price indices using CPS data.

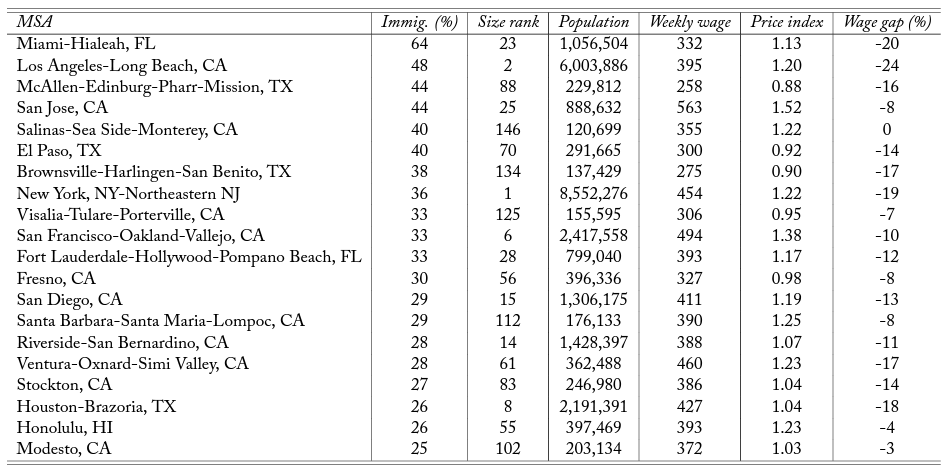

To give a sense of the metropolitan statistical areas driving most of the variation in our analysis, table 1 reports the MSAs with the highest immigrant share in the United States in 2000, together with some of the main economic variables used in the analysis. As we can see in table 1, most of the MSAs with high levels of immigration are also large and expensive and pay high wages. The gap in earnings between natives and immigrants is also large in these cities. In this general description, there are a few notable outliers, which are mostly MSAs in California and Texas relatively close to the US-Mexico border.

2.2 New Immigrant Survey and Consumer Expenditure Survey data

To explore whether immigrants consume less locally than natives, we employ two different data sets. First, we use data from the New Immigrant Survey to document remittance behavior. While not a large data set, it is the only one to our knowledge that provides information on both the income and the amount remitted at the individual or household level for immigrants residing in the United States. These data cover newly admitted legal residents.

Table 1. List of top US cities by immigrant share in 2000

Notes: This table shows a number of statistics for the sample of metropolitan statistical areas with the highest immigrant shares. These statistics are based on the sample of prime-age workers (25-59) from the 2000 census. Weekly wages are computed from yearly wage income and weeks worked. Local price indices are computed following Moretti (2013). The wage gap is the gap in wage earnings between natives and immigrants (a negative number means that natives’ wages are higher), controlling for observable characteristics.

The second data set that we use is the Consumer Expenditure Survey, which is maintained by the Bureau of Labor Statistics and has been widely employed to document consumption behavior in the United States. It is a representative sample of US households and contains detailed information on consumption expenditure and household characteristics. Unfortunately, it contains no information on birthplace or citizen status, which is why it is impossible to directly identify immigrants. Instead, we rely on one of the Hispanic categories that identifies households of Mexican origin in the years 2003 to 2015.12Monras (2015b) shows that the overlap between individuals identified as Hispanics of Mexican origin and Mexican-born individuals is around 85 percent in census data. This gives us confidence that, by using the Hispanic variable in Consumption Expenditure data, we are capturing a large number of Mexican-born individuals. The data set contains around 30,000 households per year, of which around 7 percent are of Mexican origin.

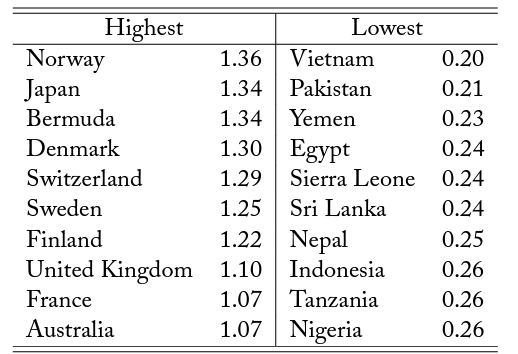

2.3 Real exchange rate data

The World Bank provides real exchange rates with respect to the United States for a large number of countries in its International Comparison Program database.13The exact title of the series is “Price level ratio of PPP conversion factor (GDP) to market exchange rate.” These data expand the 89 countries of origin that we use in our estimation exercise.14An alternative source of similar information is provided by the OECD and the Penn World Tables. The OECD also estimates price levels of various countries. The number of countries that the OECD covers is smaller, which is why we report estimates in the paper using the World Bank data, although estimates for OECD countries may be more reliable because they cover richer, more developed, countries. We obtain similar estimates using OECD data. We also obtain similar estimates using the GDP per capita in the country of origin, obtained from the Penn World Tables, to proxy for the price index. In table 2, we provide a list of the top and bottom 10 countries in terms of the average real exchange rate with respect to the United States over the years 1990, 2000, 2010. Prices in countries like Norway and Japan are around 35 percent higher than in the United States. However, there are not many countries in the world where prices are higher than in the United States. Australia, ranked 10th in the table, is only 7 percent more expensive than the United States. On the other end, prices in countries like Vietnam (with large immigrant communities in the United States) have prices that are only 20 percent of those in the United States.

Table 2. Countries with the highest and the lowest real exchange rates

Notes: This table lists the top and bottom 10 countries with the highest and the lowest average real exchange rate with respect to the United States according to real exchange rate data from the World Bank from the years 1990, 2000 and 2010.

3 Empirical evidence

In this section, we start by documenting a series of facts about immigrants’ location choices and wages. In particular, we show that immigrants concentrate much more than natives in large, expensive cities and that they tend to earn less than natives there. We also demonstrate that these patterns are stronger for immigrants coming from countries with lower price levels, as measured by the real exchange rate, and for Mexicans who moved to or within the United States in years with low real exchange rates. We then show that Mexicans from poorer origin states in Mexico disproportionately move toward richer states of destination in the United States. We also show that the patterns are stronger for immigrant groups that are likely to be less attached to the United States. We argue that these patterns are driven by the differential consumption patterns of natives and immigrants, which we document by showing that immigrants tend to consume less than similar-looking natives at the local level.

3.1 Immigrants’ location choices and city size

The first fact that we document in this paper is that immigrants tend to live in larger, more expensive cities in greater proportions than natives. This is something that was known to some extent in the literature (Eeckhout et al. 2014; Davis and Dingel 2012) but here we document it much more systematically; we use a much larger number of data sets and we expand the existing literature by showing that there is also a strong relationship between immigrant shares and local price indices.

A simple way to document this fact is to regress the distribution of immigrants relative to the distribution of natives on city size or price level. In order to do this, we define the relative immigrant share as the share of immigrants living in city c divided by the share of natives living in city c and regress this measure (in logs) on the size or price level of city c. More specifically, we run the following regression:

where Imm is the number of immigrants and Nat

is the number of natives in city

at time

. When the subscript

is omitted, the variables represent the total number of immigrants or natives living in the country in a particular time period.15We only use urban population for the entire analysis. Non-urban local labor markets are usually defined by commuting zones (Autor et al. 2013). To define non-urban commuting zones we need information on county of residence, which is not provided for ever year in CPS data. Urban commuting zones and MSAs are essentially the same.

is either the total number of people in the city or its price level. We run separate regressions for each year.

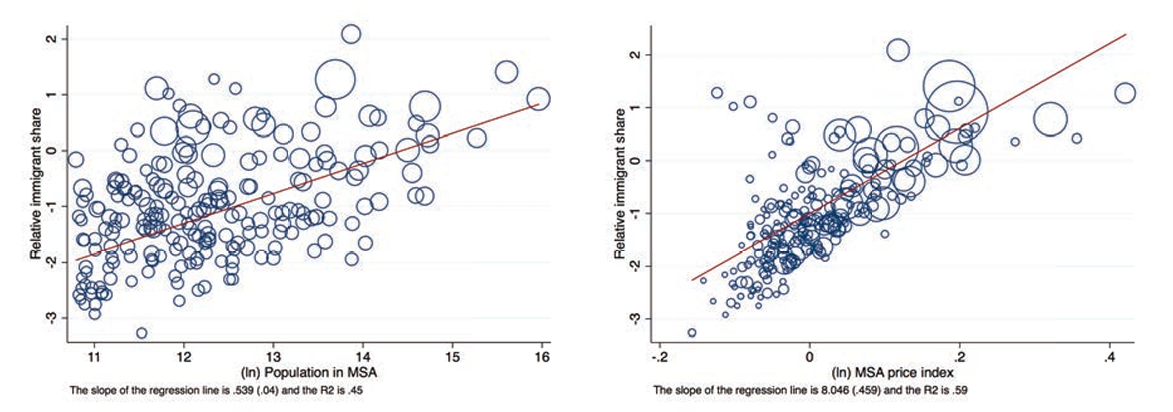

Figure 1 shows these relationships using data from the 2000 census. In the left-hand panel, we observe that, even if there is some variance in the relative immigrant share across metropolitan statistical areas, there is a positive and statistically significant relationship between the distribution of immigrants and city population. The marker sizes are proportional to the respective city price indices and indicate that the more populous cities also tend to be more expensive. The relationship between the relative immigrant share and price indices shown in the right-hand panel is even stronger, and the linear fit is better.16This is also the case when we include both city price and city size in a bivariate regression. Here, marker sizes reflect city population levels. While there are some outliers, mainly along the US-Mexico border, a city with a local price index that is 1 percent higher is associated with an 8 percent higher relative immigrant share. In appendix A.3, we show that this relationship also holds when using commuting zones instead of MSAs.17Commuting zones are a partition of the US territory. Commuting zones can be divided between urban and rural commuting zones. Urban commuting zones are equivalent to MSAs, whereas rural commuting zones are not captured by MSA information. This evidence is in line with the contemporaneous paper by Albouy et al. (2018), which argues that immigrants live in relatively high-nominal wage, low-amenity locations.

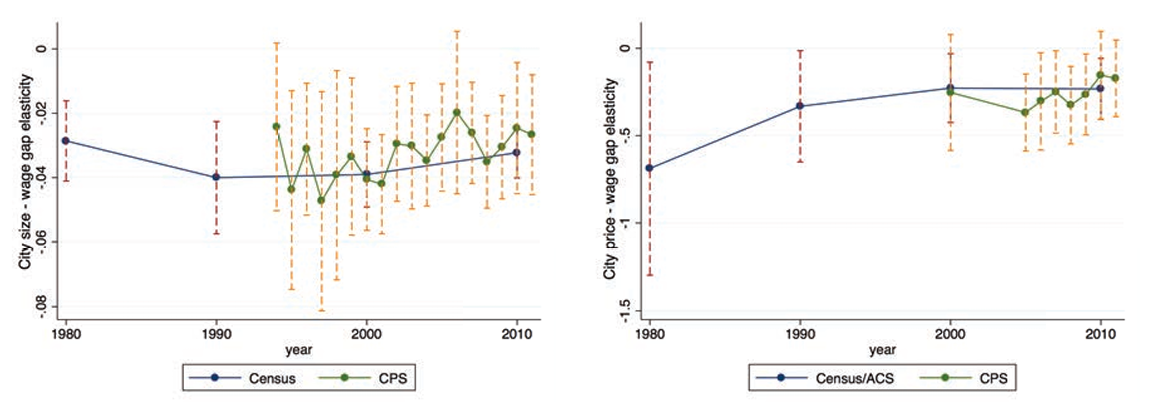

In figure 2, we investigate how these relationships have evolved over time. To show this, we first run a linear regression following equation 3.1 for each of the years displayed along the x-axis of the figure against the city size or the price index, and we then plot the various estimates and confidence intervals for these elasticities.

Figure 1. City size, price index, and relative immigrant share

Notes: This figure shows the relationship between the relative share of immigrants in an MSA and the MSA population (left) and price index (right). The relative share of immigrants is measured as the number of immigrants in the MSA relative to all immigrants in the United States divided by the number of natives in the MSA relative to all natives in the United States. The figure is based on the sample of prime-age workers (25-59) from the 2000 census. The MSA price indices are computed following Moretti (2013). Each dot represents one of 219 MSAs in the sample. Marker sizes reflect MSA price indices in the left-hand plot and population level in the right-hand plot.

Figure 2. Evolution of the city size/price elasticity of the relative immigrant share

Notes: Each dot in this figure shows the cross-MSA elasticity between the relative share of immigrants in an MSA and the MSA population (left) and the price index (right), for each year indicated in the x-axis. The relative share of immigrants is measured as the number of immigrants in the MSA relative to all immigrants in the United States divided by the number of natives in the MSA relative to all natives in the United States. Vertical lines represent 95% confidence intervals. This figure uses census, ACS, and CPS data from 1980 to 2011. Price indices are computed following Moretti (2013) and can only be computed when census and ACS data are available.

The left-hand panel in figure 2 shows that the relationship between the relative immigrant share and city size has been positive since the 1980s and has become slightly stronger over time. While in 1980 the elasticity was around 0.3 percent, it has increased over the years to reach almost 0.5 percent when using the census data. We observe a similar trend in the CPS data, but estimates are smaller and noisier, driven by measurement error of city sizes. The elasticity of immigrant shares and local price indices first decreased from around 9 to 7 percent between 1980 and 1990 but has remained relatively stable since then.

3.2 Native – Immigrant wage gaps

In this subsection, we investigate how the gap in (composition-adjusted) wages between natives and immigrants is related to city size and city prices. If wages reflect, at least in part, the value of living in a location – which is a natural result in non-competitive labor market models, see section 5 – we should expect the relationship between wage gaps and city size and city prices to be the mirror image of relative location choices documented in section 3.1. To investigate this, we run Mincerian type regressions of the following type:

where indexes individuals,

indexes cities,

indexes years,

is an indicator variable for

being an immigrant, ln

indicates city size or city prices, and

contains observable individual characteristics.18The individual controls are five dummies for race (white, black, American Indian/Aleut/Eskimo, Asian/Pacific Islander, other), five for marital status (married, separated, divorced, widowed, never married/single), four age groups (three 10-year intervals from 25 to 54 and 55 to 59), four education categories (high school dropout, high school graduate, some college, college graduate or more), and 82 occupation categories, which are based on the grouping of the 1990 occupation codes from https://usa.ipums.org/usa/volii/occ1990.shtml. An estimate of β < 0 means that the gap in wages between natives and immigrants is larger in large or more expensive cities.19We also obtain β < 0 when including year and MSA fixed effects using multiple years of data. See, for example, table 4. Note that these regressions can also be used to compute city-specific wage gaps and immigrant-native wage gaps, which are useful for visualizing the estimate of β. In the results that we report in the main text, we do not interact the controls

with the immigrant dummy. Not doing so assumes that the returns to observable characteristics are the same between natives and immigrants, which is what we later implicitly assume in the model. In table A.1, discussed in appendix A.1, we show that the results do not change if we interact the controls with an immigrant dummy.

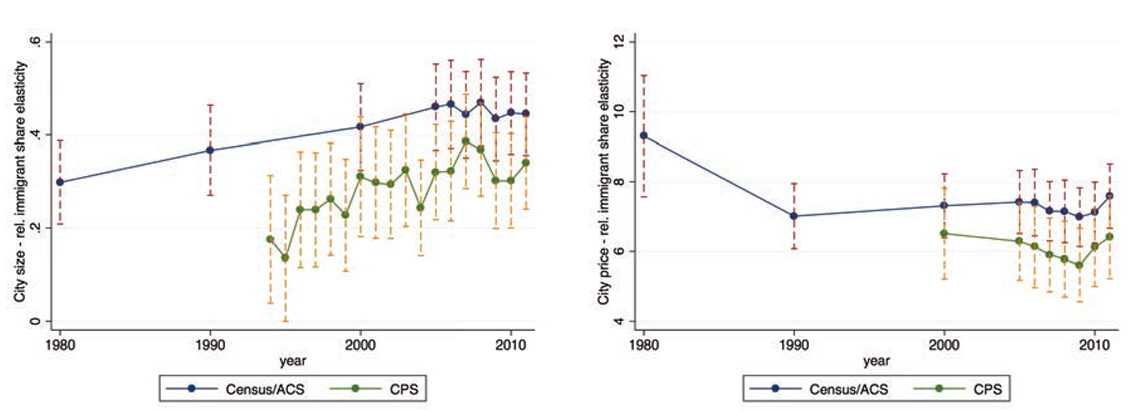

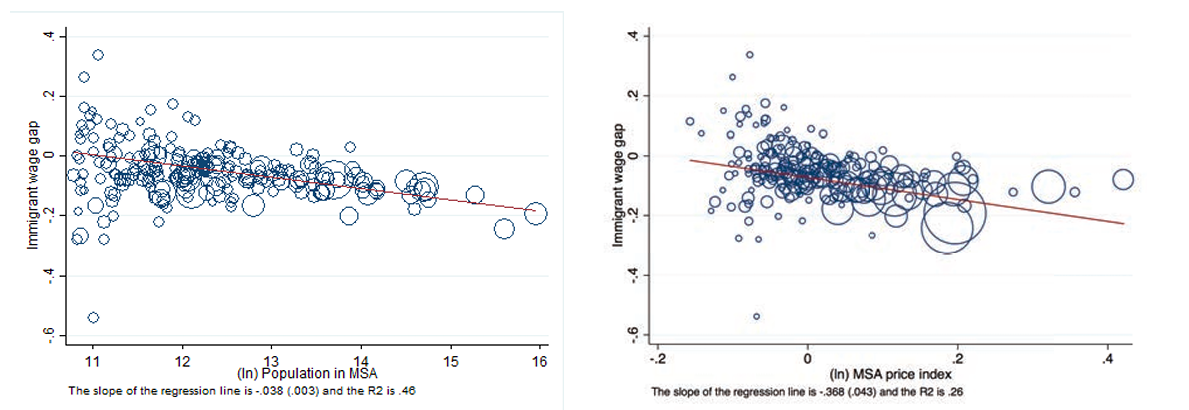

As before, we present the results in two steps. Figure 3 shows the estimates using data from the 2000 census. In the left-hand panel, we plot the difference in composition-adjusted wages between natives and immigrants in our sample of metropolitan statistical areas against the size of these cities.20We generate these wage gaps at the city level by running a regression similar to 3.2 but interacting the immigrant dummy with MSA dummies instead of population and taking the coefficients of these interactions as city-specific wage gaps. The relationship is negative and strong. The estimate is -0.038, meaning that if a city is 10 percent larger, the gap in wages between natives and immigrants is 0.38 percent larger. Moreover, the relationship between native-immigrant wage gaps and city size is very tight. The R squared is around 0.46, and the standard errors of the estimate are small. In appendix A.3, we show that this result also holds when using commuting zones instead of MSAs. The results also hold when we exclude Mexicans – which is the main immigrant group in the US – from the wage regressions, as can be seen in table A.1 in the appendix.

One way to assess the stability of the relationship between native-immigrant wage gaps and city size over

Figure 3. City size, price index, and wage gaps

Notes: This figure plots the relationship between the gap in wages between immigrants and natives (controlling for observable characteristics) and the metropolitan statistical area (MSA) population and price index. A negative number for the native-immigrant wage gap means that immigrants are paid less than natives in that MSA. The figure is based on the sample of prime-age male workers (25-59) from the 2000 census. The MSA price indices are computed following Moretti (2013). Each dot represents one of 219 MSAs in the sample. Marker sizes reflect MSA price indices in the left-hand plot and population level in the right-hand plot.

time is estimating the model for each year. The results are shown in figure 4. As before, we show the estimates using both census and CPS data over a number of years between 1980 and 2011. The relationship remains tight at around 0.035 through the entire period in both data sets. The right-hand panels of figures 3 and 4 show the relationship between native-immigrant wage gaps and local price levels. We also observe a negative and tight negative relationship. If anything, it seems that over time, this relationship has become a little weaker but remains at around -0.36.

To the best of our knowledge, this is the first paper to document this very strong feature of the data in the United States. It suggests that, for whatever reason, immigrants who live in larger, more expensive cities are paid less (relative to natives) than immigrants who live in smaller, less expensive cities.21On average, immigrants earn less than natives, but this is driven mostly by immigrant wages from lower-income countries and by immigrants of all income levels in larger cities. This is not driven by the composition of immigrants across US cities. In figures 3 and 4, we control for observable characteristics, which include education, race, marital status, occupation, and so forth. Furthermore, we check that this relationship prevails for each education group independently by running separate regressions by education category, and we check that it is robust to controlling for immigrant networks, imperfect native-immigrant substitutability, and legal status, as reported in appendix A.1. We discuss this in more detail in section 3.5.

Figure 4. Evolution of the city size/price elasticity of the wage gap

Notes: Each dot in this figure shows the cross-MSA elasticity between the relative gap in wages between immigrants and natives (controlling for observable characteristics) in a metropolitan statistical area and the MSA population (left) and price index (right) for each year indicated in the x-axis. This figure uses census, ACS, and CPS data from 1980 to 2011. Price indices are computed following Moretti (2013) and can only be computed when census and ACS data are available.

3.3 Immigrant Heterogeneity

3.3.1 Heterogeneity by real exchange rate

In section 5 below, we argue that the results reported so far can be explained by the fact that part of what immigrants consume is related to the home country. This implies that if there is some degree of substitution between consuming locally or consuming in the country of origin, the patterns documented so far should be stronger for immigrants coming from countries of origin with lower price levels relative to the United States or, in other words, lower real exchange rates with respect to the US dollar.

To show that this is indeed the case, we perform two alternative exercises in this subsection. First, we show that the relationships between local price indices and both location choices and wage gaps are stronger for immigrants from countries with lower real exchange rates. We use both across and within-country variation to document this fact. Second, we use exchange rate fluctuations between Mexico and the United States to show that these patterns are stronger for Mexicans that migrate to the United States when the real exchange rate of the Mexican peso is low.

Before using a regression framework, we first show in a simple graph the elasticities of relative locations and wage gaps of immigrants from different countries of origin as a function of the real exchange rate for the year 2000. For this, we estimate equation 3.1 at the city-origin level (i.e., we replace by the immigrant population from the respective origin, and we estimate β for each origin). We then estimate the same specification with the wage gaps as dependent variable, which are calculated for each city as the difference in natives’ and immigrants’ mean residual obtained from a regression of the wage on the control vector

(see equation 3.2).

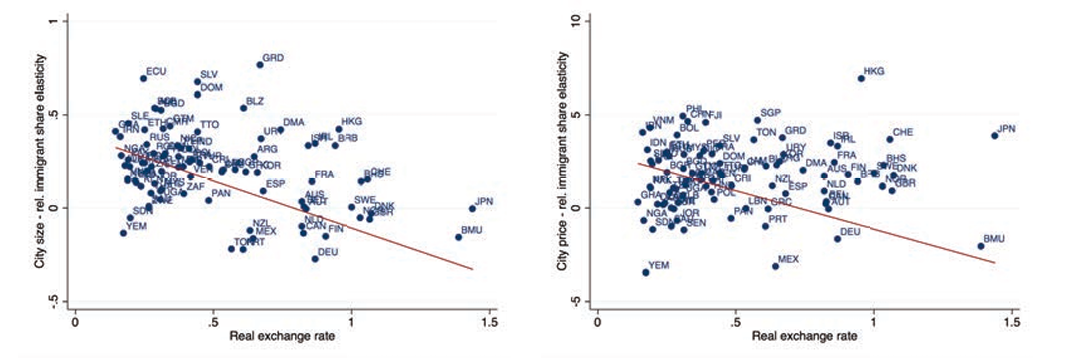

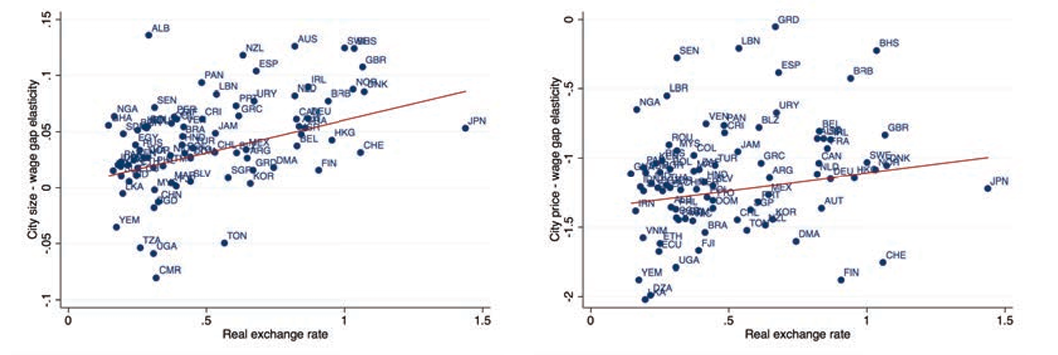

One challenge of this exercise is that there are some countries of origin for which we observe immigrants only in a subset of the MSAs of our sample, and hence there are some zeros when computing relative immigrant shares at the MA-origin level. To address this, we concentrate on the top 100 MSAs by size and the top 89 sending countries.22Different selections of MSAs lead to slightly different selections on the number of sending countries, which results in small changes in the estimates. Expanding the number of MSAs tends to introduce more measurement error, which attenuates the estimates of the regressions with many fixed effects. Reducing the number of MSAs obviously reduces the number of observations, which has small consequences on the point estimates and confidence intervals.Figure 5 shows the plots of the city price elasticities and city size elasticities of the relative immigrant share against real exchange rates in panel A and the elasticities of the wage gap in panel B. All plots show statistically significant relationships that go in the expected direction. Panel A shows that the elasticity of the relative share of immigrants with respect to city size or city price from countries with lower real exchange rates is higher. This means that immigrants from low price index countries concentrate more in bigger and more expensive cities than immigrants from richer countries of origin. The relationship of the elasticity of the wage gap with respect to city size or city price and real exchange rates is the mirror image of the relative location choices.23Recall that the wage gap is defined as immigrant wage minus native wage. Therefore, a negative elasticity indicates an increasing wage gap. As can be seen in panel B, the elasticity of the wage gap is higher for immigrants from higher price indices, meaning that the difference in wages between natives and immigrants does not increase as much for immigrants from high price, richer countries of origin. Overall, these graphs show that there is substantial variation across countries of origin, which is well aligned with the role that differences in prices should play in shaping the importance of home country expenditures for immigrants from different countries of origin.24An alternative to this exercise is to see if the interaction of the immigrant dummy and city size or city price of equation 3.2 is higher at lower quantiles of the wage distribution. We show that this is indeed the case in figure A.1 of the appendix.

To document these relationships more systematically, we expand equations 3.1 and 3.2 by interacting the city variable directly with the real exchange rate (RER) and use data not just for 2000 but for all our available censuses also. In particular, we estimate regressions of the following type:

where as before ln denotes the population or the price level of MSA

, and

is the real exchange rate of origin country

with respect to the United States.

and

are country of origin and year fixed effects, respectively. We estimate the relative share equation using a PPML regression model in order to deal with the incidence of zeros (Santos Silva and Tenreyro 2006). The wage regressions are simply extended Mincerian type regressions like the ones we used before, since

is zero for individuals born in the United States and a continuous variable instead of the immigrant dummy.

Figure 5. City size/price elasticity of relative immigrant share and wage gap by origin price level

Panel A: Relative immigrant shares

Panel B: Wage gap elasticities

Notes: This figure uses data from the 2000 census to show the elasticity between the relative immigrant shares (panel A) and the native-immigrant wage gaps (panel B) and the city size and city price, for each of the different countries of origin, as a function of the country of origin price level. Hence, each dot represents an estimate of the coefficient β in equation 3.1 and equation 3.2, restricted to each country of origin.

The estimates of interest are and

. A negative estimate of

means that immigrants from cheaper countries tend to concentrate more in larger, more expensive cities. Similarly, a positive estimate of

and

), the identifying variation comes from RER fluctuations across decades for each country of origin. When not including the fixed effects, the identifying variation comes from comparison across country of origin.

We present the results on relative immigrant shares in table 3. In the first column, we only include the real exchange rate. A positive estimate means that the distribution of immigrants from countries of origin with higher exchange rates tends to be more similar to the distribution of natives. This is because the relative immigrant share is on average higher if the distributions of immigrants and natives are more similar. The relationship is not very strong, however. In the second column, we include the population. This replicates

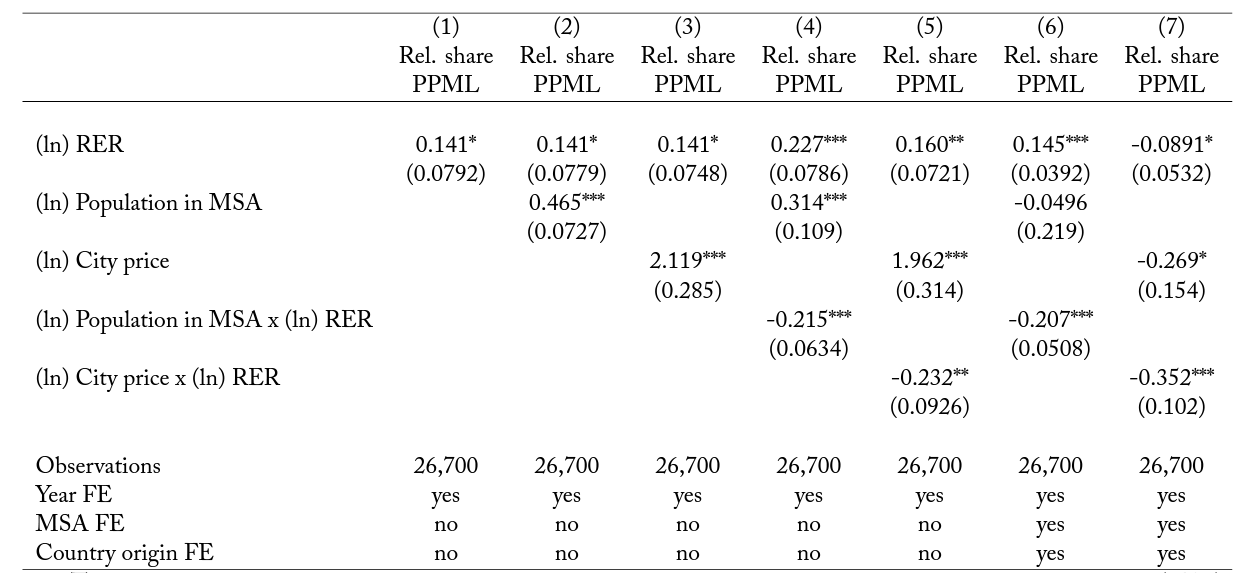

Table 3. Immigrant heterogeneity: location choices

Notes: This table shows regressions of relative immigrant shares and wages on population and city prices, real exchange rates (RER), and their interaction. The regressions are limited to the top 100 MSAs in size and 89 sending countries for the years 1990, 2000, and 2010. Standard errors clustered at the MSA-country of origin level are reported. We weight each observation by the number of individuals in a year-MSA-origin cell. * significant at the 0.10 level; ** significant at the 0.05 level; *** significant at the 0.01 level.

the result we showed before. The relative share of immigrants is increasing in city size and city price, as shown in column 3. In column 4, we introduce the interaction between real exchange rates and city sizes. A negative estimate suggests that the relative concentration of immigrants from high exchange rate locations (e.g., Japan, Germany, or the United Kingdom) in larger cities is less strong than for immigrants from lower price indices (e.g. India or China). Column 5 repeats the specification of column 4 but uses city prices instead of city sizes. The estimate is, again, negative, suggesting that immigrants from low price index countries disproportionately locate in larger and expensive cities. The identifying variation in columns 4 and 5 comes from comparing different countries of origin. In columns 6 and 7, which are our preferred specifications, we include country of origin and location fixed effects. This means that we compare the relative location of immigrants within each country of origin as a function of exchange rate fluctuations.

The estimates using this variation are quite similar in magnitude to the ones using cross-origin variation.

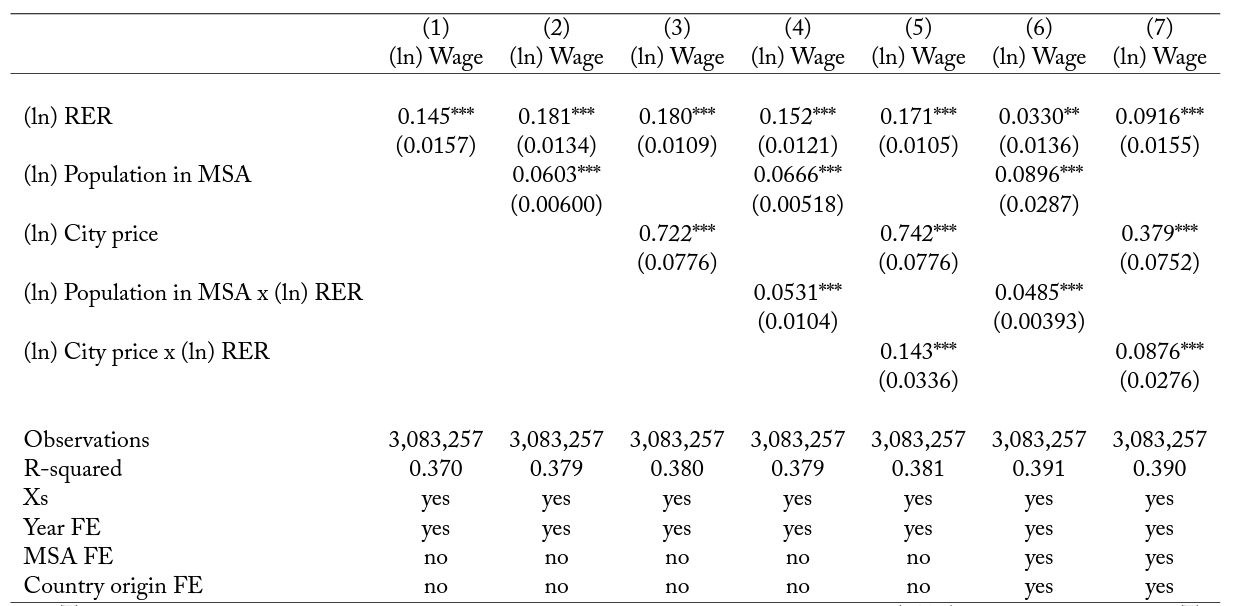

Table 4 repeats the exercise for wages. Table 4 shows that relative wages of immigrants are essentially the mirror image of relative location choices. In column 1, we include the real exchange rate in an otherwise Mincerian regression. This shows that immigrants from high price index countries tend to have higher wages than the ones from low price index countries. This likely reflects a combination of the unobservable skills brought to the United States and the outside option in the wage determination process. In the second column we include the size of the location, and in the third column we include city prices. As it is well known, larger and more expensive cities tend to pay higher wages, both to immigrants and to natives. In column 4 we include the interaction between city size and country of origin real exchange rate. A positive coefficient means that for countries of origin with high price indices, the city price premium increases more than for lower price countries of origin, and similarly, with city prices, as shown in column 5. Columns 6 and 7 repeat the exercise controlling for country of origin and location fixed effects (i.e., using within-origin variation). The results are, in what is our preferred specification, quite similar to those in columns 4 and 5.

Table 4. Immigrant heterogeneity: wage gaps

Notes: This table shows regressions of wages on population and city prices, real exchange rates (RER), and their interaction. The (ln) real exchange rate for natives is equal to 0; hence, the interaction between the real exchange rate and MSA population size or price level is the differential slope in wages between natives and immigrants as a function of the real exchange rate. The regressions are limited to the top 100 MSAs in size and 89 sending countries for the years 1990, 2000, and 2010. Standard errors clustered at the MSA-country of origin level are reported. * significant at the 0.10 level; ** significant at the 0.05 level; *** significant at the 0.01 level.

One caveat of the results shown in tables 3 and 4 is that we can only use exchange rate variation over the 10-year gaps when census data is available. To complement this evidence we also use higher frequency fluctuations in real exchange rates. Exchange rate fluctuations are common and difficult to anticipate over short time horizons.25In this paper, we complement the evidence shown in Nekoei (2013). Exchange rate fluctuations affect not only the intensive margin of immigrant labor supply decisions (i.e., hours worked) but also, and very importantly, the extensive margin (i.e., location choices). More concretely, we use variation in the exchange rate between the United States and Mexico for each year and focus our analysis on Mexican immigrants who move to the United States from abroad or who move within the United States across states in a given year. We investigate whether these immigrant movers concentrate more in large cities in years when prices in their home country are lower. For this exercise, we use the yearly CPS data and concentrate on Mexican migrants, as they are by far the largest immigrant group, and thus measurement error is smaller. We can only compute city size

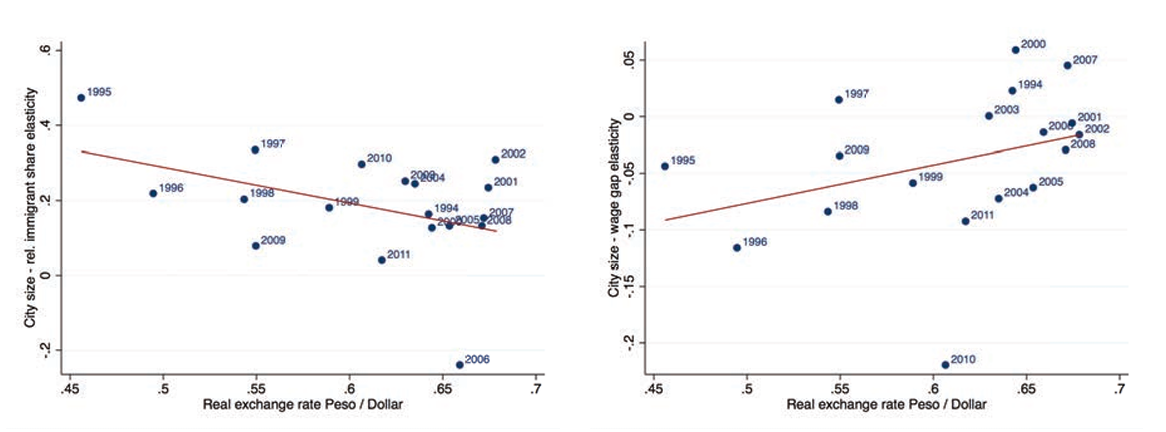

Figure 6. City size elasticity of relative immigrant share and wage gap of Mexicans

Notes: This figure uses data from the CPS 1994-2011 to show the relationships between the relative immigrant share and the (composition-adjusted) wage gap of Mexican immigrants who changed location during the indicated year and the city size elasticity. More specifically, we estimate the elasticity for each year and plot it against the average real exchange rate of the Mexican peso to the US dollar during that year. Hence, each dot represents an estimate of the coefficient β for the particular year based on equations 3.1 and 3.2. We can only compute city size elasticities because price indices can only be computed using ACS and census data, which is available only in selected years. elasticities because CPS data does not include the necessary information to compute city price levels as in Moretti (2013).

As before, we estimate equations 3.1 and 3.2 using Mexican movers separately for each year and plot the β coefficients against the average real exchange rate of the Mexican peso to the US dollar during that year.26We do not take the log of the left-hand side of equation 3.1 to avoid losing MSAs without Mexican immigrant movers. The two plots in figure 6 show a linear fit that goes in the expected direction. The lower the prices in Mexico are relative to US prices, the more positive is the elasticity of the relative share of Mexican immigrants and the more negative the elasticity of the wage gap with respect to city size.

3.3.2 Heterogeneity by state of origin in Mexico

To explore immigrant heterogeneity even further, in this subsection we use data on Mexican flows from particular states of origin in Mexico to particular states of destination in the United States.27The publicly available Matricula Consular data is only available at the state level. What we have argued would suggest that immigrants from low price index origins in Mexico would disproportionately move to high price index destinations in the United States.

Unfortunately, we do not have local price index data for Mexican locations. Instead we use GDP per capita at the state level to proxy for local price indices. There is usually a strong correlation between price levels, wages levels, and GDP per capita, which suggests that using GDP per capita is a good proxy.

To investigate the heterogeneity in migration flows by Mexican state of origin we use the following estimation equation:

where is either the fraction of all immigrants from origin

that move to destination

or the log of this fraction,

is the GDP per capita in

, and

is the GDP per capita in

. In some specifications we also control for the level of population at origin and destination, or by origin and destination fixed effects. Our main hypothesis is that

is negative. If

it means that there are relatively less flows to high GDP pc destinations from higher GDP pc origin states.

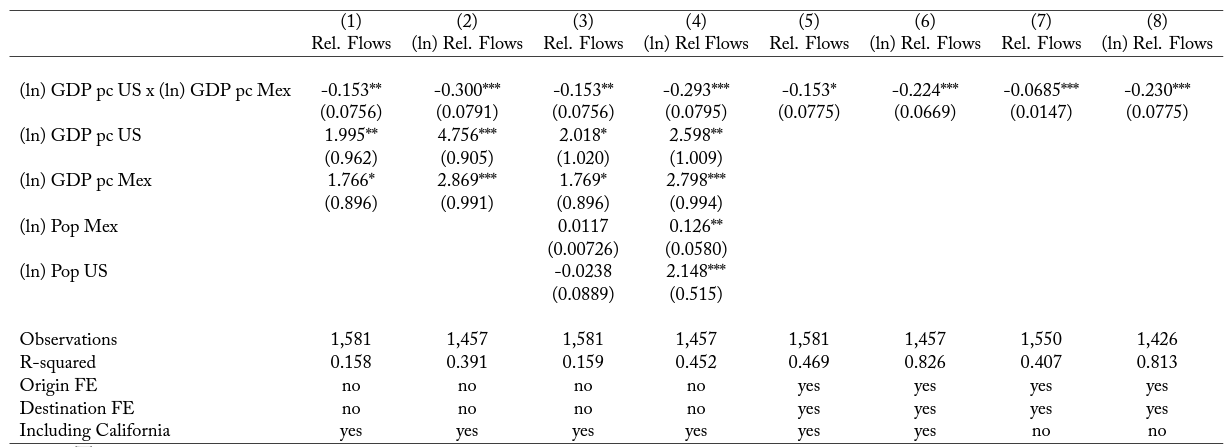

Table 5. Mexican Immigrant Flows

Notes: This table shows the results of regressing the flows of immigrants from origin to destination j relative to all migrants from Mexican state i on the GDP per capita at destination (j), at origin (i), and the interaction between the two. We also control for total population at origin and destination. The data covers 31 sending Mexican states and 51 receiving US states. Columns (7) and (8) exclude the largest destination state (California) from the regression. Data from the Matricula Consular 2016. Robust standard errors clustered at the destination level are reported. * significant at the 0.10 level; ** significant at the 0.05 level; *** significant at the 0.01 level.

Table 5 presents the results. In the first two columns we simply explain the flows of Mexican immigrants from origin to destination

by the GDP per capita at origin and at destination. Mexicans of all origins tend to disproportionately move to high GDP per capita states in the United States. This can be read as further corroborating that immigrants prefer to move to high nominal income locations. The positive coefficient of origin per capita GDP shows that there are more migrants from high GDP per capita origin states. Selection or credit constraints when migrating can explain this result (Angelucci 2015). The next two columns control for the size of the origin and destination states. This is an important control since larger origin states and larger destination states likely send and receive more migrants, respectively. In the final two columns, we include state of origin and state of destination fixed effects. These should control for unobservable characteristics of the states that go beyond size and GDP per capita. The last two columns exclude California as a destination state. All the specifications show the same result. There is a disproportionate flow of immigrants from low GDP per capita origin states towards high GDP per capita destinations.

3.3.3 Heterogeneity by attachment to the United States

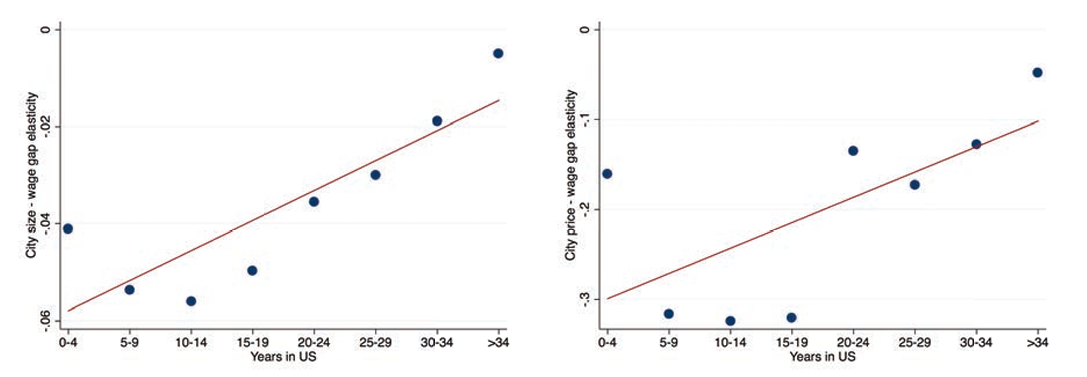

An alternative source of heterogeneity is potentially provided by Mexicans who live closer to or farther from the border. The former are likely to have stronger ties to Mexico. These ties may take various forms. When living closer to the border, it may be easier to spend longer periods of time in Mexico and to stay in closer touch with family members not in the United States; thus the weight of the home country may be greater. We can use this insight to see whether the wage gap between Mexicans and natives, and the relationship between this gap and city size, is stronger for Mexicans close to the border.28Cities close to the Mexican border are defined as locations in California, Arizona, New Mexico, or Texas, which are the four US states that share a border with Mexico. For this, we run the wage regressions with Mexican immigrants separately for people living in cities in border states and for people living in non-border states. In order to account for characteristics of Mexicans that might differ across these samples and are that likely to influence wages, we include years in the United States and a dummy for being undocumented as additional controls.

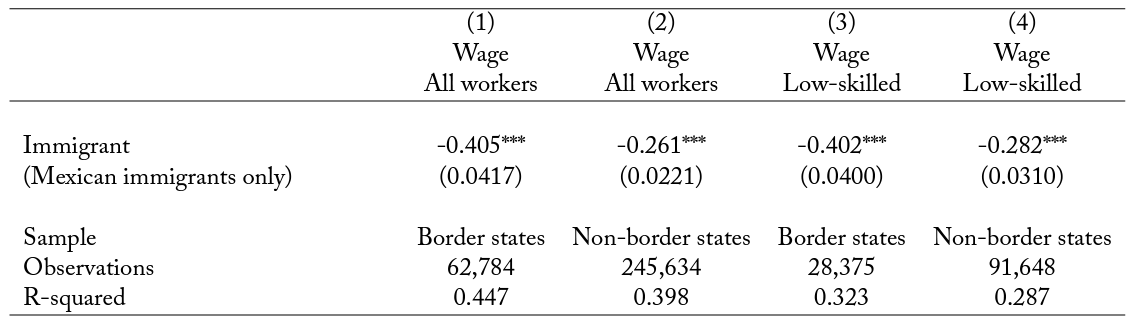

The first two columns of panel A in table 6 show that Mexicans living in border states earn less relative to natives than Mexicans in non-border states. This could suggest that the opportunity to spend a larger part of the income at lower prices across the border allows Mexicans to accept lower wages. There are also alternative explanations for these results, so it is worth emphasizing that we take them purely as suggestive evidence that the mechanism posited in this paper may be relevant for explaining these patterns in the wages of immigrants of the same country of origin. Columns 3 and 4 show that the same is true when we restrict the sample to low-skilled workers, suggesting that the differences reported in columns 1 and 2 are not driven by human capital differences. Columns 1 and 2 of panel B show that the gap in wages between Mexicans and natives decreases faster with city size in locations close to the Mexican border than in locations farther away. Thus, Mexicans earn less if they are closer to the border than they do if they are farther away. Additionally, the relationship between Mexican-native wage gaps and city size is stronger. Columns 3 and 4 of this panel restrict the regressions to low-skilled workers, again showing that the results are not driven by human capital differences.

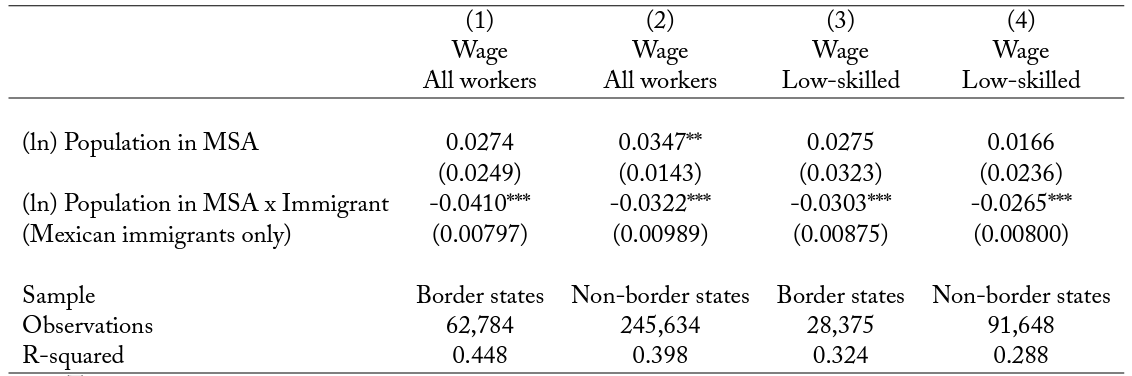

Another variable that is potentially related to host country attachment is immigrants’ length of stay in the United States. According to Dustmann and Mestres (2010), immigrants who do not intend to return to their countries of origin remit a smaller share of their income. They are also less likely to spend time back home and thus are, in some way, more similar to natives. There is also a large body of literature starting with Chiswick (1978) that estimates the speed of assimilation into the receiving country. This literature has interpreted the early gap in wages between natives and immigrants as the lack of skills specific to the receiving country. While this is certainly a possibility, it does not explain why this gap increases with city size. However, we can use the insights from the immigrant assimilation literature to see whether the relationship between city size and city price level is stronger for newly arrived immigrants than for immigrants who have been in the United States longer. To investigate these ideas, we use the year of immigration taken from the census data and divide immigrants into groups depending on their time spent in the United States. We plot the city size-wage gap elasticities and city price-wage gap elasticities for different groups of immigrants by the years since arrival in figure 7. The positive slope in each graph of the figure indicates that the differences in wages between natives and immigrants (and how they relate to city sizes and prices) tend to diminish the longer an immigrant remains in the United States.

Table 6. Mexican – native wage gaps and distance to Mexico

Panel A

Panel B

Notes: This table reports wage regressions for different samples of Mexicans, showing the differential wage of Mexican immigrants to natives (panel A) and the wage of Mexican immigrants and how it changes with city size (panel B). These regressions only report selected coefficients. The complete set of explanatory variables is specified in equation 3.2, and is expanded by including the number of years that Mexicans have been in the United States. MSA and year fixed effects are also included in the regression. These regressions use CPS data for the years 1994 to 2011. Low-skilled workers used in columns (3) and (4) are defined as being high school graduates or less. Robust standard errors, clustered at the MSA level, are reported. * significant at the 0.10 level; ** significant at the 0.05 level; *** significant at the 0.01 level.

3.4 Immigrant consumption and return migration patterns

In this section, we document the importance of consumption in the home country by analyzing remittance behavior, housing expenditure, consumption expenditure, and return migration patterns. All our findings are in line with the notion that a part of the income (or potentially of future income) of immigrants is spent at the country of origin.

Figure 7. City size/price elasticity of wage gap by immigrants’ years in the country

Notes: This figure uses data from the 2000 census to show the relationships between the city size and city price elasticity of the native-immigrant (composition-adjusted) wage gap as a function of the time spent in the United States, shown in the x-axis. More specifically, each dot represents an estimate of the coefficient β for the particular group based on equation 3.2.

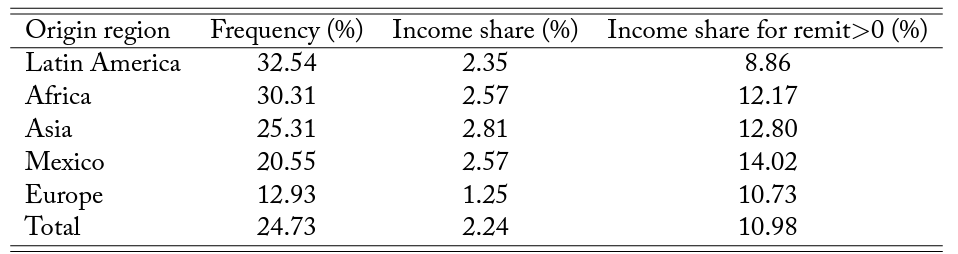

3.4.1 Remittances

Dustmann and Mestres (2010) report that immigrants in Germany remit around 10 percent of their disposable income. While data of similar quality as in their study do not exist for the United States, we can use the New Immigrant Survey to get some notion of the remittance behavior of newly admitted immigrants in the United States. Table 7 reports the likelihood, the share of income, and the share of income for those immigrants who remit, for a number of different origins. There is quite some variation in the likelihood of remitting across origins. For example, 20 percent of immigrants from Mexico and as much as 32 percent of immigrants from other Latin American countries seem to remit part of their income to their home countries. This number is significantly lower for immigrants from European countries.

Table 7. Remittances

Notes: This table uses data from the 2003 New Immigrant Survey (NIS). The NIS is a representative sample of newly admitted, legal permanent residents. Statistics are based on the subsample of immigrants with positive income (from wages, self-employment, assets, or real estate) and with a close relative (parent, spouse, or child) living in the country of origin. Income shares over 200 percent are dropped.

For the entire population of immigrants, immigrant remittances represent between 2 percent and 3 percent of income, approximately. For those who remit, this number logically increases to between 10 percent and 15 percent, which is closer to the estimate provided in Dustmann and Mestres (2010). All in all, the numbers for the United States seem broadly consistent with this prior literature. The main drawback of New Immigrant Survey data is that they do not include undocumented immigrants. Including that group would likely change the numbers significantly.

3.4.2 Expenditures on housing

One way to explore whether immigrants consume different local goods than natives is to investigate housing expenditure. If immigrants spend a portion of their income on home goods, they should (potentially) spend less of their income on local housing (i.e., their rent).29In appendix A.4 we also show results on home-ownership status. Immigrants are less likely to own a housing unit relative to similar-looking native households. Rental prices paid vary considerably by income and other characteristics that potentially differ between the immigrant and native populations; because of this, we explore whether immigrants spend less on their rent than similar-looking natives.30In this respect, the most important controls are household income and household size. We use two alternative data sets for this. The first piece of evidence comes from census and ACS data, which can be used to compute “Monthly Rents” and total household income, and at the same time identify the country of birth of each individual. We can thus use the following regression equation to investigate whether households with at least one immigrant consume less than natives, once we control for household income and other characteristics:

where “Immigrant” is a dummy variable indicating that household is an immigrant household, where

indicates household characteristics, and where

are location fixed effects. When the (household) income measure is continuous, we can use as dependent variable “Monthly Rent/Income”, which leads to similar results, as we show below.

A different type of data that contain housing expenditure is the Consumer Expenditure Survey. The main drawback of these data is that they do not allow us to identify the country of birth of a respondent. Instead, we need to rely on the identification of Hispanics from Mexico (which should be highly correlated with Mexican-born individuals, which, in turn, is one of the main immigrant groups).31See section 2 and Monras (2015b) for a discussion of this point. In these data, moreover, we do not have a continuous measure of household income. Instead, we have nine different income categories that we include as control dummies. In particular, we run regressions of the following type:

where “Housing expenditure” is the reported expenditure on housing and “Mexican” identifies households of Mexican origin. Note that this “Mexican” dummy identifies Mexican households with error. This means that we will likely obtain a downward biased estimate of β when using Consumption Expenditure Survey data.

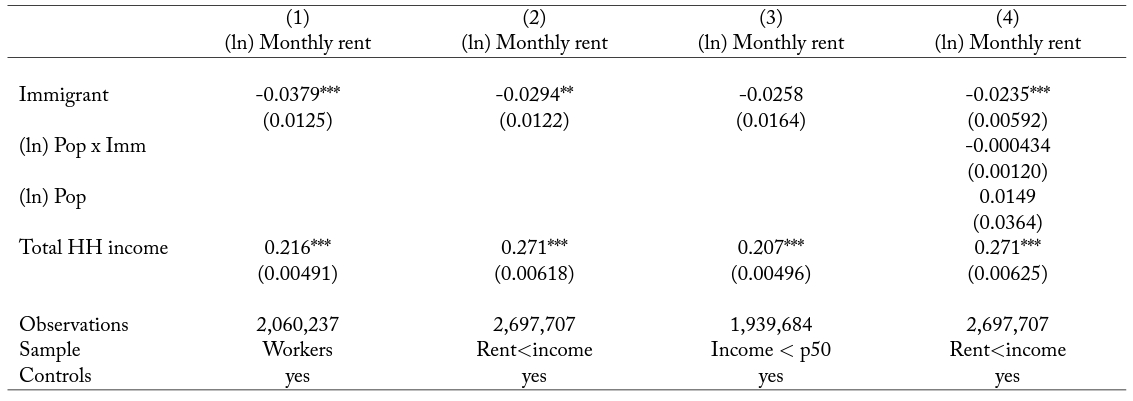

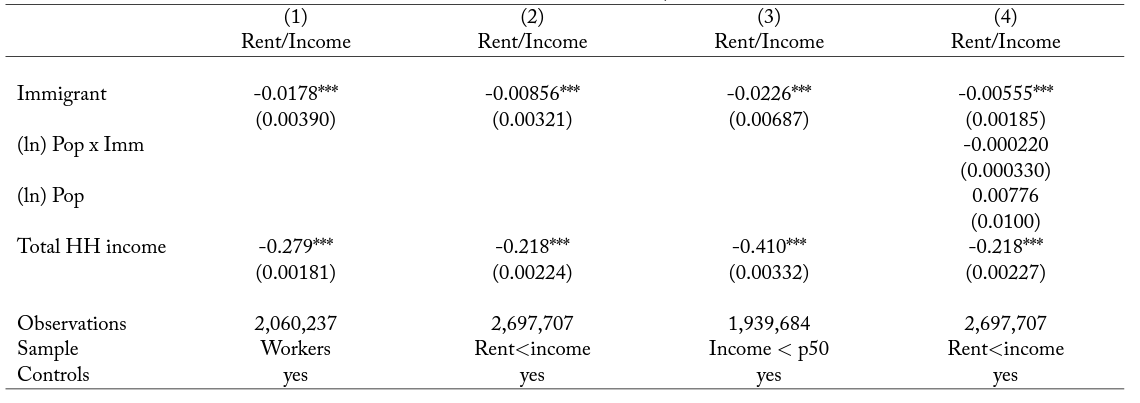

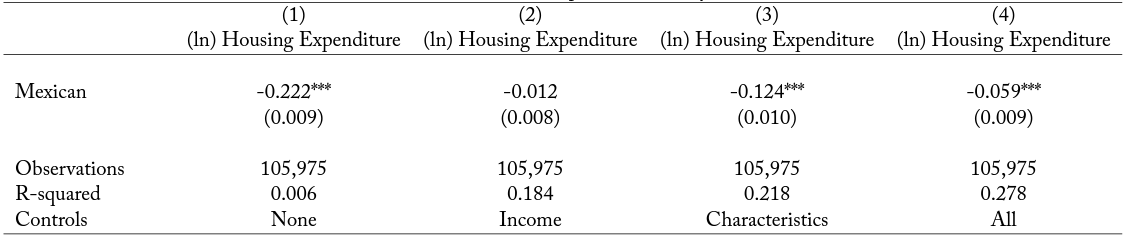

The results are reported in panels A, B, and C in table 8. In panel A, we show that immigrants pay on average around 3 to 4 percent less in rental prices than comparable natives. In column 1, we use the full sample of households where the head is working and find that, once we control for personal characteristics and household income, immigrant households pay monthly rents that are around 3 to 4 percent lower compared to native households. The estimates are similar when we use all households in the sample or only the ones in the bottom half of the income distribution. In column 4, we investigate whether these results vary with the size of the city, which does not appear to be the case.32Note that a positive estimate of the interaction term between city size and the immigrant household dummy could invalidate the fact that immigrants consume less than natives in at least some locations. Panel B reports the exact same results but uses house expenditure as a share of income instead of (log) total housing expenditure as a dependent variable. The results are in line with panel A. Immigrant households consume around 1 to 2 percentage points less of their income on rents than similar-looking natives.

Panel C reports the results using Consumer Expenditure Survey data. These data do not identify metropolitan statistical area (MSA), so all comparisons are within state. In column 1, we show the regression of housing expenditure on a dummy indicating whether the household is of Mexican origin. The unconditional regression shows that it is indeed the case that these households consume less on housing. This, however, could simply reflect that they tend to earn less, or that their observable characteristics (e.g., education or residential choices) are such that these types of household tend, on average, to consume less on housing. Column 2 controls for household income. This drops the estimate to a statistical zero. Column 3 shows that controlling for personal characteristics and for time and state fixed effects is important. Mexican households tend to be systematically different than native households in terms of education, residential choices, marital status, and, most importantly, family size. When in column 4 we control for both income and personal characteristics, we see that Mexican households consume less on housing than similar-looking native households, although the difference is not as large as the unconditional regression. This is our preferred estimate and aligns well with the census estimates. Given that we do observe the MSA of residence, we cannot see whether households in larger MSAs appear to consume differently in this data set.

Table 8. Immigrants’ expenditure on housing

Panel A: Census and ACS data

Panel B: Census and ACS data, shares

Panel C: Consumer Expenditure Survey data

Notes: Panel A shows regressions of (ln) monthly gross rents on an immigrant dummy, (ln) total household income, and observable characteristics (including race, occupation, MSA of residence fixed effects, year fixed effects, family size, and marital status). Panel B reports regressions of the share of income spent on monthly rents on the same controls. Panel C shows regressions of (ln) housing expenditure on an immigrant dummy identifying immigrants of Mexican origin, observable characteristics (including race, occupation, state of residence fixed effects, year fixed effects, family size, and marital status), and household income bins’ fixed effects instead of a continuous measure of income. The data for panels A and B are taken from the US census and ACS from 1980 to 2011. The data for panel C are taken from the Consumer Expenditure Survey. Sample “all” uses all possible observations. Sample “workers” uses the observations where the head of the household is working. Sample “rent<income” restricts the sample to households whose total income is larger than the total rent (i.e., 12 times the monthly rent). Sample “income < p50” restricts the sample to workers in the bottom half of the earnings distribution (including homeowners and renters). Standard errors are clustered at the MSA level in panels A and B and at the state level in panel C. * significant at the 0.10 level; ** significant at the 0.05 level; *** significant at the 0.01 level.

3.4.3 Total expenditure

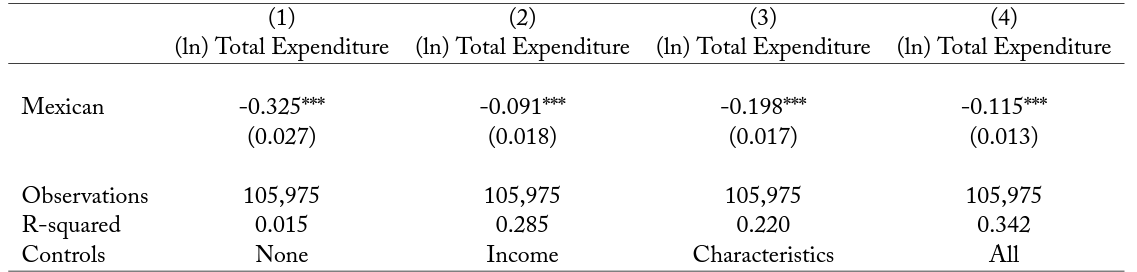

While it seems clear that immigrants spend less on housing than natives, it may be that they use this income on some other local goods, or rather that they save it for future consumption. To explore this, we can use the Consumer Expenditure Survey data and compare total local expenditure by Mexican households to that of all other households, following panel C in table 8.33For this section we use the variable “totexpcq” from the Consumer Expenditure Survey. This variable combines expenditures on all items. More specifically, we can use the following specification:

where “Total Expenditure” is quarterly total expenditure at the household level.

Table 9. Immigrants’ total expenditure, Consumer Expenditure Survey

Notes: This table shows regressions of (ln) total expenditure on a number of personal characteristics (including race, occupation, state of residence fixed effects, year fixed effects, family size, marital status, household income bins’ fixed effects instead of a continuous measure of income, and an indicator identifying households of Mexican origin). Standard errors clustered at the state level. * significant at the 0.10 level; ** significant at the 0.05 level; *** significant at the 0.01 level.

The results are reported in table 9. Mimicking the results of panel C in table 8, we show that, unconditionally, Mexicans seem to consume around 32 percent less than other households. When controlling for both income and characteristics in column 4, we find that Mexican households consume around 12 percent less than other households. Given that in Consumption Expenditure Survey data we identify Mexican immigrants imperfectly (see section 2 for more details), we expect some attenuation in this estimate. This estimate is consistent with the remittances sent to their home countries or with them saving more for future consumption. We investigate whether future consumption in the home country is a potentially important channel in the following section.

3.4.4 Return migration

A final and very important reason why immigrants care about price indices in their home country is that many of them likely plan to return home at some point during their lifetime (Dustmann and Gorlach 2016; Lessem Forthcoming; Dustmann and Weiss 2007; Dustmann 2003, 1997).

To the best of our knowledge, there are no large, representative data sets directly documenting return migration patterns. This would require observations in both the destination country and the home country over a certain period of time. While there are some data sets that make this possible, they are generally not very comprehensive.

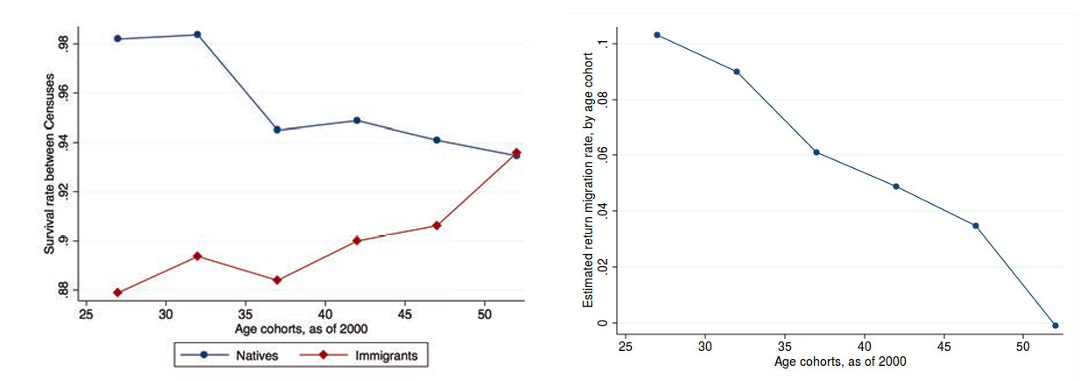

To obtain a better sense of general return migration patterns in the United States, we turn to census data. In particular, we can track the size of cohorts of immigrants and natives across censuses and use information on immigrants’ year of arrival to see how many of them are “missing” in the following census, and thus likely to have returned to their home countries.

The left-hand graph in figure 8 plots these survival rates by age cohort. We observe that more than 98 percent of the natives aged between 25 and 30 in 2000 are still present in the 2010 ACS. This survival rate declines with age. For example, for the population that in 2000 was between 45 and 50 years old, the survival rate decreases to around 94 percent. When we carry out the same exercise for immigrants who arrived in the United States before 2000, the survival rates decline substantially with respect to natives.34We use the years 2000 and 2010 because there are strong reasons to suspect that there is some undercount of immigrants in censuses prior to 2000. For example, the number of Mexican immigrants who claim to have arrived before 1990 in the 2000 census is larger than the total number of Mexicans observed in the 1990 census. See also Hanson (2006).

Figure 8. Return migration

Notes: This figure shows estimates of survival rates and return migration rates by age group. The graph on the left compares the size of the cohort of natives and immigrants who arrived before 2000 in census years 2000 and ACS 2010. The difference between 2010 and 2000 in the size of the cohorts divided by the initial size of the cohort is an estimate of the cohort survival rate. The graph on the right subtracts the native survival rates from immigrant survival rates to obtain estimates of return migration rates by age group.

In the graph on the right-hand side, we estimate return migration rates by taking the difference in survival rates between immigrants and natives. This is a good estimate if mortality rates for the same age cohort are similar in both immigrants and natives. We observe that return migration is likely to be very high for younger cohorts and converges to 0 for older cohorts, perhaps reflecting that as immigrants grow old in the host country, their ties to the home country gradually diminish. The estimates show that more than 10 percent of the immigrant population aged between 25 and 30 in 2000 are no longer in the United States by 2010. We begin the series at age 25, since these immigrants are already likely to be working in the United States. Return migration rates are even higher for younger cohorts.

This means that for a large number of immigrants, future consumption takes place in a country other than the United States – possibly their home country. Thus, given that immigrants are likely to return and to care about future consumption, return migration patterns give additional support to the idea that immigrants partly take into account the price index in their country of origin when choosing their optimal location in the United States.

3.5 Discussion of alternative mechanisms

Some of the evidence presented can in principle be explained with alternative mechanisms. In this section we argue that none of the alternatives can fully explain the patterns in the data. Very often, alternative mechanisms have a hard time explaining the heterogeneity across immigrant groups. In other occasions we can explicitly control for the role of these alternative mechanisms. We discuss them in what follows and provide extra empirical evidence in appendix A.1.

There is a large literature documenting the role of immigrant networks in shaping immigrant locations (Altonji and Card 1991; Munshi 2003), so immigrant networks might be a potential explanation for some of the empirical patterns we described in previous sections. Perhaps immigrants initially settled in random locations. These locations may have grown due to subsequent immigration inflows, as predicted by immigrant networks. This could, moreover, generate bigger gaps in wages between natives and immigrants in these cities if newer immigrant inflows put disproportionate pressure on wages of immigrants.

To address this concern, we extend our wage gap regressions with a control for the relative size of the immigrant community within the MSA for each of our countries of origin. As shown and discussed in more detail in the appendix A.1, table A.2, including immigrant networks as a control does not change our main results. Furthermore, it is difficult to explain the country of origin immigrant heterogeneity. It is unclear why immigrants from low-income countries would concentrate in large and expensive cities in the earlier periods, or why cities where immigrants from low-income countries concentrate grow disproportionately more than cities with more immigrants from higher-income countries. In general, the evolution of city sizes is slow and the level of immigration in the United States not sufficiently large to dramatically change city size rankings (Duranton 2007). In appendix A.1, see table A.1, we show that our results do not change if we measure city size using only native population or using lagged city size. Neither do they change if we exclude the largest immigrant group (Mexicans) in the wage regressions.

Taken altogether, we think that it is more likely that immigrants keep going to the same large and expensive cities not just because former immigrants moved into them, but because the same incentives that drove the earlier immigrants also shape location choices of newer ones.

A second concern for our results is that they maybe reflect differences in human capital between natives and immigrants. We address this concern in three ways. First, we show in appendix A.1, table A.3 that our results on wages hold within education groups. For this, we run regressions where we only use observations in one of these four education categories: high school dropouts, high school graduates, some college, and college graduates or more. Results are similar across education groups. Second, we include the relative supply shock within each education group in an otherwise standard Mincerian regression. Third, we show that our results hold for each decile of the wage distribution. In figure A.1 of the appendix, we plot the interaction of the immigrant dummy and the city size for each decile using quantile regressions.

A third concern is that if immigrants and natives are imperfect substitutes, then the relative supply of immigrants should disproportionately affect immigrant wages, perhaps affecting wage gaps between natives and immigrants. The results shown in table A.4 show that controlling for the relative supply of immigrants within education does not change our results. The basic relationship between city size and immigration remains unchanged. More generally, immigrant-native imperfect substitutability is not necessarily related to city size. It is rather a statement that means that natives and immigrants sharing the same observable characteristics are fundamentally different factors of production.

A fourth concern is that some of our results might be driven by undocumented immigrants. Immigrants lacking work permits and residential permits may find it easier to hide in larger cities and avoid deportation. To address this concern, we check whether results seem to differ between immigrants who are likely documented and those who are not. To distinguish them, we use information on participation in welfare programs, which has been shown to identify undocumented immigrants reasonably well, particularly among low-skilled workers (Borjas Forthcoming; Albert 2017). The results are very similar across the two samples.

A fifth concern is that immigrants might settle in larger cities because it is easier to find a job there. This story seems to have a hard time explaining the wage results and the results on immigrant heterogeneity. To further discard this story, we show in the appendix A.1, figure A.2, that there is no systematic relationship between city size and job finding rates or unemployment rates of immigrants. Thus, labor market opportunities of immigrants in large cities do not seem to be systematically better than in smaller ones.