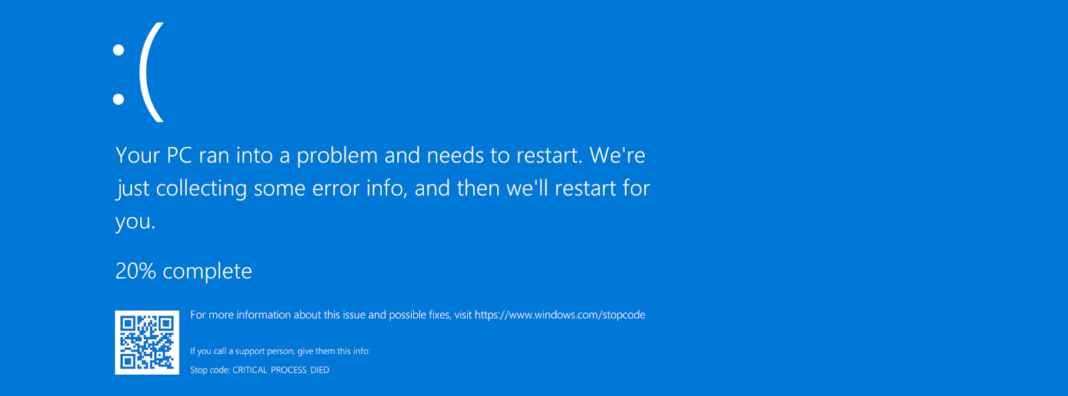

Have you ever experienced a blue screen of death? Nobody likes it when his computer crashes, but the BSoD, the screen that is displayed when Windows crashes, features a particularly frustrating problem: It is difficult to know who is to blame for the crash.

An operating system can crash for a number of reasons. The most obvious is that there is a bug in the operating system, in which case the OS manufacturer is to blame. Another is that there is a hardware failure. The motherboard, RAM, peripherals like a video card: any of these could cause a crash. It could be the drivers, the pieces of software that help the OS speak to peripheral hardware. Perhaps it is a piece of malware that has taken root on the system. Or perhaps it is a poorly written piece of software that the user himself installed.

When an ordinary Windows user encounters a BSoD, it can be difficult to know whether to blame Microsoft, Dell, Intel, Micron (the RAM manufacturer), NVidia (the graphics card manufacturer), malware developers, or the developers of that new piece of software you just installed.

Being unable to assign blame is bad for consumers. The ability to blame guilty parties is part of what makes markets work. If you find fingernail clippings in your box of Frosted Flakes, you know exactly to whom to complain (Kellogg’s), or you can stop buying Kellogg’s cereal altogether and switch to General Mills products. When the consumer doesn’t know who is at fault, as in the case of the BSoD, he apportions blame to everyone. The whole activity of computing gets blamed as frustrating and unreliable. The guilty party only receives a small portion of the blame, resulting in only a marginal incentive to fix the problem. For example, if the consumer knew with certainty that the problem was caused by NVidia, NVidia would have a strong incentive to fix the problem so that the customer would not switch to AMD graphics cards. Without this accurate ability to blame the guilty party, the consumer just gets disgusted with computing, and he can’t make informed marketplace decisions to remedy the problem. Maybe he takes up another activity instead.

Inability to blame the appropriate party, then, results in an externality. It’s an externality that, if it doesn’t make the market unravel, can at a minimum chill customer enthusiasm for the product. It reduces demand, and makes it so that all suppliers — Microsoft, Dell, Intel, Micron, NVidia and more on down the supply chain — can’t charge as much for their products.

Vertical integration solves the blame ambiguity problem

One way to ensure accountability for mistakes is through vertical integration. This is the strategy that Apple has chosen for its computer products. If you want to run MacOS, Apple’s desktop operating system, you have to run it on Apple hardware. While Apple doesn’t make every component, they are a single integrator you can fairly blame for any hardware problem. Apple doesn’t control all software on the Mac, but with new versions of MacOS, it imposes ever more restrictions on developer access to Kernel Extensions, software that can access low-level hardware and thus cause a system crash. As a result, if a Mac crashes, users know who to blame: Apple. They supplied the hardware, operating system, and rules for software access to low-level hardware. This concentration of blame removes the externality and allows the market to operate efficiently.

Of course, it’s not just Apple that uses vertical integration to ensure blame is not ambiguous. Peloton, for example, operates its own delivery and assembly service. Imagine you bought a Peloton bike and hired the teenager down the street to assemble it for you. If you had a bad experience with the bike, you wouldn’t know whether it was defective or misassembled. You might not properly apportion blame to the assembler. As an unsatisfied customer, you would be less likely to buy Peloton services or advertise the bike via word of mouth. To preempt this problem, Peloton simply provides assembly itself.

Apple’s vertical integration strategy fosters trust in the App Store

Vertical control of the entire customer experience, then, is a valuable tool to make markets work. Yet it is now under assault in the context of Apple’s iPhone and iPad App Store. As with its desktop and laptop systems, and to an even larger degree, Apple has taken an approach of closely controlling the customer experience on its phones and tablets. The result has been wild success. Apple is the most valuable company in the world, and it is all due to these closely controlled products, which make up most of Apple’s revenue. Whatever you may say about the model of closely controlling the user experience, it has passed the market test. Consumers like it.

Source: Apple’s Q3 Consolidated Financial Statement

The App Store is a key part of this strategy. Apple uses the App Store to enforce countless rules. For example, you cannot distribute an app on iOS that continuously uses Bluetooth in the background, which would run down the battery on the device. If a consumer downloaded such an app, she might not know why her battery had run down, only that her battery did not last very long and that she was unhappy about it. She could very well blame Apple. It might make her less likely to enjoy her phone or to invest money in new models or more apps. Solving for the equilibrium, Apple simply disallows this behavior in third-party apps.

A similar logic applies to payments. Apple’s 30% commission on App Store sales and in-app purchase provide a nice revenue source for Apple (one that incentivizes them to lower initial prices for hardware, by the way), but that percentage, which is standard in the platform market, is irrelevant to the importance of presenting the consumer with a good payment user experience. Even if Apple charged a 0% commission for payments, it would still insist on the use of its payment system on its devices because its rules enforce pro-consumer behavior.

Consider an in-app subscription. Per Apple’s rules, you can easily cancel your subscription any time with a few clicks in a central location. The developer won’t know your subscription is running out until the moment your paid-up time expires. The developer can’t make it hard for you to cancel the subscription. The developer doesn’t have your billing information and can’t accidentally renew your subscription. If you have a problem with the subscription, or even if you forget to cancel, you can complain to Apple and get your money back.

The pro-consumer behavior enforced by Apple’s in-app subscription rules increases trust in the entire system. A small developer in Belarus or Nigeria can submit an application to the App Store and receive global subscription revenue that would never be possible if he were soliciting credit card information. If something goes wrong with payments to the Belarussian developer, consumers know who to blame: Apple. This fact makes the market for in-app payments much bigger than it would be in the absence of strict App Store rules. This increase in the market for in-app payments means better outcomes for developers, not just consumers.

Not everyone is happy, but that doesn’t mean Apple is wrong

Apple’s App Store policies, then, enforce an environment that protects the user experience and promotes trust in on-platform commerce. But not everyone wants this environment. Developers who are big enough to have earned consumer trust independently — large developers like Epic and Spotify — are seeking the ability to work around App Store rules. Because so many consumers already trust them, they don’t feel they need to leverage the trust built by Apple’s App Store policies.

These large developers may be right that their revenues would be higher without Apple’s cut of the transaction. But this is a simple business dispute between large companies that doesn’t undermine the fact that, in general, Apple’s policies benefit consumers and most developers, especially the smallest developers. There is no reason for courts or policymakers to get involved.

To be sure, there is nothing that guarantees that Apple will always get each of its thousands of App Store policies exactly right. But the proof of the pudding is in the eating. Apple’s products are popular if not dominant, and they are universally considered premium devices. Apple has ridden its pro-consumer vertical integration strategy to become the most valuable company in the world. If users don’t like Apple’s close control of the ecosystem, they can switch to Android, Windows, or Linux devices. And if developers don’t like it, they can pursue constructive conversations with Apple or leave to develop for those other systems.