Imagine an energy source that is cheap, compact, safe, non-polluting, reliable, inexhaustible, and unconstrained by geography. What if this energy nirvana has been right under our noses—and beneath our feet—all along?

Our planet holds a tremendous amount of heat. The center of the earth has a temperature that is about the same as the sun’s surface. Scientists have estimated that the band from the surface to a depth of 10 kilometers contains about 50,000 times more thermal energy than the chemical energy in all of the planet’s oil and gas reserves. Furthermore, this heat is continually replenished. The decay of radioactive elements in the earth’s interior creates an estimated 44.2 terawatts of heat flux—about twice humanity’s primary energy consumption today.

Humans have produced electricity from the earth’s subsurface heat since 1904, when Italians first harnessed geothermal steam at Larderello, in Tuscany. Today, the same site produces enough power for 10 million Italian households, about 10 percent of the world’s geothermal electricity. This high share concentrated in one place reflects the small installed base of current geothermal technology. In the United States, today’s geothermal power plants represent a tiny sliver of total energy output, supplying about 0.4 percent of the country’s utility-scale electricity. Conventional geothermal technology is only deployed at sites where subsurface heat makes itself evident through visible features like hot springs, geysers, and fumaroles. The main geothermal field at Larderello is called Valle del Diavolo—Valley of the Devil—because it contains springs of boiling water. The largest geothermal field in the world, in California, is called the Geysers, although the features for which the area is misnamed are actually fumaroles.

Thanks to recent technological advances, accessing geothermal energy is becoming feasible even in places where the planet’s heat does not appear at the surface. But to harness our planet’s innate energy to the fullest extent—in the process, cutting greenhouse gas emissions and making our economy boom—we need much more experience with new concepts for geothermal energy production. In many domains, proficiency inexorably increases with experience—you get better at doing something the more you do it—a phenomenon illustrated through learning curves. Learning curves have been essential in energy, where researchers have made rapid improvements in solar power and battery technology as cumulative production has increased.

For geothermal energy, perhaps the closest analogue to past learning curves is the shale oil revolution. That revolution not only dramatically advanced the state of the art in drilling and subsurface engineering, but its advances are also now helping push frontiers in geothermal energy. A repeat of the shale revolution with next-generation geothermal would promise clean and inexhaustible energy, but it requires gaining experience and getting started along the learning curve. While the shale industry benefited from Congress simplifying rules around leasing permits and access to land, these policy obstacles remain for geothermal exploration and production on federal lands—and threaten the next potential revolution in energy.

Learning by Fracking

Both the shale industry and the next generation of geothermal energy are premised on subsurface engineering and exploration, although applied to different ends and with differing characteristics. Indeed, it is mainly because of the advances learned in the shale fields that next-generation geothermal energy has become a possibility.

Like geothermal, tight oil and shale gas started from tiny bases. U.S. tight oil production grew from 0.42 million barrels per day 15 years ago to over 8.30 million barrels per day before the Covid-19 pandemic. Likewise, shale gas production increased from 5.4 billion cubic feet per day to more than 73.6 billion.

Getting oil and natural gas out of shale formations is tricky. Producers first have to decide where to drill based on data and educated guesses about where shale resources might lie. Then, they drill thousands of feet until they reach a shale formation. Next, they drill horizontally through the formation to increase the surface area of the well in contact with oil-rich resources. Finally, they frack—they use a fluid at high pressure to create vertical cracks in the shale to increase the flow of oil and gas into the borehole and up the well.

Horizontal drilling and hydraulic fracturing had been done for research purposes by the 1970s, but to become commercially viable, cost was key. Oil and gas producers needed to explore, drill, and frack cheaply enough to compete in the unforgiving global commodity market. In addition, they needed to compensate for the risk of wells that come up dry. Over the course of a decade, the accumulation of experience, best practices, and technology—including adoption of new drill bits and well casings—made the United States a player in global energy markets. One energy policy paper estimated that the price of natural gas at the wellhead fell by 13 percent for every doubling of natural gas output from the shale fields between 2005 and 2015.

When America became a net energy exporter in 2019, many commentators felt that it came out of nowhere. Politicians had for years prattled about energy independence without anyone believing that it was a realistic prospect. Yet the country’s newfound energy self-sufficiency was the result of policy choices, particularly the Energy Policy Act of 2005, which contained numerous provisions that addressed unconventional energy resources. Critically, the act’s Section 390 established a presumption that small-footprint oil and gas wells on federal lands need not go through a lengthy environmental review before permits or leases are granted. Substantive environmental laws like the Clean Water Act still apply to oil and gas drilling, but the cumbersome, often multi-year process to obtain a permit is streamlined.

In a nascent field where learning curves rule, removing obstacles to getting the learning process started is paramount. In this regard, streamlining permitting was a boon to the industry. It’s difficult to imagine initial, experimental drilling on public lands with still-high costs and no guarantee of finding oil when it is preceded by months or years of environmental paperwork. But with the major policy obstacles out of the way, the industry got rolling, leading to the very breakthroughs that now make geothermal energy a possible game changer.

Next-Generation Geothermal

Conventional geothermal wells are technically hydrothermal—they work by extracting steam from a production well. Typically this steam flows upward through hot porous rock, acquiring heat energy along the way, but then gets trapped under impermeable caprock. Placing a production well where the steam is trapped gives it only one way to go—up the well, where, at the surface, it can power a turbine to produce electricity. A second well, called an injection well, is used to put water back into the system, without which the supply of steam would eventually dry up and lose pressure.

Producing hydrothermal energy is pretty simple, and it would be very cheap at scale, but it requires this subsurface configuration—hot porous rock topped with impermeable capstone—to work. It is impossible to scale it because of these subsurface requirements. Next-generation geothermal technology moves beyond these geographical limitations to access heat that is available even when it is not immediately evident at the surface, and even when subsurface rock configurations don’t make it so easy.

There are many concepts for how next-generation geothermal could work, and they span a spectrum from evolutionary to revolutionary. On the evolutionary end of the technology spectrum, so-called enhanced geothermal systems work a lot like existing conventional geothermal systems, applying advances in subsurface engineering gained from the shale oil revolution to make more resources viable. Like conventional systems, enhanced ones use production and injection wells to generate steam, but there are two key differences. First, they access deeper sources of heat discovered through analysis and exploration. In principle, heat is everywhere if you drill deep enough, but nascent enhanced geothermal firms look for resources that are in a sweet spot that balances ubiquity and depth.

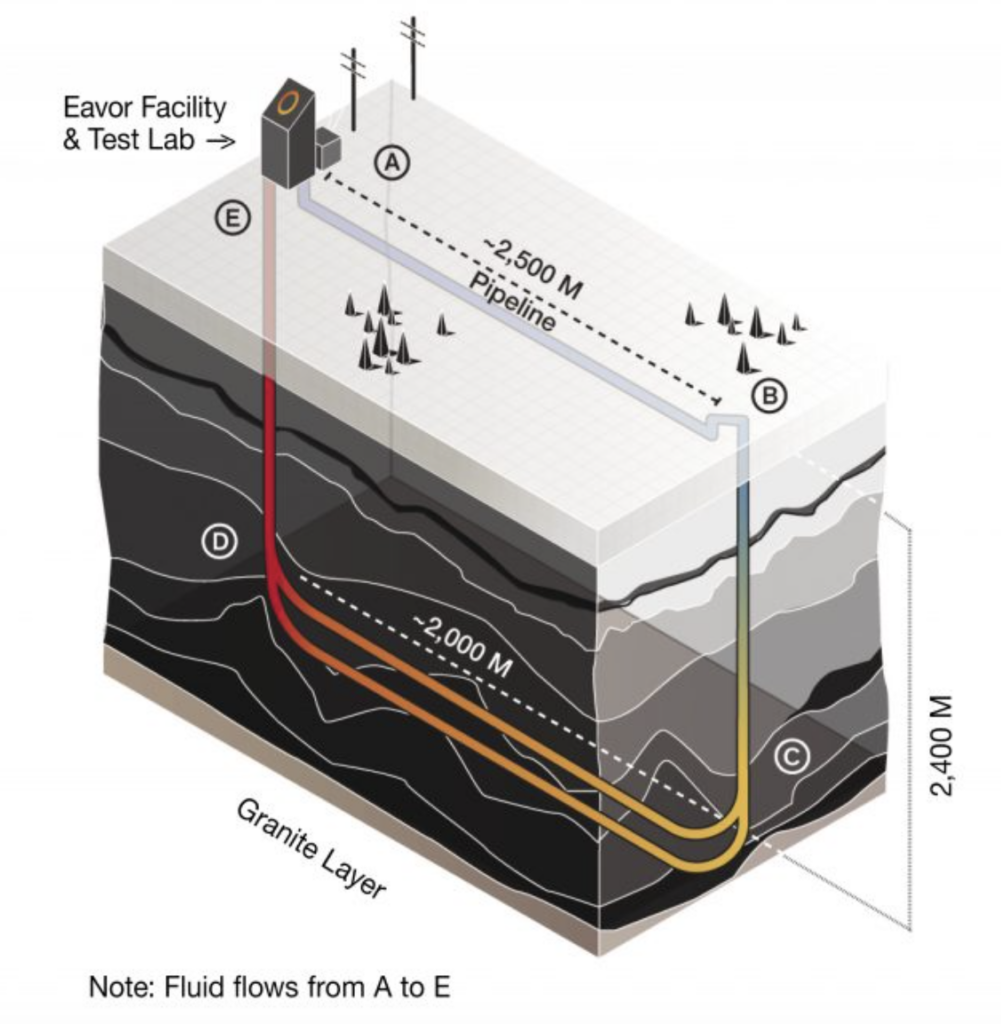

Diagram of Eavor’s closed-loop geothermal demonstration project. ©Eavor

Second, in addition to enabling the use of deeper thermal sources, enhanced geothermal technology makes energy extraction possible in areas where rock formations aren’t optimal for transferring heat energy. For example, if the production and injection wells sit on two sides of hot, solid rock with a network of fractures between them—created using fracking techniques perfected in the shale fields—then water can flow between the wells, absorbing heat and turning to steam. Subsurface engineers are quick to point out that the purpose of fracking in such cases is different than in oil and gas extraction. Enhanced geothermal frackers don’t use proppants like sand because the purpose isn’t to hold the fractures open to extract resources. Rather, they aim to create a network with a lot of surface area through which water can flow. Furthermore, oil and gas fracking occurs in sedimentary rock, whereas geothermal applications like the one described above create fractures in igneous or basement rock formations. Many engineers say that these differences slash the risk of seismic events.

On the revolutionary end of the technology spectrum are closed-loop geothermal systems, also called advanced geothermal systems. A closed-loop design is different from conventional and enhanced methods in that a working fluid flows only within a set of pipes that are closed to the subsurface. Water or another fluid introduced at the surface flows in a downward pipe segment until it reaches the bottom of the system, absorbs heat, and then returns to the surface in an upward segment. A turbine converts heat into electricity at the surface, and the fluid continues its circular course back underground. Some projects use working fluids that become supercritical—acting as a liquid and a gas at the same time—at the temperatures and pressures inside the well. This allows them to absorb more energy with fewer losses from circulation.

The most attractive element of advanced geothermal is the ability, in principle, to place such systems anywhere—even next to or underneath major cities. No assumptions about subsurface rock structures need to be made. If you can drill deep enough, you will find heat, guaranteed. If you can drill cheaply enough—vertically to reach heat and laterally to increase surface area—the system will be economically viable. Advanced technology, then, transforms the viability of geothermal energy everywhere on the planet into a simple question of how low drilling costs can go. If they were to go low enough, advanced geothermal systems could supply the entire planet with electricity. We would reach energy nirvana.

Drilling for Steam

Limited by today’s drilling costs, many of the ex-oil-and-gas veterans now turning to geothermal energy are adopting concepts in the middle of the technology spectrum—using a closed loop, but also applying other subsurface engineering methods. One company, Sage Geosystems, has a design that uses a downward-facing fracture network at the bottom of its well that is filled with conductive and convective fluid. This approach draws heat from deep rock formations toward the base of the loop, reducing the depth producers have to bore and economizing on drilling costs. Sage is currently developing a demonstration well using this approach. “Once we get through a successful pilot these next few months,” company CTO Lance Cook said in early 2021, “we are off to the races.”

While various enhanced and advanced geothermal concepts are likely viable with current technology, near-term breakthroughs could make the sector boom. Progress in subsurface engineering has been primarily focused on needs of the shale industry, which are subtly different from those of next-generation geothermal. This means that the new geothermal sector still needs a repeat of what happened in the shale oil boom—incremental, iterative improvements focused on specific needs that arise from experience. Geothermal needs to work up its own learning curve.

One set of new technologies needed for some geothermal projects centers on resource characterization—figuring out where exactly the best underground heat resources are located, how hot they are, and what sort of rock formations are nearby. This problem can be tackled to some extent with big data and machine learning. Combining data from industry partners who, until now, have had no need to identify heat resources could yield a better understanding of the subsurface and save on exploration and drilling costs. Ultrasound techniques could also be applied to map the subsurface.

Next come drilling advances. An underappreciated driver of the shale oil revolution was the polycrystalline diamond compact drill bit, invented in 1971 but perfected by the end of the 20th century. Although the bit has been a game changer in the shale fields, no manufacturer currently outfits their bit with the circuitry necessary to operate in the temperatures, pressures, and shock levels needed for deep geothermal applications. Suitable electronics exist in the space sector, but they would need to be ported over to the drilling industry to decrease costs in geothermal conditions.

Less incremental drilling technologies are also on the horizon. Non-rotary concepts such as water hammers could work much faster in hot, dry rock. ARPA-E has even funded development of a millimeter-wave-directed energy beam capable of melting and vaporizing rock. When commercialized, it could lead to deeper wells and access to hotter temperatures than currently available.

Finally, new generation technologies could make turning heat into electricity more efficient. A popular idea in closed-loop geothermal is to use carbon dioxide as a working fluid. Supercritical fluids can transport more heat from a given well, and CO2 reaches supercritical conditions at relatively low temperatures and pressures compared to alternatives. So far, there is no turbine generator appropriate for supercritical CO2, although in principle there could be, and it would increase power output significantly for some well types. Another technology that could be promising is thermoelectric generators, solid-state devices that turn a temperature gradient into electricity. Today’s thermoelectric generators are optimized to produce tiny amounts of current from small temperature differentials, but if the technology were adapted for geothermal energy, it could someday even be used down-hole to produce large amounts of power directly where the hottest temperatures emanate.

With today’s technology, most of the startups pursuing enhanced and advanced geothermal concepts reckon they could produce electricity at or below four cents per kilowatt-hour. That is for electricity that runs 24/7, whether the sun shines or the wind blows. With new technology, the cost could fall by half or more. Like the geothermal fields at Larderello that have been producing electricity for more than a century, wells drilled today will produce heat for eons. Once the drilling costs have been amortized, the only significant cost of electricity production will be to maintain and occasionally update the generation equipment—the primary energy will be effectively free.

Policy Predicaments

How do we achieve a geothermal future? The most important step is simply to get started, so that the industry can work up the learning curve of geothermal-specific problems and the technologies that address them. Here, policy barriers play a role. Although the goal should be to eventually support geothermal energy generation anywhere, simply by drilling deeply enough, the best place to get started is still where heat resources lie closest to the surface. Scientists at Southern Methodist University’s Geothermal Laboratory have shown that the most accessible resources in the country lie in the West, and they overlap considerably with federal lands.

To get started in earnest, then, the industry needs permits to drill wells and produce geothermal energy on lands leased from the federal government. Section 390 of the Energy Policy Act of 2005 streamlined the permitting process for oil and gas wells, but that provision does not include geothermal wells. At issue is a categorical exclusion from environmental review under the National Environmental Policy Review Act, or NEPA. Congress provided a rebuttable presumption that, within certain limits on surface footprint and other criteria, oil and gas wells are excluded from NEPA review. Congress’s failure to include geothermal wells within the same parameters means that geothermal permits face a multi-year environmental assessment process while oil and gas permits do not.

Tim Latimer, CEO of Fervo Energy, has noted the unequal treatment that his geothermal company has faced relative to the oil and gas industry:

“I’ve been astounded as I’ve entered this industry coming from the oil and gas space, where we have very responsive regulators that work with us to tell us what to do and where to do it, and we were able to get projects permitted very quickly. … A common experience for me in geothermal is we submit all of the necessary paperwork, regulations, environmental impact assessments to the regulatory bodies, and it sits there for months and months and months, and we actually can’t even get a response.”

The overlap between federal lands and the most accessible sources of heat in the United States means permitting obstacles may be even more important in geothermal than they were for unconventional oil and gas. As it turned out, there are vast shale resources accessible from private and state land for which federal permitting requirements did not matter—because they do not apply. Removing federal permitting obstacles was important to get the shale industry going, but ultimately, it may have only sped up an inevitability. In contrast, it is difficult to see how enhanced geothermal systems can get off the ground without some permitting flexibility, given the reality that so much of the West is owned by the federal government.

The prize that awaits us if we can fix this permitting obstacle is cheap, clean, scalable baseload electricity for the country and—once we get the technology right—the world. A number of new companies, generally started by ex-oil-and-gas executives, have emerged to take advantage of the opportunity. Houston-based Fervo is developing enhanced geothermal wells. Eavor has completed a closed-loop demonstration system in Alberta, Canada. Sage Geosystems, also founded in Houston, is pursuing a hybrid model. Quaise is commercializing millimeter-wave drilling invented at MIT.

If these companies and others like them are given a chance, geothermal know-how could become a major export industry by the 2030s. If we want to convert the world to non-fossil energy, removing technical obstacles through practice is essential. It would be a shame if something as obscure as a permitting asymmetry on federal lands delayed the global transition to clean energy.

PERC

PERC