Introduction

A decade after the 2007–2009 financial crisis, housing has once again returned to center stage but for polar opposite reasons. Whereas the crisis during the Great Recession involved plunging house prices, several years of rising prices and rents since then have stoked concerns about a growing housing affordability crunch. Once primarily the concern of expensive metropolitan areas, the issue of housing affordability has gone national—attracting the attention of the public as well as political and private sector leaders at every level of American society.

One area in which the push for action has manifested itself is in a renewed interest among policymakers in rent control. Only four states (plus Washington, DC) had localities with some form of rent control in 2018, but several states have recently sought its expansion.1 “Landlords Strike Back, Suiting to Dismantle Rent Regulation System,” New York Times, 7/6/2019, https://www.nytimes.com/2019/07/16/nyregion/ny-rent-regulation-lawsuit.html In California, concerns over a lack of affordable housing prompted a November 2018 ballot initiative (Prop 10) to overturn the 1995 Costa-Hawkins Act which limited municipalities’ ability to engage in rent control. Despite the broad public concern about housing costs, Prop 10 was defeated handily, potentially out of fear that it would allow for regulation not just of large multi-family units but also single-family rentals. In 2019, Oregon became the first state to implement state-wide rent control. The Oregon law caps annual rent hikes at CPI inflation plus 7% and bans “no-cause” evictions. The New York state legislature also recently tightened rent control laws and expanded them to much of the state instead of primarily just New York City.2“Landmark Deal Reached on Rent Protections for Tenants in N.Y.,” New York Times, 7/11/2019, https://www.nytimes.com/2019/06/11/nyregion/rent-protection-regulation.html?module=inline California has since become the latest state to institute rent control by limiting annual increases to 5% after inflation while adding barriers to eviction.

Leaders have also looked beyond rent control to other far-reaching remedies. For example, Minneapolis recently passed a law (Minneapolis 2040) which effectively ends single-family zoning, thereby facilitating higher-density housing throughout the city’s residential areas. The Seattle Planning Commission has recently explored similar actions, stating in its Neighborhoods for All report that “Allowing more housing in single-family zones, especially in high-cost areas, is critical for stemming the rapid increase of displacement in Seattle’s most vulnerable communities.” Similarly, Salt Lake City’s Growing SLC plan calls for zoning changes that would permit greater housing density. A 2018 report states that, between 2011 and 2014, rents increased at more than twice the rate as wages for renters, and house prices increased four times faster than homeowner wages.3“Growing SLC: A Five Year Housing Plan: 2018 – 2022,” Salt Lake City Housing and Neighborhood Development, 1/2/2018, http://www.slcdocs.com/hand/Growing_SLC_Final_No_Attachments.pdf

Affordable housing has also featured prominently on the presidential campaign trail leading up to the 2020 elections. On the Democratic side, candidates have proposed a wide range of policy initiatives ranging from expanded construction subsidies to down payment assistance to zoning reforms to modified mortgage lending regulations.4For a brief summary of proposals, see “Elizabeth Warren and Tom Steyer want to build millions of homes – where the 2020 presidential candidates stand on affordable housing,” Market Watch, 11/21/2019, https://www.marketwatch.com/story/heres-where-2020-presidentialcandidates-including-elizabeth-warren-and-kamala-harris-stand-on-affordable-housing-2019-07-25 or “A New Approach on Housing Affordability,” New York Times, 7/7/2019, https://www.nytimes.com/2019/07/07/opinion/affordable-housing-construction.html In March 2019,the White House released its Memorandum on Federal Housing Finance Reform, which called for reforms that preserve access “for qualified homebuyers to… mortgage options that best serve the financial needs of potential homebuyers,” and which define “the GSE’s role in promoting affordable housing.” More recently, President Trump issued Executive Order 13878, Establishing a White House Council on Eliminating Regulatory Barriers to Affordable Housing.

Efforts have not been confined to the public policy arena. In March 2017, Housing Trust Silicon Valley launched the TECH (Tech Equity Community Housing) fund to provide flexible financing to affordable housing developers with the aim of stimulating the construction of at least 5,000 below-market-rate units targeting those earning below 60% of the area median income.5For more information, see https://housingtrustsv.org/tech-fund/. The fund has thus far raised over $100 million, with Cisco, LinkedIn, and several other companies as early multi-million dollar investors. In July 2019, Google announced its own $50 million investment into the fund as just one part of a $1 billion affordable housing pledge for the San Francisco Bay Area.6https://www.blog.google/inside-google/company-announcements/1-billion-investment-bay-area-housing/. Separately, some companies have even been experimenting with 3-D printing technology to be able to build houses at a dramatically lower cost than what is required with the use of traditional labor.7 “Can Robots Solve the Affordable Housing Crisis?,” Politico, 7/11/2019, https://www.politico.com/magazine/story/2019/07/11/robots-solveaffordable-housing-crisis-227276.

After outlining some recent trends in housing costs, the remainder of this paper discusses the economics of housing affordability policies. Such policies come in many different forms. For example, the architecture of the U.S. housing finance system is designed largely around promoting the expansion of homeownership. This system features government-sponsored enterprises to support liquidity in the mortgage market along with tax subsidies to homeowners and direct subsidies to buyers. In addition, the federal government subsidizes rental housing through a combination of tenant-based and placed-based policies, such as vouchers and the low-income housing tax credit. Lastly, this paper analyzes the efficacy of rent control as well as the impact of zoning and land use regulations. Importantly, policies which aim to improve housing affordability by boosting low-income housing demand are more likely to be effective if accompanied by efforts to reduce constraints on housing supply.

Recent Trends in Housing Affordability

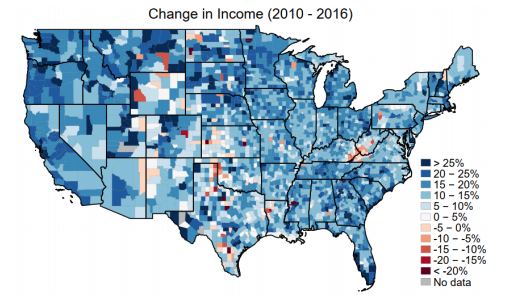

The U.S. economy has enjoyed a historically long expansion since the depths of the Great Recession, with incomes rising in nearly every geographic area, as shown in figure 1 below. However, at the same time, house prices have rebounded strongly, thereby increasing the wealth of homeowners while making it more difficult for renters to make the transition into ownership. Moreover, rent increases have markedly accelerated over the past decade, with the rent-to-income ratio rising from 25% to over 28%.8See Pedro Gete and Michael Reher, “Mortgage Supply and Housing Rents,” 2018, Review of Financial Studies, 31(12), pp. 4884–4911; and Lambie-Hanson, Lauren, Wenli Li, and Michael Slonkosky, “Leaving Households Behind: Institutional Investors and the U.S. Housing Recovery,” 2019, Working Paper.

Figure 1: IRS Adjusted Gross Income (Nominal)9The data can be downloaded at https://www.irs.gov/statistics/soi-tax-stats-individual-income-tax-statistics-zip-code-data-soi.

House Prices

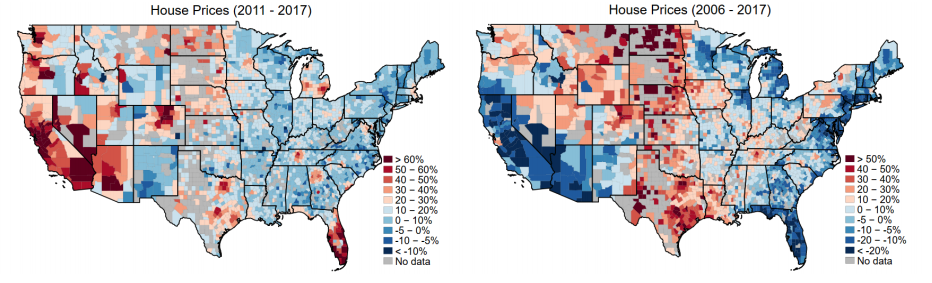

One measure of house prices comes from the Federal Housing Finance Agency, which constructs a repeat-sales price index on single-family properties with mortgages securitized by Fannie Mae or Freddie Mac. As such, the measure has broad geographic coverage but does not cover the entire housing market within geographic areas (such as houses financed by non-conforming loans). As evident in figure 2, house prices have recovered throughout most of the country since 2011 with the exception of a handful of counties colored in dark blue. California, Arizona, Nevada, and Florida—four of the states which experienced the worst of the housing crash between 2006 and 2011—demonstrate the most robust growth in house prices, followed by much of the Mountain West, Pacific Northwest, and pockets in Texas, Tennessee, and North Dakota.

However, the right panel of figure 2 shows that the house price surge in California (with the exception of the San Francisco Bay area), Arizona, and Florida has been insufficient to erase the entire decline during the crisis. Thus, in these places, price appreciation over the past several years can be thought of as a return to the pre-crisis “normal,” whereas price growth throughout the vast geographic middle of the country demonstrates the scope of the housing affordability crisis as viewed through the lens of homeownership.

In the past, places like Texas and North Dakota were relatively insulated from concerns over rising housing costs, but they are now two of the states with the most rapid price growth. A comparison of figures 1 and 2 reveals only a weak relationship between income growth and price growth over the past several years, indicating that other factors are at play when it comes to explaining geographic differences in house price dynamics. If house price growth were confined to upper-end homes, perhaps the above trend would be of little concern from a housing affordability perspective. However, data from Zillow shows that house price growth has in general been even more robust among the bottom tier of properties (i.e., starter houses).10The data can be downloaded at https://www.zillow.com/research/data/.

Figure 2: FHFA House Price Index (Nominal)11The data can be downloaded at https://www.fhfa.gov/DataTools/Downloads/Pages/House-Price-Index.aspx.

Data from the Home Mortgage Disclosure Act (HMDA) demonstrates that the increase in house prices has coincided with rising mortgage debt relative to income over the past decade. Furthermore, the pattern is starker for homeowners with Federal Housing Administration (FHA) loans or Department of Veteran’s Affairs (VA) loans than for owners with conventional loans. For example, in 2007, very few counties featured loan-to-income ratios above 3 for conventional loans. By 2017, an increasing number of counties in the West along with a couple of pockets in the DC-Boston corridor exceeded this ratio. Such high loan-to-income ratios were much more common in 2007 for FHA and VA loans and have become noticeably more prevalent over the past decade.12The data can be accessed at https://www.consumerfinance.gov/data-research/hmda/.

Thus, it would appear that buyers are not paying for more expensive houses out of higher income or accumulated savings, but rather by increasing their debt balances. While lower mortgage rates mitigate the financial burden of higher debt balances, the data reveal that the average payment-to-income ratio rose from 30% in the early 1990s to 37% in 2017.13 See Davis, Morris, William Larson, Stephen Oliner, and Benjamin R. Smith, “Mortgage Risk Since 1990,” 2019, FHFA Staff Working Papers 19-02, Federal Housing Finance Agency. Furthermore, higher leverage leaves owners more vulnerable to foreclosure if house prices decline in the future and cause their equity cushion to evaporate.

Rent

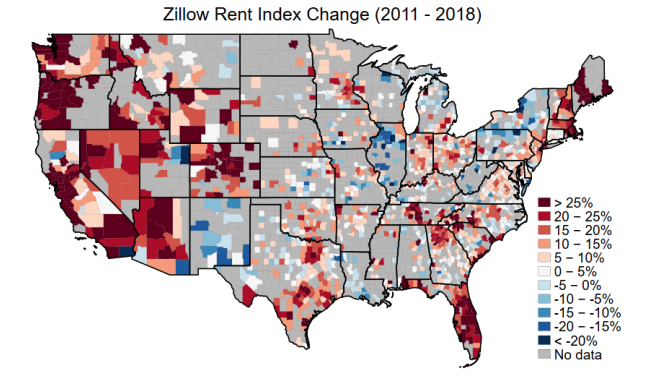

Over one-third of households are renters, and they tend to have lower income than homeowners. Thus, any discussion of housing affordability must naturally focus on costs faced by this segment of the population. At the county level, data from Zillow in figure 3 reveals substantial growth in rents between 2011 and 2018 with a pattern that mimics that of the increase in house prices over the past several years. The greatest rent growth appears in Florida and much of the West, though large rent increases also appear in pockets elsewhere.

Figure 3: Zillow Rent Index (Nominal)14The data can be downloaded at https://www.zillow.com/research/data/.

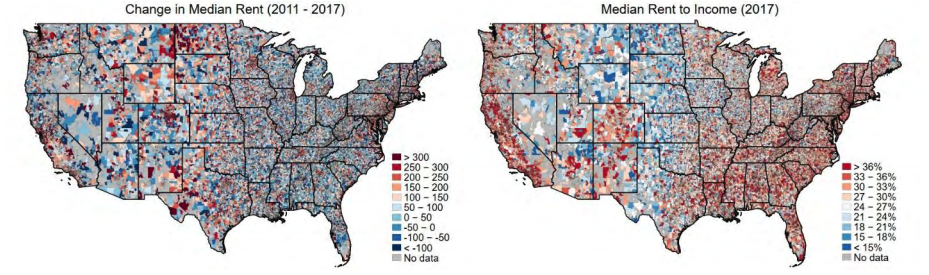

One shortcoming of the county-level data is that some counties are quite large, both in terms of population and geography. For example, Los Angeles county has a population of over 10 million—nearly 25% of the entire population of California. An even more stark example is Maricopa County, Arizona, which accounts for more than half the population of Arizona. To deal with this issue, figure 4 presents ZIP Code level data from the American Community Survey. The left panel reveals that, from 2011 to 2017, many ZIP Codes experienced rent increases of at least $100 per month. Moreover, the right panel shows an impressively large number of ZIP Codes exhibit median rent to income in excess of 30%, which is the threshold that the U.S. Department of Housing (HUD) uses for determining whether a household is cost burdened by housing.

Figure 4: Median Rent (nominal). Source: American Community Survey 2011 and 2017.

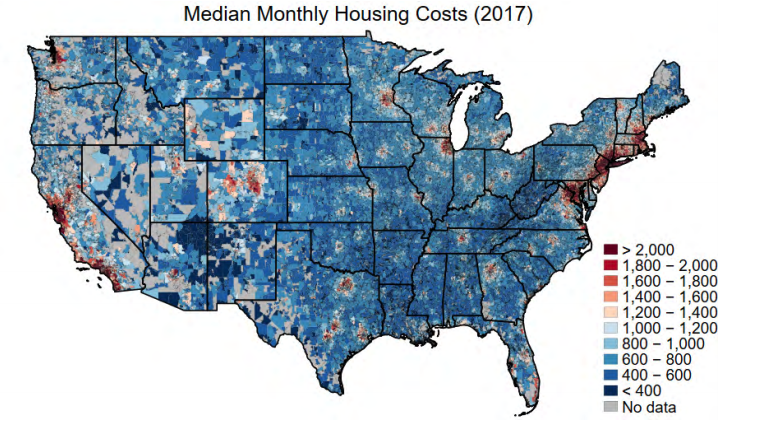

Lastly, to put housing costs further in perspective, figure 5 maps out median monthly housing costs. In terms of land area, most ZIP Codes feature monthly housing costs below $1,200. However, much of the population is concentrated in metro areas throughout the country where housing costs can easily exceed $1,500 per month. Lastly, median housing costs exceed $2,000 (often by a considerable margin) in the DC-Boston corridor and along much of the California coast. Thus, while each of the previous metrics provides a different angle of insight into the state of affordable housing, a clear picture that emerges is one of rising housing costs throughout the country that are in many instances outpacing income gains.

Figure 5: Median Monthly Housing Costs. Source: American Community Survey 2017.

Why Housing Affordability Matters

Access to affordable housing promotes economic growth and facilitates resilience in the face of shocks. Thus, affordable housing is a matter of broader economic policy importance. However, as this paper discusses later, misguided policy approaches can be counterproductive both to the narrower goal of promoting housing affordability and to the broader objective of enhancing economic opportunity.

Affordable Housing and Economic Growth

In terms of growth, housing plays a central role in facilitating the efficient spatial allocation of labor by making it feasible for workers to accept jobs and live in places where they have the best opportunity to be productive. As discussed earlier in this paper, the lack of affordable housing in the San Francisco Bay Area has made it difficult for tech workers to relocate there. To the extent that some workers choose less productive, lower paying jobs in other parts of the country as a result of exorbitant housing costs in San Francisco, national economic output suffers. The same reasoning applies when middle class workers flee other expensive locations purely to evade high housing costs. Even if such decisions are optimal from the perspective of individual workers and families seeking better lives, the economy as a whole would be more productive if housing costs did not act as a significant distortion affecting where people choose to live and work.

Multiple studies have recently quantified the extent to which unaffordable housing has acted as a drag on U.S. economic performance over the past few decades. In one analysis, economists Chang-Tai Hsieh and Enrico Moretti find that exorbitant housing costs in highly productive cities like New York and San Francisco lowered cumulative U.S. economic growth by 36% between 1964 and 2009.15Hsieh, Chang-Tai and Enrico Moretti, “Housing Constraints and Spatial Misallocation,” 2019, American Economic Journal: Macroeconomics, 11(2), pp. 1–39. They blame much of the inflated housing costs in those cities on supply restrictions, which this paper discusses more thoroughly later. In a similar vein, Nobel laureate Ed Prescott along with co-authors Kyle Herkenhoff and Lee Ohanian find that U.S. labor productivity would be 12.4% higher and consumption 11.9% higher if not for artificially high housing costs in the most productive U.S. cities, driven by onerous land use regulations.16Herkenhoff, Kyle F., Lee E. Ohanian, and Edward C. Prescott, “Tarnishing the Golden and Empire States: Land-Use Restrictions and the U.S. Economic Slowdown,” 2018, Journal of Monetary Economics, 93, pp. 89–109.

Affordable Housing and Economic Resilience

Because housing is the largest asset on most households’ balance sheets, it can have a significant impact on their consumption behavior.17 There is an extensive literature on the impact of housing on consumption. See, for example, Berger, David, Veronica Guerrieri, Guido Lorenzoni, and Joe Vavra, “House Prices and Consumer Spending,” 2018, Review of Economic Studies, 85(3), pp. 1502–1542; Kaplan, Greg, Kurt Mitman, and Gianluca Violante, “The Housing Boom and Bust: Model Meets Evidence,” Forthcoming, Journal of Political Economy; Mian, Atif, Kamalesh Rao, and Amir Sufi, “Household Balance Sheets, Consumption, and the Economic Slump,” 2013, Quarterly Journal of Economics, 128(4), pp. 1687–1726; and Garriga, Carlos and Aaron Hedlund, “Mortgage Debt, Consumption, and Illiquid Housing Markets in the Great Recession,” 2019, Working Paper. During good times, housing acts as a valuable source of collateral for people looking to start or expand a small business who may lack access to other external capital. Similarly, the ability to extract home equity provides a useful buffer to households looking to hedge against economic risk, whether it be job loss, an adverse health event, or an unexpected large expense (e.g., car repair).18Several studies examine the link between household balance sheets and consumption. For example, one recent study finds that “Households with higher wealth, i.e. mortgage owners and outright owners…have more consumption insurance compared to households with lower wealth.” See Cho, Yunho, James Morley, and Aarti Singh, “Household Balance Sheets and Consumption Responses to Income Shocks,” 2019, Working Paper.

In principle, the degree of affordability does not necessarily alter these salutary channels of transmission from housing to the rest of the economy. However, the more expensive housing is, the larger mortgages buyers must take out. The consequence of this higher leverage is worse macroeconomic fragility for the economy as a whole. Specifically, homeowners with higher loan-to-value ratios are at greater risk of becoming underwater on their mortgages if house prices fall even modestly. In such a scenario, these owners can no longer use their houses as a source of consumption insurance and are therefore more vulnerable to economic shocks such as job loss. Debt overhang in this scenario acts as a drag on consumption, and the aggregate impact of higher foreclosures can amplify house price declines and worsen macroeconomic outcomes.19 See Garriga and Hedlund, 2019.

Such negative impacts on macroeconomic fragility extend to firm behavior as well. Because young firms rely on home equity as an important source of funding, large house price swings can cause disruption in firm growth and investment. In the case of the Great Recession, Steven J. Davis and John Haltiwanger attribute much of the collapse in young-firm activity to the precipitous drop in house prices.20 Davis, Steven J. and John Haltiwanger, “Dynamism Diminished: The Role of Housing Markets and Credit Conditions,” 2019, Working Paper. Furthermore, they demonstrate that local employment shifts away from young and less educated workers as a result of the relative decline in young-firm activity. Thus, to the extent that unaffordable housing drives up leverage, the result is not only greater economic fragility but also reduced economic dynamism.

This relationship between macroeconomic fragility and housing provides a cautionary tale for affordable housing policies. To the extent that affordable housing policies reduce housing costs, they have the potential to improve economic outcomes. However, if policymakers equate the promotion of affordable housing with encouraging greater homeownership, they run the risk of pursuing policies that achieve this goal by inducing households to take on greater debt and adopt riskier balance sheet positions.

An Overview of Affordable Housing Policies

The United States has an extensive portfolio of housing policies. Along one dimension, these housing policies can be divided into those which seek to promote homeownership and those which primarily target renters. Along another dimension, affordable housing policies can be separated into those which are focused on boosting housing demand and those which seek to add to the supply of affordable housing.

Prominent demand-side policies include the mortgage interest deduction, down payment assistance, and housing vouchers. Policies which seek to expand housing supply include the place-based Low Income Housing Tax Credit (LIHTC), which over the past 30 years has subsidized construction of affordable housing in low-income areas. Lastly, zoning and land use regulations have a major impact on the supply of housing through their impact on the costs of new residential development.

The Economics of Homeownership Promotion

There are many individual economic benefits to homeownership. Depending on the local price-rent ratio and a household’s expectations of how long they plan to live in an area, owning may be cheaper than renting as a means of consuming housing services. In addition, owning a house can be a means to build wealth and may represent an important component of a well-diversified financial portfolio, although many people arguably have a disproportionate share of their wealth tied up in housing. Homeownership can also act as an insurance device against different sources of risk, both because of the ability of homeowners to extract home equity during difficult times and because fixed-rate mortgages provide for a stable monthly payment, whereas rents may unexpectedly rise.

However, these individual benefits from homeownership do not themselves justify the public policy motive for encouraging homeownership over renting. Instead, policymakers often appeal to putative externalities from ownership, such as greater social cohesion and more neighborhood stability. Assessing the empirical evidence regarding the existence and size of these externalities is beyond the scope of this paper. Instead, this section takes as given the government’s interest in promoting ownership and assesses the impact of some of the most common policy instruments used to achieve this goal. In particular, this section discusses (1) different aspects of the tax treatment of rental vs owner-occupied housing and (2) the impact of direct interventions to encourage home purchases via down payment assistance and mortgage subsidies.

Asymmetric Tax Treatment of Rental Income

Preferential tax treatment of owner-occupied housing dates back to the Civil War era.21 See page 1116 of Chambers, Matthew, Carlos Garriga, and Don Schlagenhauf, “Housing Policy and the Progressivity of Income Taxation,” 2009, Journal of Monetary Economics, 56. The main pillars of this differential housing taxation are the mortgage interest deduction, the tax exclusion of owner-occupied imputed rental income, the deductibility of state and local property taxes, and the special treatment of capital gains from selling a house. The tax exclusion of imputed rental income is perhaps the most subtle but is important because it introduces a tax asymmetry between owner-occupiers and landlords: Suppose a household rents housing from a landlord. The rent payments the landlord receives are treated as taxable income, which reduces landlords’ incentive to supply rental housing, resulting in higher rents to the tenant. In other words, renters bear some of the burden of the taxation of rental income. Alternatively, suppose a household is an owner-occupier. One can then view the household as a landlord which rents to itself, except that it does not have to pay tax on the implicit income—the forgone income that the homeowner could receive if they rented the house to someone else.

Some studies have found that eliminating this asymmetry by taxing imputed rental income would lead to smaller houses and lower homeownership.22For a discussion of these papers, see page 1130 of Chambers, Matthew, Carlos Garriga, and Don Schlagenhauf, “Housing Policy and the Progressivity of Income Taxation,” 2009, Journal of Monetary Economics, 56. However, a more recent analysis that takes into account a broader array of economic forces suggests this would actually increase homeownership. 23Chambers, Matthew, Carlos Garriga, and Don Schlagenhauf, “Housing Policy and the Progressivity of Income Taxation,” 2009, Journal of Monetary Economics, 56, pp. 1116–1134. In particular, a revenue neutral implementation of this tax equalization reform would increase the homeownership rate by up to 3 percentage points from 64.6% to 67.6%. This is because of the lower average and marginal tax rates (spread over a larger tax base) and the enhanced incentive to invest in productive capital for housing.24 Another study which finds that reducing the tax advantage of housing relative to other forms of capital would increase economic output is Nakajima, Makoto, “Capital Income Taxation with Housing,” 2019, Working Paper.

Mortgage Interest Deduction

As its name indicates, the mortgage interest deductions (MID) allows homeowners to deduct mortgage interest payments from their taxable income. This policy lowers the cost of ownership, particularly for highly leveraged borrowers, but at the expense of $90 billion in forgone federal tax revenue.25 See page 272 of Sommer, Kamila and Paul Sullivan, “Implications of US Tax Policy for House Prices, Rents, and Homeownership,” 2018, American Economic Review, 108(2), pp. 241–274. Several recent studies have examined the likely impact of removing the MID on house prices and the homeownership rate. Although they present somewhat differing quantitative findings, they all refute the concern among policymakers that its removal would lead to a collapse in ownership. A study by Matthew Chambers, Carlos Garriga, and Don Schlagenhauf finds that removing the MID would lead to a 0.7 percentage point increase in homeownership. Note that these authors also present a partial analysis that ignores the response of house prices, rents, interest rates, and the ability to reduce other taxes. If those factors are ignored, removing the MID would result in a homeownership rate decline of over 3 percentage points.26 See table 8 of Chambers et al. (2009). Kamila Sommers and Paul Sullivan find that eliminating the MID would have a much larger impact—a 5 percentage point increase in the homeownership rate—with low-income households benefiting disproportionately.27See table 8 of Sommer and Sullivan (2018). Moreover, their analysis concludes that house prices would only fall by 4% in inflation-adjusted terms. This should alleviate concerns over a potential collapse in housing values. A study by Pedro Gete and Franco Zecchetto also takes into account the response of mortgage rate spreads, and finds similarly mild effects of removing the MID on house prices and only a modest 0.65% reduction in the homeownership rate.28 Gete, Pedro and Franco Zecchetto, “Distributional Implications of Government Guarantees in Mortgage Markets,” 2018, Review of Economic Studies, 31(3), pp. 1064–1097. Consistent with these findings, Christian Hilber and Tracy Turner’s recent empirical study concludes that in markets with less land use regulation the MID boosts ownership only of high-income households, whereas in tighter markets it mostly serves to boost house prices at the expense of ownership. Overall, Hilber and Turner find that the MID has no discernible overall impact on ownership.29Hilber, Christian A.L. and Tracy M. Turner, “The Mortgage Interest Deduction and its Impact on Homeownership Decisions,” 2014, Review of Economics and Statistics, 96(4), pp. 618 – 637. The ineffectiveness of the MID and its skewed benefits toward high-income households was one of the motivations behind the introduction of a cap through the Tax Cuts and Jobs Act of 2017.

Mortgage Market Interventions and Down Payment Assistance

The federal government seeks to boost homeownership in many other ways besides through the tax code. In particular, the creation of Fannie Mae and Freddie Mac as government-sponsored enterprises was aimed largely at promoting homeownership by ensuring access to stable mortgage financing for the entire country. One important feature of GSEs is that they act as a significant form of spatial redistribution.30Hedlund, Aaron, “Building a Solid Foundation for the American Dream: A Primer on Housing Finance Reform,” 2019, Center for Growth and Opportunity Policy Paper Series. Specifically, a recent study shows that by setting uniform interest rates instead of allowing them to vary based on region-specific economic risks—as was done in the private jumbo market—the GSEs shift resources to distressed areas.31See Hurst, Erik, Benjamin J. Keys, Amit Seru, and Joseph Vavra, “Regional Redistribution through the US Mortgage Market,” 2016, American Economic Review, 106(10), 2982–3028. The study does not determine the impact of this national mortgage rate policy on house prices or homeownership. However, it stands to reason that such a policy is likely to lead to elevated prices in distressed areas, greater leverage, and an ambiguous impact on homeownership. In other words, such a policy may very well decrease housing affordability and sow the seeds of greater economic fragility.

The U.S. has also sought to promote homeownership through the creation of FHA and VA loans. Although the target audiences differ, the common thread involves the government insuring private lenders against losses in the event that borrowers default on their loans. As a result, FHA and VA loans tend to look riskier along several dimensions, including featuring lower average borrower credit scores and higher ratios of cumulative loan-to-value (exceeding 95% on average) and payment-to-income (exceeding 42% on average).32See figure 15 on page 13 of Hedlund, Aaron, “A Primer on Housing Finance Reform,” Center for Growth and Opportunity Policy Paper 2019.006. Even with the prevalence of these low-down payment FHA and VA loans, the U.S. homeownership rate has not shown any signs of improvement in the wake of the Great Recession even while (or perhaps because) house prices have rebounded strongly.

The federal government along with several states have at times also provided direct subsidies to encourage home buying. For example, in 2003 President George W. Bush signed into law the American Dream Downpayment Initiative to help families cover down payments and closing costs. During the depths of the housing crisis, the U.S. government passed the $20 billion First-Time Homebuyer Credit (FTHC) to help the housing market. One recent study finds that the FTHC successfully stimulated transitions into homeownership.33Berger, David, Nicholas Turner, and Eric Zwick, “Stimulating Housing Markets,” Journal of Finance, Forthcoming. However, other research has found that while changes to down payments can bring about temporary changes in the ownership rate, they are less salient than commonly believed for long-run ownership.34Hedlund, Aaron, “Down Payments and the Homeownership Dream: Not Such a Barrier After All?” 2019, CGO Working Paper 2019.005.

The Economics of Rent Control

The aforementioned policies are aimed at promoting homeownership rather than affordable housing per se. In fact, none of the above policies aims to reduce house prices, and in many cases, their economic impact is exactly the reverse. However, policymakers have pursued a number of different avenues to address housing affordability for renters. Historically, one common approach was to directly regulate rents.

Despite falling out of favor during the second half of the twentieth century, rent control has begun to re-emerge as a prominent approach to increase affordable rental options. At first glance, rent control has a certain intuitive appeal by proposing to directly control prices. Unfortunately, a wide body of economic research indicates that—as with many price controls—rent control entails significant negative unintended consequences: misallocation, shortages, and deterioration in maintenance and residential investment. Basic economic theory demonstrates that rent control reduces overall economic welfare by preventing mutually beneficial trades. While some tenants benefit from lower rent (or, as is more often the case in practice, smaller increases), offsetting this gain is the fact that fewer people will be able to find a rental property at all.

Even this analysis is overly generous by ignoring the costs of misallocation from rent control—namely, the fact that those who successfully rent are not likely to be those who place the greatest value on doing so. To understand why, note that in the absence of rent control, any household with a willingness to pay at or above the market rent will transact in the market and become a tenant. With rent control, there are many households who are willing to pay at the rent-controlled amount but will be unable to do so because of shortages. It then becomes an open question as to which of those households end up successfully in units and which do not. Besides the fact that individual willingness to pay is unobservable, there is also no requirement that landlords allocate properties based on the personal valuations of prospective tenants. Such shortages thus raise serious concerns that bribery or discrimination could taint the allocation of rental units to tenants. Empirically, one prominent study estimates that 20% of apartments in rent-controlled New York City are misallocated.35Glaeser, Edward L. and Erzo F. P. Luttmer, “The Misallocation of Housing Under Rent Control,” 2003, American Economic Review, 93(4), pp. 1027–1046.

Furthermore, the negative consequences of rent control have been confirmed empirically and shown to compound over time. One illustrative case is San Francisco, which imposed rent control in 1979 and expanded the restrictions in 1994. An important feature of rent control in San Francisco is that it regulates the magnitude of rent increases from one year to the next rather than setting the absolute level of rent. One study finds that tenants placed significant insurance value on this rent control, as inferred by their 20% lower propensity to move.36 See Diamond, Rebecca, Tim McQuade, and Franklin Qian, “The Effects of Rent Control Expansion on Tenants, Landlords, and Inequality: Evidence from San Francisco,” 2019, American Economic Review, 109(9), pp. 3365 – 3394. Other recent research has also found insurance benefits to rent stabilization, which is absent in a purely static analysis.37 See Favilukis, Jack, Pierre Mabille, and Stijn Van Nieuwerburgh, “Affordable Housing and City Welfare,” 2019, Working Paper and Sieg, Holger and Chamna Yoon, “Waiting for Affordable Housing in New York City,” 2019, Working Paper. Nevertheless, this insurance comes at high cost, as landlords in the San Francisco study did not passively accept this limitation on their ability to adjust rents with market conditions. Instead, landlords began substituting to other forms of real estate, whether by converting properties to condos or redeveloping buildings to exempt themselves from the law. The study attributes a 15% reduction in the total supply of available rental housing and a 25% decline in the number of renters living in rent-controlled units to the rent control law.

In addition, new construction shifted toward less affordable types of housing aimed at catering to high-income households, leaving tenants in rent-controlled units more likely to live in areas with worse amenities. Thus, rather than promoting economic integration, rent control often ends up isolating the poor. This is a point that has also been made in other research.38 Glaeser, Edward L., “Does rent control reduce segregation?” 2003, Swedish Economic Policy Review, 10, pp. 179–202. The authors conclude that “The lost rental supply likely drove up market rents in the long run, ultimately undermining the goals of the law.” In a companion paper, they show that this negative landlord response to rent control was especially concentrated among corporate landlords, who—aided by superior access to capital—were better able to convert properties to other uses and decreased their supply of rent-controlled housing by 64%. Thus, not only did tenants face higher rents and fewer available properties as a result of rent control, but “Mom and Pop” landlords were left shouldering a disproportionate fraction of the burden on the supply side of the market.39Diamond, Rebecca, Tim McQuade, and Franklin Qian, “Who Pays for Rent Control? Heterogeneous Landlord Response to San Francisco’s Rent Control Expansion,” 2019, American Economic Review Papers and Proceedings, 109, pp. 377 – 380.

Studies have also examined the impact of going in the opposite direction and removing rent control. One notable case is Massachusetts, which eliminated rent control in 1995 via ballot initiative. One study examining this episode attributes a significant increase both in the supply of rental units and in housing maintenance to the abolition of rent control.40 Sims, David P., “Out of Control: What Can We Learn from the End of Massachusetts Rent Control?” 2007, Journal of Urban Economics, 61(1), pp. 129–151. The author summarizes the findings by stating that “the intuition presented in simple microeconomic models is correct. Rent control decreases the quantity of rental units supplied, as well as rent and unit maintenance.” In another paper studying the same episode, the authors use property-level data to show that the elimination of rent control caused price appreciation not just of the rent-controlled units but also units that were exempt from the rent controls. In other words, they show that rent control has significant negative spillovers on cities as a whole, not just the specific properties affected.41Autor, David H., Christopher J. Palmer, and Parag A. Pathak, “Housing Market Spillovers: Evidence from the End of Rent Control in Cambridge, Massachusetts,” 2014, Journal of Political Economy, 122(3), pp. 661–717.

The Economics of Rental Housing Subsidies

Rent control represents only one lever used by policymakers to promote—however ineffectively—affordable rental housing, and it is largely confined to local and occasionally state governments. By contrast, the federal government over the past several decades has used public housing as well as tenant-based and place-based subsidies to advance its affordable housing goals. While public housing has accounted for a significant fraction of the federal government’s affordable housing portfolio, its role has diminished over time. For example, the 1998 Public Housing Reform Act explicitly prohibited public housing authorities (PHAs) from increasing their inventories of public housing units, although those numbers had already been falling prior to 1998. In addition, PHAs were allowed in some cases to convert public housing units into vouchers, while at the same time the HOPE VI program has led to a net demolition of units.

The Low Income Housing Tax Credit

Place-based subsidies seek to encourage the construction of affordable rental housing in areas of need rather than being attached to specific tenants based on individual need. Since its creation as part of the Tax Reform Act of 1986, the Low Income Housing Tax Credit (LIHTC) has become the largest subsidy for the construction of rental housing.42Collinson, Robert, Ingrid Gould Ellen, and Jens Ludwig, “Low-Income Housing Policy,” 2016, Economics of Means-Tested Transfer Programs in the United States, Volume 2, Ed. Robert A. Moffitt, University of Chicago Press. The funding for these credits comes is allocated by the federal government to states on a constant per capita cost basis, after which point state housing finance authorities are responsible for the actual implementation and awarding of credits to private developers. Because the credits can only be used to offset tax liabilities and are non-refundable, developers typically sell them to third-party investors in exchange for equity financing, thereby reducing the amount of debt required to begin construction. Enhanced LIHTCs which are 30% more generous to developers are available in locations designated as difficult development areas (DDAs) or qualified census tracts (QCTs).43 See page 3 of https://fas.org/sgp/crs/misc/RS22389.pdf.

Despite its political durability, there is little evidence that the LIHTC has meaningfully improved housing affordability in the United States as a whole. The most charitable estimates from Rebecca Diamond and Tim McQuade’s recent analysis suggest that the LIHTC can contribute to the revitalization of neighborhoods with median income below $26,000. There, the LIHTC can increase house prices (to the tune of 6.5%), reduce crime, and attract a more diverse population in terms of both race and income. However, in areas with median income above $54,000, they find that the LIHTC causes house prices to fall by 2.5% and leads to a decrease in home buyer income.44Diamond, Rebecca and Tim McQuade, “Who Wants Affordable Housing in Their Backyard? An Equilibrium Analysis of Low-Income Property Development,” 2019, Journal of Political Economy, 127(3), pp. 1063–1117. Critically, Diamond and McQuade do not take into account any potential crowding out effects of the LIHTC on private development and are careful to assert that they are not analyzing “the effectiveness or welfare impact of the LIHTC program versus private market development.”45See page 51 of Diamond and McQuade (2019).

Unfortunately for the LIHTC, other research has indeed found strong crowd out effects. For example, Michael Eriksen and Stuart Rosenthal find that nearly 100% of LIHTC development is offset by a reduction in the construction of unsubsidized units.46Eriksen, Michael D. and Stuart S. Rosenthal, “Crowd Out Effects of Place-Based Subsidized Rental Housing: New Evidence from the LIHTC Program,” 2010, Journal of Public Economics, 94, pp. 953–966. For another example of a crowding out effect, see Freedman, Matthew and Tamara McGavock, “Low-Income Housing Development, Poverty Concentration, and Neighborhood Inequality,” 2015, Journal of Policy Analysis and Management, 34(4), pp. 805–834. Todd Sinai and Joel Waldfogel conclude that each new unit of government-subsidized housing only adds one-third to one-half of a unit to the total housing stock, implying a crowding out effect of one-half to two-thirds.47 Sinai, Todd and Joel Waldfogel, “Do Low-Income Housing Subsidies Increase the Occupied Housing Stock?” 2005, Journal of Public Economics, 89, pp. 2137 – 2164. Looking beyond the crowding out factor, Ingrid Ellen, Keren Horn, and Katherine O’Regan show that “poverty rates decline in high-poverty neighborhoods after the completion of LIHTC developments but that on the whole, LIHTC investments do little to reduce poverty concentration,” which is one of the aims of the LIHTC specifically and place-based policies more generally.48 See page 50 of Ellen, Ingrid G., Keren M. Horn, and Katherine M. O’Regan, “Poverty Concentration and the Low Income Housing Tax Credit: Effects on Siting and Tenant Composition,” 2016, Journal of Housing Economics, 34, pp. 49–59. Kirk McClure’s recent research levels an even harsher appraisal of LIHTC, asserting that it actually contributes to the spatial concentration of poverty.49 McClure, Kirk, “What Should Be the Future of the Low-Income Housing Tax Credit Program?” 2019, Housing Policy Debate, 29(1), pp.65-81. A more nuanced but broadly consistent conclusion emerges from a study by Morris Davis, Jesse Gregory, and Daniel Hartley, which conducts a counterfactual to determine what would happen if some specified number of low-income housing units were added to a census tract. The paper finds that, when low-income units are geographically concentrated, they result on average in a rise in the share of low-income households.50Davis, Morris A., Jesse Gregory, and Daniel A. Hartley, “The Long-Run Effects of Low-Income Housing on Neighborhood Composition,” 2019, Working Paper.

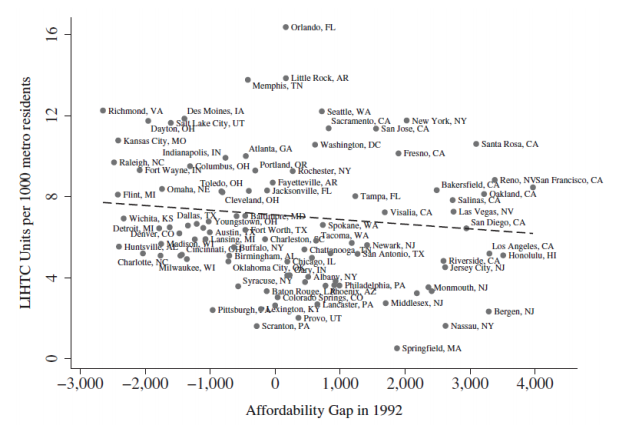

Figure 6, below, which comes from a recent article by Michael Eriksen and Bree Lang, indicates that the LIHTC is poorly targeted. This figure reveals no discernible relationship between the degree of housing unaffordability at the metro area level in 1992 and the amount of LIHTC construction per 1,000 residents between 1992 and 2013. 51Eriksen, Michael D. and Bree J. Lang, “Overview and Proposed Reforms of the Low-Income Housing Tax Credit Program,” Regional Science and Urban Economics, Forthcoming.While there are many possible reasons for this poor targeting, one culprit is the LIHTC’s constant per capita state allocation that is independent of state-level variation in housing costs.

Figure 6: LIHTC Construction (1992 – 2013) for the 100 Largest Metro Areas in 2013. Source: Eriksen and Lang (2018)

Given this allocation method, simply increasing total spending on the LIHTC is not a promising avenue for reform. It makes little sense from a cost-effectiveness standpoint to tackle high housing costs in one area by raising LIHTC spending in all areas. In addition, even if the LIHTC could be perfectly targeted, its strong crowd out effects would render any expansion almost futile when it comes to increasing the total stock of available affordable rental units. Compounding this problem is the fact that, by subsidizing just the non-land component of construction, the LIHTC causes developers to inflate the square footage of subsidized buildings by 25–29% relative to unsubsidized buildings, thus driving up costs.52 Lang, Bree J., “Input Distortions in the Low-Income Housing Tax Credit: Evidence from Building Size,” 2015, Regional Science and Urban Economics, 52, pp. 119–128.

The body of research compiled and discussed in this paper suggests some guideposts for LIHTC reform. Arguably the most pressing problems with the LIHTC are its lack of targeting, its crowd out effects, and its incentives to inflate costs. In terms of where the LIHTC should be targeted the research is not sufficiently clear at the moment. On the one hand, the Diamond and McQuade study discussed earlier finds promising revitalization effects of LIHTC in low-income areas.53Diamond, Rebecca and Tim McQuade, “Who Wants Affordable Housing in Their Backyard? An Equilibrium Analysis of Low-Income Property Development,” 2019, Journal of Political Economy, 127(3), pp. 1063–1117. On the other hand, the Davis et al. study seemingly contradicts those findings.54Davis, Morris A., Jesse Gregory, and Daniel A. Hartley, “The Long-Run Effects of Low-Income Housing on Neighborhood Composition,” 2019, Working Paper. It shows that placing LIHTC units in areas with high social mobility scores would lead to the best results for improved earnings. But neither of those studies considers the response of private development to LIHTC units. A more promising approach may be to focus on adding units to areas with high housing costs and supply restrictions where private development is already constrained. For example, California has a Density Bonus Law that allows developers to bypass local zoning laws and build at a higher density level than normally allowed if the project meets certain affordability requirements. Lastly, to remedy the cost inflation incentives endemic to the current LIHTC, policymakers should consider allowing the subsidy to vary with local labor costs or limiting the subsidy on a per unit basis. However, there is a strong case for shifting more fundamentally away from a place-based policy like LIHTC toward tenant-based subsidies, which are discussed next.

Tenant-Based Subsidies

In contrast to the many policies this paper has thus far discussed and found wanting, tenant-based policies hold more promise to assist financially-constrained households in finding affordable housing. Before discussing the economic theory and empirical studies supporting this assertion, it is worthwhile to delve into some institutional details. Currently, section 8 vouchers are the largest source of tenant-based assistance. They are administered by local PHAs and paid directly to private landlords on behalf of low-income households. The general structure of these vouchers is such that families choose where they want to live and contribute 30% of their adjusted income toward rent, with the voucher paying the difference between that amount and actual rent up to some maximum amount. Importantly, eligibility for the program is restricted to families earning less than 50% of the local area median income or less than 80% if they also meet other criteria.55 See page 8 of “Overview of Federal Housing Assistance Programs and Policy” by the Congressional Research Service. In addition, because the program is not an entitlement, waiting lists are common given the limited amount of vouchers.

From the standpoint of economic theory, tenant-based subsidies—that is, vouchers—have strong efficiency and insurance properties relative to place-based policies or rent control. First, by following families wherever they go, rather than constraining them to live in a “needy” area, vouchers facilitate labor mobility and encourage families to seek out locations that best suit their individual needs. Second, vouchers are simpler and more cost effective to implement, especially compared to the complicated web of intermediaries and bureaucrats that are needed to execute the LIHTC program. Third, from an insurance and equity perspective, vouchers can be more accurately targeted toward those in genuine financial need—that is, those who would not otherwise be able to find affordable housing. Moreover, such need can and ought to be reassessed periodically to ensure that recipients of vouchers are still in need. (Whereas the existing research finds that many beneficiaries of the LIHTC are not in particularly dire circumstances, section 8 vouchers are better targeted toward the lowest income households.) Arguably its main deficiency in meeting need is the limited number of vouchers and the associated long waiting list. In other words, section 8 vouchers provide considerable insurance to those who are lucky enough to get off the waiting list.

Quantitatively, Jack Favilukis, Pierre Mabille, and Stijn Van Nieuwerburgh find that tightening income qualification requirements creates large welfare gains. It frees up resources to reduce waiting lists, which improves access to insurance. Given the large insurance benefits of affordable housing, the study also concludes that funding an overall expansion of housing vouchers would lead to better economic outcomes.56 See Favilukis et al., 2019. Deven Carlson and co-authors largely confirm the economic intuition that vouchers increase geographic mobility in both the short run and the long run while also leading to improvements in neighborhood quality.57Carlson, Deven, Robert Haveman, Thomas Kaplan, and Barbara Wolfe, “Long-Term Effects of Public Low-Income Housing Vouchers on Neighborhood Quality and Household Composition,” 2012, Journal of Housing Economics, 21, pp. 101–120. Judy Geyer examines the impact the voucher design has on the tradeoff households face between higher housing consumption versus better neighborhood quality. If the policy objective is to facilitate households moving to areas with the greatest economic opportunity, the analysis in the paper concludes that letting maximum voucher amounts vary by neighborhood rather than metro area could have large impacts on mobility by reducing the concentration of poverty, although at a 14% higher program cost. A partial rebate for housing expenses would achieve nearly the same positive effect on mobility while reducing the cost of the voucher program by 8.2%.58 Geyer, Judy, “Housing Demand and Neighborhood Choice with Housing Vouchers,” 2017, Journal of Public Economics, 99, pp. 48–61.

Recent research by Peter Bergman and co-authors confirms the need for reforms by investigating why low-income families tend to cluster in neighborhoods that offer limited opportunities for upward mobility. In particular, the paper investigates whether this clustering arises because low-income families actively prefer to live in such neighborhoods because they have other attractive features—such as proximity to family—or whether families face barriers to moving to high-opportunity areas. The study concludes that barriers in the housing search process severely inhibit relocation and that customized assistance can greatly reduce residential segregation.59 See Bergman, Peter, Raj Chetty, Stefania DeLuca, Nathaniel Hendren, Lawrence F. Katz, and Christopher Palmer, “Creating Moves to Opportunity: Experimental Evidence on Barriers to Neighborhood Choice,” 2019, Working Paper. Dionissi Aliprantis, Hal Martin, and David Phillips find that low-income households also face difficulties in relocating to higher-rent areas because of landlord aversion to voucher tenants. They conclude that raising voucher payments in such areas is helpful to voucher tenants but that engaging landlords is likely necessary to improve access to neighborhood opportunity.60 See Aliprantis, Dionissi, Hal Martin, and David Phillips, “Landlords and Access to Opportunity,” 2019, Working Paper.

Overall, the bulk of the research indicates that housing vouchers are better able to improve access to affordable housing and at a lower cost per recipient than other policies aimed at boosting low-income housing demand. However, in addition to some current design deficiencies that reduce vouchers’ effectiveness, any set of demand-based housing affordability policies are likely to fall short of achieving their goals absent accompanying reforms on the supply side to ease restrictions on new development. This paper turns to such issues next.

The Economics of Zoning and Land Use Regulation

Despite their varying and at times dubious effectiveness, the previously discussed policies have at least been pursued with the intention of improving housing affordability. However, such policies have been fighting an uphill battle against a backdrop of restrictive zoning and land use ordinances set at the state and local level. These restrictive policies are often supported by homeowners more interested in boosting property values than in expanding affordability.61For more discussion of housing supply constraints, see Erdmann, Kevin, Shut Out: How a Housing Shortage Caused the Great Recession and Crippled Our Economy, 2019, Rowman and Littlefield Publishers.

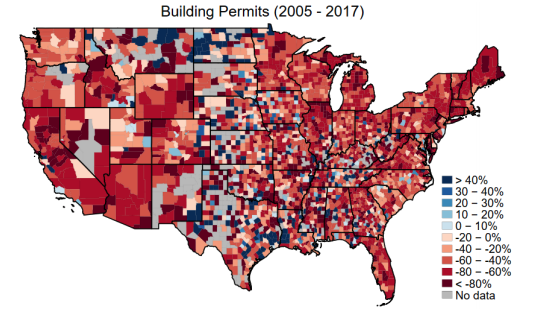

Such land use regulations come in many forms, ranging from minimum lot sizes, minimum parking requirements, and minimum setback distances to maximum height restrictions and lengthy environmental permitting processes. Perhaps no ordinance has had greater impact than single-family zoning, which prohibits the construction of multi-unit housing in vast swaths of highly productive urban areas. While geographical features can themselves act as an impediment to new construction, the surprising lack of density in areas like Palo Alto compared to cities like Hong Kong which also face geographic constraints suggests that zoning and land use regulations play a significant role in limiting development. Consequently, even while house prices have experienced a robust recovery since the Great Recession, figure 7 indicates that building permits remain far below their 2005 levels in much of the country.

Figure 7: New Single-Family Permits (% Change from 2005 to 2017). Source: Census Building Permits Survey

This discussion is not meant to imply that all zoning and land use regulations are without merit, but their cost should not be ignored, both for individuals looking to move into affected localities and for the economic performance of the country as a whole. As mentioned toward the beginning of this paper, multiple studies find that land use restrictions at the local level profoundly alter total U.S. economic productivity and output over time. One such study uses data from 220 metropolitan areas and calculates that cumulative U.S. growth between 1964 and 2009 was 36% lower than it would have been absent the adoption of increasingly stringent housing supply restrictions.62See Hsieh and Moretti, 2019.

Another study constructs a comprehensive measure of land regulations throughout the U.S. and demonstrates that they have become significantly tighter since 1980. The authors find that reverting California’s land use regulation to its 1980 level would alone increase U.S. GDP by 1.5% by facilitating greater mobility of workers to productive areas within California.63See Herkenhoff et al., 2018. They find that deregulating all states to their 1980 levels would raise consumption by about 9%. This is a similar increase to an alternative scenario where all states change their level of land use regulations to that of Texas, which has some of the loosest restrictions. Looking at the case of Greater Boston, researchers document a profound increase in house prices and decline in the number of new units without any notable increase in density levels. Their analysis attributes these trends to supply restrictions, with minimum lot size playing a particularly important role.64 Gyourko, Joseph and Raven Molloy, “Regulation and Housing Supply,” 2015, Handbook of Regional and Urban Economics, 5, pp. 1289–1337. More broadly, these findings are supported by another study which demonstrates that metropolitan areas with a high degree of housing supply regulation experience considerably lower employment growth because of the drag of high housing costs on labor mobility.65Saks, Raven E., “Job Creation and Housing Construction: Constraints on Metropolitan Area Employment Growth,” 2008, Journal of Urban Economics, 64, 178–195. These patterns lead Joseph Gyourko and Raven Molloy to conclude that “Most theoretical and empirical research has found that the costs of regulation outweigh the benefits by a substantial margin.”66 See page 1332 of Gyourko and Molloy (2015). Moreover, such regulatory costs fall disproportionately on the relatively poor. Despite these clear disadvantages of supply restrictions, concentrated political power among homeowners and NIMBYism can perpetuate such policies.67See Ikeda, Sanford and Emily Washington, “How Land-Use Regulation Undermines Affordable Housing,” 2015, Mercatus Center.

There are several paths policymakers can follow to reverse these deleterious effects. At the local level, leaders should first address regulations which are likely to engender the least political opposition. For example, loosening parking requirements, relaxing minimum lot sizes, and legalizing accessory dwelling units are likely to prove less controversial than encouraging the construction of high-density housing in predominantly single-family neighborhoods. At the same time, given the prevalence of single-family zoning and its constraining impact on the ability of cities to accommodate larger populations, leaders should also explore ways to allow existing owners—and not just developers—to share in the gains associated with loosening zoning rules. For example, owners could be allowed to upzone themselves, thereby raising the value of their land. Alternatively, existing owners could be directly compensated out of the property tax revenues generated by new development.68 For additional reform options, see Schleicher, David, “City Unplanning,” 2013, Yale Law Journal, 122, pp. 1670–1737. At the same time, the research discussed above demonstrates that local ordinances have aggregate effects that local political leaders do not internalize. To overcome this problem, state governments could pursue either a light touch of providing incentives to localities to allow greater construction or a heavier approach of directly limiting localities’ ability to impose restrictions. Improved transportation networks would also allow productive cities to absorb more workers without needing to rely entirely on accommodating them through new housing within as close of a proximity. Lastly, one novel approach suggested by Elliot Anenberg and Edward Kung is improving amenities in lower priced neighborhoods. They find that such an approach would not only make the lower priced neighborhoods more attractive but also alleviate cost pressure in higher priced neighborhoods, as people would place a smaller premium on living there.69Anenberg, Elliot and Edward Kung, “Can More Housing Supply Solve the Affordability Crisis? Evidence from a Neighborhood Choice Model,” 2019, Working Paper.

Summary and Conclusions

The U.S. currently pursues a wide array of policies aimed at expanding affordable housing options both to renters and prospective owners. Unfortunately, many of these policies have proven lacking, in part because of tensions between different policy goals and in part because of the inherent flaws in their economic design. With respect to competing goals, one question policymakers face is whether the higher priority is to pursue affordable housing as a goal regardless of an individual’s tenure status as an owner or renter, or whether the quintessential American dream of homeownership must remain at the heart of housing policy efforts. Philosophical and normative concerns ultimately weigh heavily on such a judgment, but from a purely economic perspective, there is ample reason to de-emphasize homeownership as an explicit policy goal.

While homeownership confers many individual benefits, it is not without risks, particularly when exacerbated by policies which encourage the accumulation of debt that contribute to greater economic fragility. By contrast, ensuring the availability of affordable housing options in productive locations provides gains both to those living in such areas and to households everywhere. The engine of the American economy has long been its dynamism, rooted partly in the willingness and ability of workers to move to opportunity. Excessive housing costs driven by regulatory barriers to construction impede this engine by limiting worker mobility.

Policymakers also face a number of other important considerations. First, economic analysis has highlighted that many current policies have large inefficiencies associated with them (e.g. cost inflation, misallocation, etc.) while still providing valuable insurance to beneficiaries. Rent control emerges as a stark case. Tenants who live in units with rent stabilization benefit from the predictability that their housing costs will not rise precipitously over time, just as homeowners benefit from the stability of making predictable mortgage payments. However, an extensive and impressive body of evidence demonstrates that such rent control policies lead to a significant reduction in the size and quality of the available rental stock. This raises costs and limits options for prospective tenants who are looking to move into an area. These negative consequences of rent control make a strong case for eliminating it, but political forces may perpetuate it unless a substitute policy can provide comparable insurance to tenants.

A second consideration policymakers must wrestle with, particularly as they ponder alternatives to rent control, is whether to pursue people-based or place-based subsidies, or even whether to explicitly subsidize housing at all. After all, standard consumer choice theory states that, absent externalities, households would be better off with cash-based assistance instead of in-kind assistance. That said, if such externalities exist and are sufficiently large to dominate negative political economy considerations—debatable, no doubt, but outside the scope of this paper—theoretical and empirical economic analysis both point to the superiority of vouchers over policies like the LIHTC. By targeting those most in need and not constraining them to live in a particular location, vouchers provide greater insurance benefits, are more cost effective, and enhance labor mobility.

Lastly, and perhaps most importantly of all, any affordable housing agenda that focuses on boosting demand without also removing the dizzying array of zoning ordinances and land use regulations that constrain housing supply risks inflating housing costs rather than achieving the goal of greater affordability and enhanced economic opportunity