Introduction

Many discussions about tax policy focus on which taxes do (or do not) discourage hard work and wealth creation. Unfortunately, this narrow focus on labor supply and investment misses the bigger picture of what has been occurring in the U.S. economy over the past half-century. Just as heavy machinery transformed the U.S. from an agrarian society into an industrial powerhouse, so too has the new knowledge economy changed the nature of economic growth.1More discussion on the importance of knowledge diffusion for growth, along with a list of additional references, can be found in Akcigit and Ates (2019), “What Happened to U.S. Business Dynamism?” 2019, NBER Working Paper 25756.

This paper explores the latest academic findings on how income tax policy—both at the personal and corporate level—affects innovation. To do so, it focuses on the impact of tax policy on the incentive to innovate, the quantity and quality of new ideas, and business startups and productivity. The research shows that both high income tax rates and inefficient tax structures can negatively influence innovation and entrepreneurship.

The Importance of Productivity for Sustained Growth

Nobel laureate economist Robert Solow first explained how capital—machines, equipment, and other reproducible factors of production—allowed countries to escape the trap of subsistence living during the Industrial Revolution.2Solow, Robert M., “A Contribution to the Theory of Economic Growth,” 1956, Quarterly Journal of Economics, Vol. 70(1), pp. 65–94. Solow also showed that diminishing returns would cause the growth rate in living standards (measured as GDP per capita) to eventually flatten as each additional unit of capital led to smaller incremental gains in output.

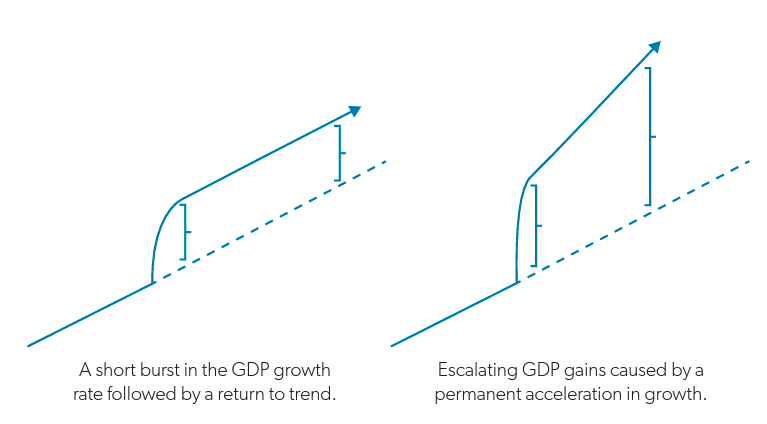

Figure 1. The Compounding Effects of Persistent Economic Growth on Living Standards

The distinction between permanent changes in growth rates and one-time improvements in living standards is crucial. Compare the gains from the permanently accelerated growth rate in the right panel of figure 1 to the gains from the short burst in growth on the left. A policy that only affects the incentive to work or invest in capital can only hope to achieve a fleeting jump in growth followed by a return to the previous trend, like in the left panel. By contrast, rising productivity—that is, the ability to produce more with less— can create faster growth over the long run.

Decades after Solow, another Nobel laureate economist, Paul Romer, identified ideas—such as the discovery of a new chemical formula or the development of better management practices—as the foundation for rising productivity.3Romer, Paul M., “Endogenous Technological Change,” 1990, Journal of Political Economy, Vol. 98(5), pp. S71–S102. What distinguishes ideas from traditional goods is that they are nonrivalrous, meaning the use of an idea by one individual does not diminish its usefulness to another individual. Because ideas remain useful regardless of the number of times they are used, they build off of each other, presenting boundless opportunities for progress and improvement. Thus, the challenge for economic growth ultimately becomes one of discovering the best ways to nurture rather than thwart the creation and dissemination of ideas.

Evidence about the Effect of Income Taxes on Innovation

Researchers are now able to precisely estimate the effects of federal and state-level taxes on idea creation thanks to advances in economic methodology and greater access to detailed, micro-level “big data.” This growing body of research reveals that taxes have a significant impact on innovation and entrepreneurship—ultimately affecting productivity and growth as a result.

Income Taxes Affect the Number and Location of Innovators

Although the decision to become an innovator is often shaped by a number of personal factors, such as the influence of mentors, research indicates that financial incentives play a significant role. For example, in one recent study, a simulated 40% increase in the income tax rate is shown to produce up to a 48% drop in the number of people filing patents.4Bell, Alexander M., Raj Chetty, Xavier Jaravel, Neviana Petkova, and John Van Reenen, “Do Tax Cuts Produce More Einsteins? The Impacts of Financial Incentives vs. Exposure to Innovation on the Supply of Inventors,” 2019, NBER Working Paper #25493.

In two related studies, income tax hikes at either the personal or corporate level are also shown to have negative effects on state-level innovation and the individual behavior of inventors.5Akcigit, Ufuk, John Grigsby, Tom Nicholas, and Stefanie Stantcheva, “Taxation and Innovation in the 20th Century,” 2018, NBER Working Paper #24982; and Mukherjee, Abhiroop, Manpreet Singh, and Alminas Zaldokas, “Do corporate taxes hinder innovation?” Journal of Financial Economics, Vol. 124, pp. 195–221. For instance, Akcigit et. al. find that each percentage point increase in the average personal tax rate leads to between 6% and 10% fewer patents and citations.6Moreover, these negative results apply to corporate taxes as well, thus impacting business incentives for the archetypal “garage” inventor. Depending on the success of their invention, garage inventors may opt to remain unincorporated, they may start a business and incorporate, or they may sell their patent to another corporation. Higher corporate taxes reduce the value of the latter two options, thus limiting the upside potential to any garage inventor. This finding is consistent with other evidence that patent application tends to mark “the peak of a successful career in innovation” rather than the beginning of the path toward high returns. Heavier taxes reduce the likelihood that any given innovator will ever make it to that peak.

Besides reducing the total quantity of inventors nationwide, higher income taxes also affect where they choose to live. This has significant implications for state economic performance and policy. Two recent studies find that top-tier scientists and inventors actively migrate toward locations with lower taxes.7 Moretti, Enrico and Daniel J. Wilson, “The Effect of State Taxes on the Geographical Location of Top Earners: Evidence from Star Scientists,” 2017, American Economic Review, Vol. 107(7), pp. 1858–1903; and Akcigit, Ufuk, Salomé Baslandze, and Stefanie Stantcheva, “Taxation and the International Mobility of Inventors,” 2016, American Economic Review, Vol. 106(10), pp. 2930–2981. Of course, other factors besides taxes also play a role in migration decisions. But Enrico Moretti and Daniel J. Wilson, authors of one of the studies, find that at the margin a 1% hike in state taxes is associated with a 1.8% higher net outflow of innovators.8See Moretti and Wilson (2017).

Income Taxes Impact the Quantity and Quality of New Ideas

What matters for overall economic performance is not just the quantity of inventors but also the quality of new ideas being created. Here, too, income taxes have a significant impact. Recent research by Alexander M. Bell et al. has found that the private gains to inventors (i.e., their income) are highly correlated with the social impact of their inventions as measured by citations. Therefore, raising income taxes may reduce inventors’ incentive to create inventions with large social impact. Quantitatively, their simulations imply that a 40% hike in income taxes produces between a 9.4% and 12.5% reduction in quality-adjusted innovation as measured by citations.9Bell, Alexander M., Raj Chetty, Xavier Jaravel, Neviana Petkova, and John Van Reenen, “Do Tax Cuts Produce More Einsteins? The Impacts of Financial Incentives vs. Exposure to Innovation on the Supply of Inventors,” 2019, NBER Working Paper #25493.

Income Taxes Affect Business Startups and Productivity

Innovation is the foundation for rising productivity, but the connection is not automatic. Instead, entrepreneurs must be willing to adopt the innovations, through both new and existing enterprises. Here, too, research has shown significant impacts of the income tax code on business dynamism and, thus, productivity. For example, one recent study by Mark Curtis and Ryan Decker identifies a strong negative connection between state income taxes and entrepreneurship.10 Curtis, Mark E. and Ryan A. Decker, “Entrepreneurship and State Taxation,” 2018, Working Paper. Specifically, the authors establish that each percentage point increase in the state corporate tax rate results in a 3.7–4.4% drop in the number of workers employed at startup firms. Another study, by Xavier Giroud and Joshua Rauh, shows that, as state taxes rise, the number of startups falls, as does the number of employees per startup.11Giroud, Xavier and Joshua Rauh, “State Taxation and the Reallocation of Business Activity: Evidence from Establishment-Level Data,” Forthcoming, Journal of Political Economy. A recent study by Jeremy Greenwood, Pengfei Han, and Juan M. Sánchez finds that increases in capital gains tax rates depress the amount of venture capital invested in startups.12Greenwood, Jeremy, Pengfei Han, and Juan M. Sánchez, “Financing Ventures,” 2018, Federal Reserve Bank of St. Louis Working Paper #2017-035C.

As startups mature, access to larger pools of capital becomes increasingly valuable to facilitate productivity-enhancing investment. The income tax code plays a large role in this process by shaping firms’ legal structures. Specifically, the interaction between the personal and corporate tax codes can jointly shape decisions about whether a firm is organized as a pass-through entity or a C-corporation. Incorporating as a C-corporation provides greater access to external funds but at the expense of double taxation— first at the corporate level, and then at the shareholder level. By contrast, income from pass-through entities gets taxed at the personal level.

Recent research concludes that reforms that lower the corporate rate produce economy-wide gains in productivity by encouraging incorporation. This is precisely because incorporation can alleviate financial constraints and permit greater investment.13Chen, Daphne, Shi Qi, and Don Schlagenhauf, “Corporate Income Tax, Legal Form of Organization, and Employment,” American Economic Journal: Macroeconomics, Vol. 10(4), pp. 270–304. Similarly, recent work by economists Sebastian Dyrda and Benjamin Pugsley shows the importance of how tax reforms are structured. They find that reforms which widen the gap between the personal and corporate tax rates (e.g., by cutting the personal rate without also reducing the corporate rate) can cause a counterproductive drop in wages and output. Such reforms may induce firms to organize as pass-through entities for tax reasons at the expense of less access to capital.14Dyrda, Sebastian and Benjamin Pugsley, “Taxes, Private Equity, and the Evolution of Income Inequality in the US,” 2019, Working Paper.

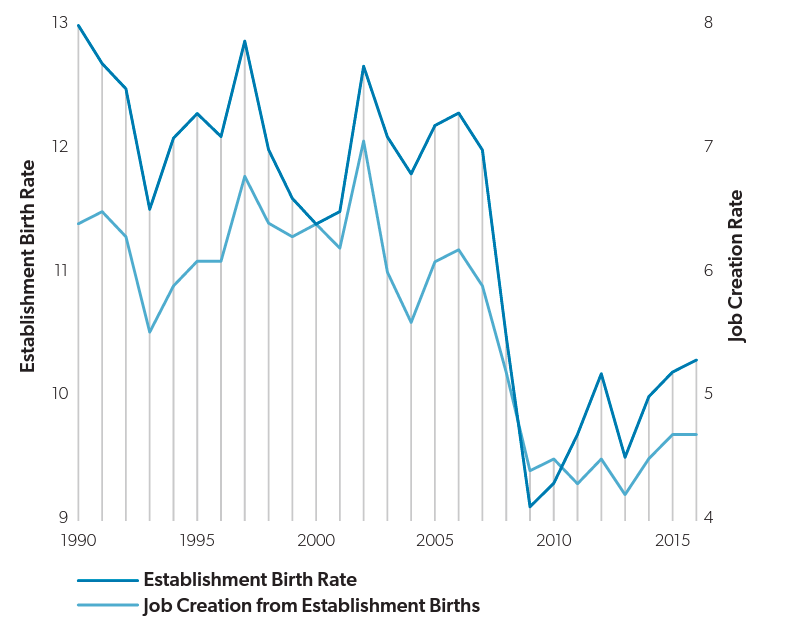

Unfortunately, measures of economic dynamism, such as the rate of new business creation, seen in figure 2, have sharply declined in recent years. This fact is a bad omen for future productivity growth.15More discussion on the link between declining dynamism and slowing productivity can be found in Decker, Ryan A., John Haltiwanger, Ron S. Jarmin, and Javier Miranda, “Declining Dynamism, Allocative Efficiency, and the Productivity Slowdown,” 2017, American Economic Review Papers & Proceedings, Vol. 107(5), pp. 322–326.

Figure 2. Business Startups and Job Creation

Data Source: Census Business Dynamics Statistics Visualization Tools16The establishment birth rate equals 100*(number of establishments born from year t – 1 to year t)/(average number of establishments across years t and t – 1). The job creation rate from establishment births is 100*(number of jobs created by establishment births from year t – 1 to year t)/(average employment across years t and t – 1).

Policy Implications

Taken together, these studies suggest that tax policies that reduce the financial gains to innovation risk hurting a country’s economic growth. Some have suggested that these negative consequences can be avoided by targeting higher taxes only at the wealthy, but recent research indicates otherwise.

In their analysis of patent records, Bell et. al. find that a relatively small number of inventors account for a disproportionate share of high-quality inventions.17 Bell, Alexander M., Raj Chetty, Xavier Jaravel, Neviana Petkova, and John Van Reenen, “Do Tax Cuts Produce More Einsteins? The Impacts of Financial Incentives vs. Exposure to Innovation on the Supply of Inventors,” 2019, NBER Working Paper #25493. Moreover, because ideas are nonrivalrous, an unlimited number of people can subsequently build on them. As a result, any policy that reduces the incentives for new ideas is likely to create broad-based negative consequences for growth and welfare. To be concrete, economist Charles Jones shows that raising the top income tax rate to 75% could (1) reduce overall GDP by over 8% and (2) reduce the income of the bottom 90% of income earners by over 3%, even under the assumption that they would be direct recipients of all the newly raised tax revenue.18 Jones, Charles, “Taxing Top Incomes in a World of Ideas,” 2018, Working Paper. Economists Nir Jaimovich and Sergio Rebelo provide further evidence, finding that raising the capital income tax rate to 60% could cut economic growth rates in half.19 Jaimovich, Nir and Sergio Rebelo, “Nonlinear Effects of Taxation on Growth,” Journal of Political Economy, Vol. 25(1), pp. 265–290.

Some degree of taxation is necessary to fund the core functions of government and make beneficial public investments in the future.

The question being asked is not whether to tax. Rather, these studies emphasize the importance of getting tax rates and tax structures right. The costs of getting it wrong include reduced entrepreneurship and innovation and therefore lower long-run growth rates, not just a diminished incentive to work hard.

In addition, research suggests the design of the tax code is just as critical as the top-line revenue figure. Two lessons stand out. First, policymakers should consider the tax code as one unified object, rather than viewing personal and corporate income taxes as operating independently from each other.

Second, targeting a small class of high-income taxpayers with rate hikes does not mitigate the damage of excessive taxation. Research shows that the negative effect on economic growth accelerates as rates increase. Thus, broad-based taxes featuring low rates are more likely to foster a healthy ecosystem of innovation than are tax regimes built on high rates and a large array of loopholes that shrink the tax base. This lesson is particularly important in light of the pivotal role that inventors and innovators play in generating new ideas that increase prosperity for society as a whole. By considering how both the level and the design of the tax code affect innovation, policymakers can take steps to improve economic growth and thus produce rising living standards for decades to come.