Introduction

In modern history, employment in the United States has typically involved working full-time for one employer in exchange for a salary and benefits. But an increasing number of Americans are now working in nontraditional work arrangements, often as independent contractors rather than as full-time employees. These nontraditional work arrangements can offer greater flexibility and autonomy, giving workers the ability to set their own schedules and decide which projects they’d like to take on. They also come with some added risk due to a lack of healthcare and other benefits traditionally offered by employers.

Although nontraditional work arrangements themselves are not new, technological change has enabled greater access to markets and information, bringing with it new and innovative business models. Online platforms have reduced barriers for contractors and customers to do business with each other. These platforms have contributed to recent growth in a sector of the workforce often referred to as the gig economy. In this paper, the term “gig work” is used to describe work arrangements enabled by digital platforms that are not permanent, such as contract or freelance work. Growth in the gig economy has been fueled by on-demand ridesharing services like Uber and Lyft, by handymen putting their skills to work through one-off home improvement projects on sites like Thumbtack, and by artisans selling their crafts to customers around the world on Etsy.

In this paper, we explore the role technological innovation has played in redefining employer-employee relationships and fueling growth in the gig economy. The key mechanism we focus on is the way new innovations have impacted transaction costs—the tangible and intangible costs incurred any time two or more individuals engage in a mutually beneficial exchange. In the context of labor markets, we focus specifically on labor market matching costs. For example, when a company wants to hire a new employee, they face numerous costs, such as posting a job listing, examining resumes, spending time interviewing prospective candidates, and training a new hire. Likewise, any individual searching for employment must invest time and effort into identifying potential jobs, creating a resume, and interviewing. These are but a few examples of the costs which must be borne by employer and employee before they can enter the beneficial contract of employment.

Over the last two decades, online platforms have reduced labor market matching costs through secure payment processing, two-way rating systems, and the provision of liability insurance, among others. By providing these services, online platforms are helping to increase trust between would-be strangers, and allowing the gig economy to flourish.

Nontraditional work arrangements are on the rise, especially in the wake of the COVID-19 pandemic, which has pushed many workers and companies to adopt more flexible forms of work out of necessity. But despite this increase in gig work, public policy has not kept up. Modern labor laws, which were developed in response to the traditional employment structure of the 20th century, could benefit from greater flexibility. We conclude by suggesting several potential policy changes that would allow for greater flexibility and more innovative arrangements between workers and employers, increasing the mutual benefits for both.

The Changing Nature of Work

According to Nobel laureate economist Christopher Pissarides, the global labor force is currently undergoing the greatest change the world has seen since the end of World War II.1Christopher Pissarides, “How Can We Make Labor Shifts Work for People?,” interview by Rik Kirkland, McKinsey Global Institute, May 18, 2018, https://www.mckinsey.com/featured-insights/future-of-work/how-can-we-make-labor-shifts-work-for-people. This change is largely being driven by major innovation and technological advancement in artificial intelligence, automation, and computing. Such changes have allowed for new types of work to emerge, including gig work mediated by online platforms. These new arrangements provide workers with greater flexibility and autonomy. But technological change also makes many people uneasy about whether workers may be automated out of jobs altogether.

Numerous academic studies in recent years have attempted to quantify the effect of technological innovation on employment. The resulting answers, however, fail to provide a clear picture of what the future holds for the American worker. For example, a landmark 2013 study from Oxford professors Carl Benedikt Frey and Michael A. Osborne found that 47 percent of total US employment is at risk of computerization.2Carl Benedikt Frey and Michael A. Osborne, “The Future of Employment: How Susceptible Are Jobs to Computerisation?,” Technological Forecasting and Social Change 114 ( January 2017): 254–80. Those findings received international recognition among news outlets, and the novel machine learning methodology they developed was implemented by the US Council of Economic Advisors and the World Bank, among others.3“Dr. Carl Benedikt Frey,” University of Oxford: Oxford Martin School, accessed January 15, 2021, https://www.oxfordmartin.ox.ac.uk/people/dr-carl-benedikt-frey/.

Three years after the Oxford study, the Organization for Economic Co-operation and Development (OECD) released a study based on the same methodology. They sought to add more nuance to the discussion, however, by focusing on the risk of specific tasks being automated, rather than entire occupations. The authors note that

In this paper, we follow a task-based approach to transfer the results by [the Oxford study] to other OECD countries. The approach is based on the idea that the automatability of jobs ultimately depends on the tasks which workers perform for these jobs, and how easily these tasks can be automated.

Using this task-based approach, the OECD study found that only 9 percent of US employment was at risk of automation—a far smaller number than the Oxford study found.4Malanie Arntz, Terry Gregory and Ulrich Zierahn, “The Risk of Automation for Jobs in OECD Countries: A Comparative Analysis”, OECD Social, Employment and Migration Working Papers, No. 189 (May 2016). A 2020 paper by economists Daron Acemoglu and Pascual Restrepo analyzes data from 1990 to 2007 to gain historical context about how robots have replaced jobs in the past and what that may mean for workers going forward. The authors found that over the 17-year span, every additional robot per thousand workers reduced wages by 0.42 percent and employment by 0.2 percentage points. That is to say, every new robot displaced 3.3 workers.5Daron Acemoglu and Pascual Restrepo, “Robots and Jobs: Evidence from US Labor Markets,” Journal of Political Economy 128, no. 6 (August 2019): 2188–244.

The literature has not been all doom and gloom, however. Several recent studies have also found positive economic growth due to technological advancement. In 2018, economists Georg Graetz and Guy Michaels used data from 17 different countries, including the United States, South Korea, Australia, and a mix of European countries, to understand how the growing use of robots impacted labor and productivity from 1993 to 2007. Graetz and Michaels found that the growing use of robots has had no significant impact on overall employment in the countries studied. They did, however, find a number of positive impacts resulting from the growing use of robotics, including a 15 percent increase in aggregate economy-wide productivity, increases in both total-factor productivity and wages, and a reduction in output prices.6Georg Graetz and Guy Michaels, “Robots at Work,” Review of Economics and Statistics 100, no. 5 (December 2018): 753–68.

A 2017 study from economists David Autor and Ana Solomons examined the effect of productivity growth on employment, rather than the effects of specific technologies, noting that technological innovation is generally useful as a way to increase productivity.7David Autor and Anna Salomons, “Robocalypse Now—Does Productivity Growth Threaten Employment?,” in Investment and Growth in Advanced Economies (Conference proceedings, ECB Forum on Central Banking, Sintra, Portugal, June 26–28, 2017), 45–118. The study used a dataset of 19 countries and covered the years from 1970 to 2007. The authors found that while sector-specific productivity increases did tend to decrease employment in those specific sectors, the spillover effects of those productivity gains also led to aggregate growth in employment.

As experts have pointed out—and many of the authors listed above have acknowledged—attempting to predict the impact of innovation on future employment is a challenging task. Throughout history, the only constant in the American workplace has been change. Technological innovation has a habit of disrupting existing industries; for example, automobiles replaced horse-drawn buggies and their drivers. But technology has also brought with it massive improvements in Americans’ quality of life and the creation of new jobs that yesterday’s workers may never have imagined. We no longer have horse-and-buggy drivers (at least not outside of novelty uses), but instead we have millions of jobs in transportation, ranging from semi truck drivers to airplane pilots.8US Bureau of Labor Statistics, “Industries at a Glance,” accessed October 22, 2020, https://www.bls.gov/iag/tgs/iag48-49.htm.

Technology allows for new kinds of firms to emerge, bringing with them new job opportunities. Thanks to technological change, today’s workforce also includes ridesharing drivers who use their cars to earn extra income and freelancers who offer graphic design or software coding services through online platforms. As technology continues to evolve, the workforce will continue to change, too.

With this change will come a continued adjustment in most people’s relationships with work. This adjustment promises to provide greater flexibility, autonomy, and potentially even greater job satisfaction for the workers of the future. But realizing these benefits will also require policy makers to reimagine their approach to regulating labor markets.

Birth of the Traditional Workplace

The fear of being innovated out of a job is not a new phenomenon. In 1930, economist John Maynard Keynes wrote a thought-provoking essay titled “Economic Possibilities for our Grandchildren.” Keynes, in addressing the Great Depression and economic despair of the times, sought to provide an optimistic view of the future. He coined the term “technological unemployment” in referring to the fear that innovation was making economic production so efficient that it was outpacing people’s ability to find new means of employment—the fear that workers were becoming obsolete.

Keynes acknowledged a shift was occurring in the labor force. But rather than allowing the dire circumstances of 1930 to cloud his view, he took a step back to look at the overall landscape of human and economic growth. He pointed out that for the vast majority of human existence, quality of life remained relatively unchanged. Subsistence farming was the employment of the masses, and the primary human pursuit was survival. This all began to change in the 18th century. The Industrial Revolution, which was set in motion by the development of the steam engine, fundamentally altered mankind’s economic foundations. The subsequent growth in wealth brought with it a windfall of innovations, each of which vastly improved the standard of living in industrialized countries.9John Maynard Keynes, “Economic Possibilities for Our Grandchildren,” in Essays in Persuasion (New York: W. W. Norton & Co., 1963), 358–73. It also fundamentally shifted how people were employed.

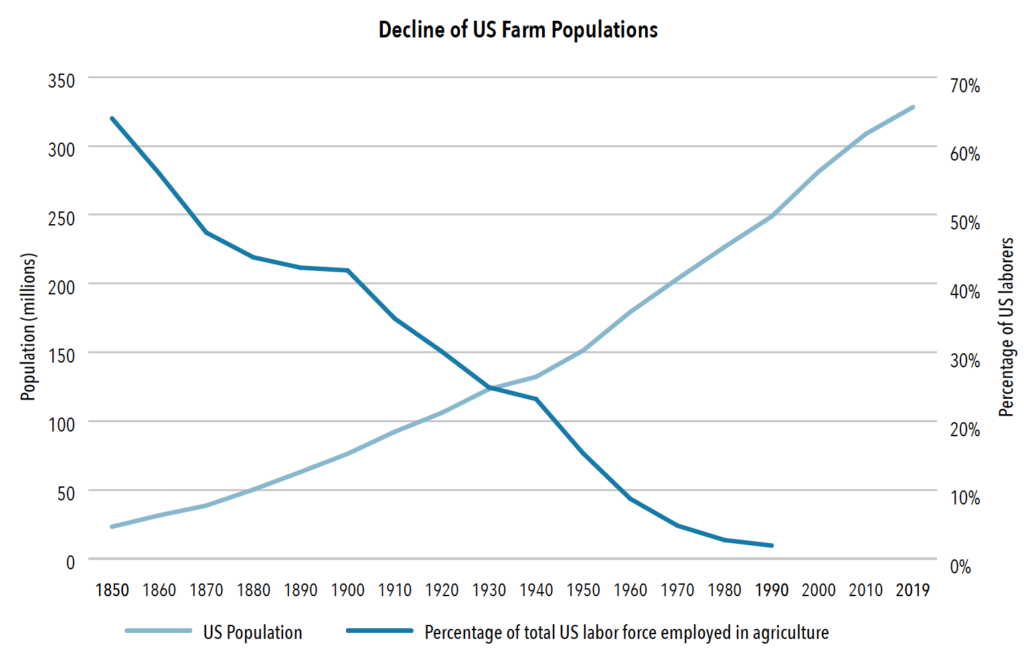

As shown in figure 1, by 1870, agriculture no longer accounted for the majority of employment in the United States. The left axis denotes population in millions and the right axis denotes the percentage of US workers in agriculture. Fifty years later, when Keynes was writing his essay, only one-fourth of total employment was in agriculture. Scholars who documented this massive shift point to two key drivers: rising wages in nonagricultural jobs led workers to seek employment elsewhere, and improving technology made it more efficient to operate fewer total farms, but on a larger scale.1010 Clayton A. Hayes, “The Integration of 18th and 19th Century Subsistence Farming Practices into the Planning and X-zoning Laws of the City and County of Baltimore” (master’s thesis, James Madison University, 2013), 11–12, https://commons.lib.jmu.edu/cgi/viewcontent.cgi?article=1244&context=master201019. As Keynes pointed out, many people failed to recognize the growth in nonagricultural industries that had occurred before the Great Depression, and he accurately predicted that growth would continue far into the future.

Figure 1. Decline of US Farm Populations

Source: US Census Bureau, “Decennial Census of Population and Housing,” accessed October 22, 2020, https://www.census.gov/programs-surveys/decennial-census.html.

Economists had long observed how resources are allocated through the price mechanism. As Sir Arthur Salter described it, “The normal economic system works itself. For its current operation it is under no central control, it needs no central survey. Over the whole range of human activity and human need, supply is adjusted to demand, and production to consumption, by a process that is automatic, elastic and responsive.”11Ronald H. Coase, “The Nature of the Firm,” Economica 4, no. 16 (November 1937): 386–405.

What stumped economists, however, was why labor was not allocated in the same way. Rather than individual workers moving from job to job depending on where their skills were most valued at any given time, they had organized into structured employer-employee relationships, which economists referred to as firms. This employment structure seems very natural today, but it was a fairly new phenomenon in the years following the Industrial Revolution.

In 1937, an English economist named Ronald Coase published a groundbreaking paper titled “The Nature of the Firm.”12Coase, “Nature of the Firm.” In it, he posited that the reason firms arise is due to the existence of transactions costs. Coase defined transaction costs in his Nobel lecture: “What the prices are has to be discovered. There are negotiations to be undertaken, contracts have to be drawn up, inspections have to be made, arrangements have to be made to settle disputes, and so on.”13Ronald H. Coase, “The Institutional Structure of Production” (Nobel Prize Lecture, Stockholm, Sweden, December 9, 1991), https://www.nobelprize.org/prizes/economic-sciences/1991/coase/lecture/. Coase was describing the cost of negotiating prices, agreeing on the specific terms of a given transaction, gathering information, and establishing the procedures to be followed if the interaction fails to go as planned.

According to Coase, firms develop as a mechanism to reduce the burden of transaction costs. When an employer sets up a contract with an employee, he is agreeing to pay a wage for an employee’s time and talents, and in return the employee is expected to act in the company’s best interests by devoting his or her efforts to furthering the mission. This aligns the employer’s incentives with those of the employee.

The alternative to hiring full-time employees would be to create separate contracts with workers for every task that needs to be done. But establishing contracts is costly. It takes time and effort to find the right person for a specific contract, to establish terms for payment and what constitutes satisfactory completion of the job. As Coase described it, “A firm is likely therefore to emerge in those cases where a very short-term contract would be unsatisfactory.”14Coase, “Nature of the Firm.”

This idea that transaction costs impact resource allocation became such a fundamental part of economic theory that it is now known as the Coase Theorem. It is also key to understanding why technological innovation has had such a major impact on traditional employment.

Transaction Costs and the Future of Work

Following the end of World War II, the United States began a new era of economic prosperity. It was the beginning of the information age and marked the US transition from a mostly industry-driven economy to one centered around technology and information. The rate of innovation also continued to increase. Televisions began to replace radios. The 50-ton supercomputer that ushered in the information age evolved into a much more powerful desktop computer in several decades.

As technology evolved, so did firms. Workers began to move from factory floors into corporate offices. Employer capital began to shift from industrial machines to office equipment. Knowledge workers— workers whose main asset is not their physical labor but rather their specialized knowledge—became increasingly more valuable and more numerous than before.

As all of this change was occurring, scholars were working to expand upon Coase’s ideas of transaction costs and firm organization. Two key perspectives grew out of this scholarship that provide deeper insight into today’s changing nature of labor market relationships. The first, developed by economists Arman Alchian and Harold Demsetz in the 1970s, recognized that firms help reduce transaction costs not only between employers and employees but also between employees. Alchian and Demsetz claimed that firms act as the contractual agent between a team of specialists, effectively lowering the cost of cooperation and allowing teams within a firm to work together more efficiently.15Armen A. Alchian and Harold Demsetz, “Production, Information Costs, and Economic Organization,” American Economic Review 62, no. 5 (December 1972): 777–95. This created more value as knowledge work grew and specialists needed a way to connect and work together.

The second line of research, introduced by Kathleen Conner and C. K. Prahalad in the 1990s, argued that firms also provide a lower-cost option for laborers to access valuable resources—in this case, knowledge. Conner and Prahalad argued that firms create a knowledge substitution effect. An employer who is an expert in a certain area or with a certain skill can hire multiple employees who are not experts but have a desire to learn. Through knowledge substitution, the employer transmits his knowledge to his employees, making them better employees for him and providing them with an increased understanding. As the authors put it, “An individual will favor knowledge substitution—and hence, all else equal, a firm—when the manager’s understanding (present or future) is believed to be of superior value compared to corresponding elements of the employees.”16 Kathleen R. Conner and C. K. Prahalad, “A Resource-Based Theory of the Firm: Knowledge versus Opportunism,” Organization Science 7, no. 5 (September-December 1996): 469–592. Essentially, Conner and Prahalad claimed that in an instance where the transaction costs of being hired by a firm are equal to those of being hired as a contractor, workers will favor the firm because the worker stands to gain from the knowledge held by managers within the firm.

These scholars, writing at the end of the 20th century, could never have foreseen the technological shifts the United States would undergo during the coming decades. Their ideas, however, can provide insight into how technology may shape the nature of work in coming years as innovation continues to reduce transaction costs and potentially reduce or eliminate many of the benefits of organizing as a firm in some industries. In the rest of this paper, we explore the ways technology is allowing workers to find and create new work arrangements, often outside of traditional firms. We also discuss the potential shortcomings of current labor regulations structured around traditional firm employment and suggest opportunities to make benefits more flexible and therefore capable of supporting both traditional and nontraditional employment.

The 21st Century Firm

As the cost of computing power continues to fall and Internet access becomes more widely available, vast amounts of information are increasingly accessible to anyone with an Internet connection. This information revolution has dramatically changed the way that individuals interact with friends, customers, co-workers, and employers. It has also drastically reduced barriers to knowledge, making it easier than ever to learn new skills or identify potential business opportunities.

Platforms such as Indiegogo and Kickstarter provide a much wider market for aspiring inventors to raise capital for new products. Others, like Etsy, offer individuals the chance to sell goods to a broader customer base than would otherwise be possible without the Internet. Complete strangers who have never met are now able to not only find one another but to also confidently transact with each other online. Before buying something on Amazon or inviting a contractor to do renovations on their home, customers can first read reviews online and learn from the experience of others. Poor service providers receive poor reviews, incentivizing better customer service. Tools such as Zoom, Facetime, online forums, and online training sites have made it easier than ever to find specialists to learn from and collaborate with.

The expansion of online platforms has greatly expanded job opportunities for workers looking for the flexibility and autonomy of nontraditional work arrangements through freelance work. Platforms such as Upwork and Freelancer.com now allow independent workers to create profiles to showcase their skills and experience. Companies and individuals can post jobs and receive proposals from freelancers who may be a good fit for their projects. Before they decide with whom to partner, companies can review freelancers’ past work and read reviews from previous clients. These sites also handle payments, further reducing transaction costs.

In the same way that technological innovation is making it easier to connect buyers and sellers, it is also making it easier for employers and employees to find one another. Online platforms such as Monster.com, LinkedIn, and ZipRecruiter now allow companies to post a job opening where it can be seen by millions of job seekers across the globe. Individuals looking for a job can review job openings online before deciding which would be the best fit for their skills and career goals. Sites like Glassdoor also allow job-seekers to read reviews of companies from current and former employees to learn about a company’s culture and rates of job satisfaction. All of this information increases the likelihood that an employer will be able to find the right employee and that an individual will be able to find the right job.

These transformations in technology have given rise to a growing sector of the economy often referred to as “the gig economy.” Scholars Seth Oranburg and Liya Palagashvili describe these broad changes:

[S]earch costs have fallen with the expansion of the Internet and search engines like Google; payment methods have become easier with PayPal and credit cards; the reputation of suppliers has become more open with online review systems, and a host of other technological changes have enabled our modern digital platform systems that have reduced the costs of finding and contracting with individuals across the world.17Seth Oranburg and Liya Palagashvili, “The Gig Economy, Smart Contracts, and Disruption of Traditional Work Arrangements” (working paper, October 22, 2018).

All of these changes mean that work in the 21st century may look very different than it did in 1940s America. Workers now have more options in terms of the type of work arrangement that works best for them. To be sure, most workers continue to work for a single employer in a traditional work arrangement. But many are also taking advantage of opportunities to participate in the gig economy. Online platforms provide workers the chance to earn extra income on the side by driving for ridesharing companies. Others choose to piece together their entire income from different gigs that give them the flexibility and autonomy they seek. In what follows, we examine key differences between opportunities in the gig economy and traditional employment.

The Birth of the Gig Economy

The gig economy refers to the growing sector of the labor force participating in work arrangements outside of a traditional employer-employee relationship. A traditional full-time employee is often referred to as a W-2 worker because of the tax form that such workers file with the IRS. Likewise, independent contractors or freelancers are sometimes referred to as 1099 workers. Such workers have more autonomy over their terms of employment, including the work they engage in and when and how they perform that work. They can also choose to take on work from multiple employers at any given time.

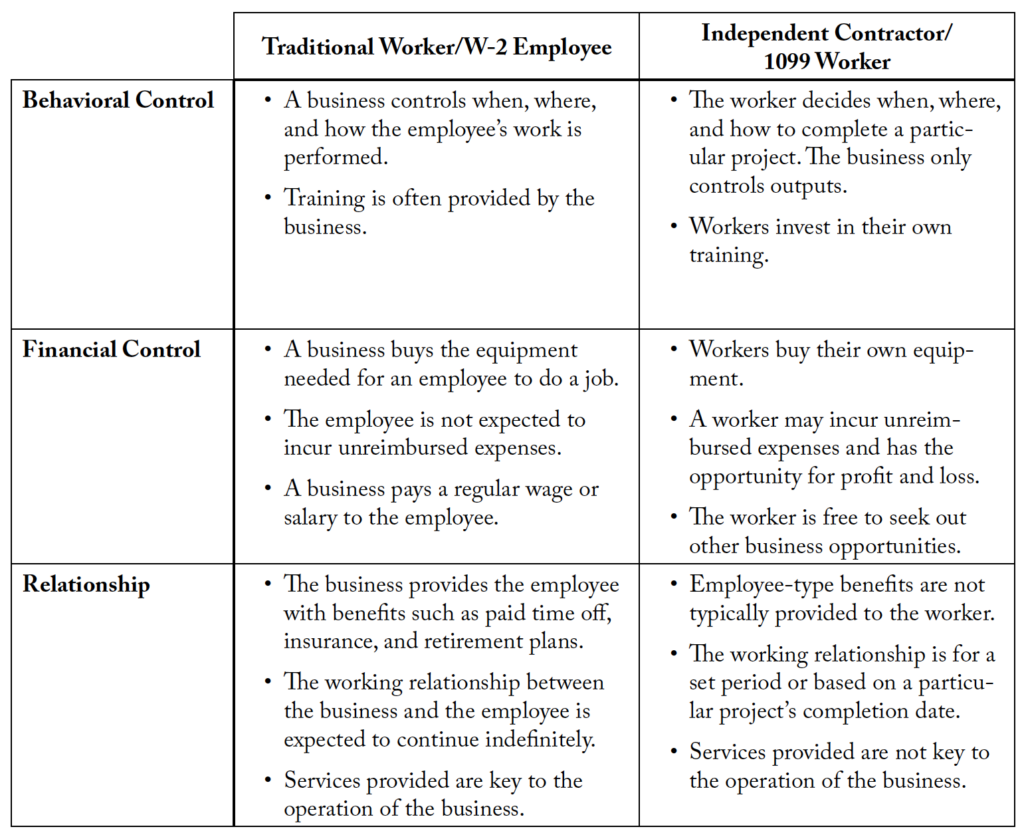

The IRS provides guidance to businesses about how to categorize their workers as W-2 employees or 1099-MISC contractors, which is an important distinction for tax purposes. These factors include the degree to which the business controls the work being performed and whether benefits such as paid time off and access to tax-advantaged retirement accounts are provided. One key distinction the IRS makes is whether an employment relationship is expected to continue indefinitely (as in the case of a W-2 worker) or not (as in the case of an independent contractor). Not all gig workers are 1099 workers, and some W-2 workers may also participate in gig work outside of their W-2 job. But the designations can be useful when classifying workers. Table 1 provides a summary of the key determinants as to whether a worker is an employee or a contractor.

Table 1. Determining a Worker’s Employment Status

Source: Internal Revenue Service, “Understanding Employee vs. Contractor Designation,” July 20, 2017, https://www.irs.gov/newsroom/understanding-employee-vs-contractor-designation.

The gig economy includes the growing workforce of independent contractors who provide services or do work for multiple clients, often through an online platform. In other research she has published on the new era of the worker, Liya Palagashvili defines the gig economy as “labor market activities coordinated via digital platforms whereby individuals take on commissioned tasks without guarantee of further employment.”18Liya Palagashvili, “Barriers to Portable Benefits Solutions for Gig Economy Workers” (CGO Policy Paper Series 2020.010, Center for Growth and Opportunity at Utah State University, Logan, UT, October 13, 2020).

Instead of working for one employer, someone in the gig economy may work for many different customers by providing services such as transportation or home repairs, or by offering a spare room for rent. Gig economy work is often differentiated from freelance work in that gig work is often mediated by online platforms or apps. For example, Uber and Airbnb provide platforms for gig economy workers to find people who are willing to pay for a ride from point A to B or vacationers who are willing to pay to rent someone’s home or spare room.

Freelance work, on the other hand, is not necessarily mediated by an app or platform, and freelancers often have more ability to set their own rates. Freelancers may provide services, but they are often more focused on knowledge work, such as editing, writing, or software development. Freelancers may use apps such as Upwork or Freelancer.com to find potential clients, but those sites do not set rates for services provided like Uber would.19Palagashvili, “Barriers.” For the purpose of understanding the role of technology in facilitating nontraditional work arrangements, this paper uses the term “gig economy” to refer to workers who rely on digital platforms and those who engage in more traditional freelancing by using digital technologies.

Oranburg and Palagashvili have written about the decision firms must make either to contract with full-time workers or to engage with contractors on a one-off basis. They find that firms are more likely to engage with contractors for jobs that are not likely to be repeated, for jobs that rely on the development of knowledge or skills that are not core to the company’s future operations, and for jobs where assessing someone’s performance is relatively easy. But, as Palagashvili and Oranburg write, “In those cases where there is more uncertainty about individual performance, traditional employment offers an advantage over contracting out to the market because it gives firms the opportunity to closely monitor employee performance.”20Oranburg and Palagashvili, “The Gig Economy.” Essentially, full-time employment helps align the worker’s incentives with the best interests of the company, and this in turn helps increase trust between the two parties.

This model of firms hiring full-time employees to reduce transaction costs helps explain the popularity of traditional W-2 work over the course of the 20th century. Gig work is by no means replacing W-2 work, but it appears that it may be carving out an important sector of the economy.

How Large Is the Gig Economy?

Attempts to quantify the size and scope of the gig economy in recent years have resulted in a wide range of estimates. Differences in how gig work is defined and the ways it is measured both play a role in these discrepancies.

In 2018 the Bureau of Labor Statistics (BLS) released data suggesting that the percentage of American workers in both contingent and alternative employment arrangements fell from 2005 to 2017. BLS defines contingent workers as individuals without an explicit contract for continuing employment. BLS estimated these workers made up 1.3 to 3.8 percent of overall employment in 2017—down from 1.8 to 4.1 percent in 2005. Alternative work arrangements include non-traditional job labor arrangements such as independent contractors, on-call workers, temporary help agency workers, and workers provided by contract firms. According to BLS data, independent contractors made up 7.4 percent of workers in 2005 but only 6.9 percent in 2017.21US Bureau of Labor Statistics, “Contingent and Alternative Employment Arrangements—May 2017,” June 7, 2018, https://www.bls.gov/news.release/pdf/conemp.pdf.

These numbers, however, may underestimate the true number of workers involved in the gig economy. BLS measures employment based on traditional measures and only counted those who participate in the gig economy for their primary source of income.22US Bureau of Labor Statistics, “FAQs about Data on Contingent and Alternative Employment Arrangements (CPS),” August 7, 2018, https://www.bls.gov/cps/contingent-and-alternative-arrangements-faqs.htm. Many people are actually participating in nontraditional work arrangements at night or on the weekends to supplement their existing income and thus would not be included in BLS’s numbers. To add to that, the BLS survey only included those who engage in freelance work at least every week, despite the fact that many are participating in the gig economy on a much less consistent or less frequent basis.

Economists Lawrence Katz and Alan Kreuger used a version of the BLS Contingent Workers Survey to conduct their own analysis, modifying it slightly in an attempt to capture a more complete picture of whether individuals were undertaking gig work. They found that the rate of workers engaged in alternative work arrangements was potentially as high as 15.7 percent toward the end of 2015.23Lawrence F. Katz and Alan B. Krueger, “The Rise and Nature of Alternative Work Arrangements in the United States, 1995–2015,” ILR Review 72, no. 2 (December 2018): 382–416.

In 2018, the Federal Reserve published a report using the Survey of Household Economics and Decisionmaking (SHED), which collects information on

three types of non-traditional activities: offline service activities, such as child care or house cleaning; offline sales, such as selling items at flea markets or thrift stores; and online services or sales, such as driving using a ridesharing app or selling items online. This definition of gig work, encompassing both online and offline activities, takes a broad view of the gig economy and underscores the fact that such supplemental work predates the Internet. Gig work is largely done in addition to a main job, so this is often distinct from those who work as contractors in their main job.24See the “Employment” section in Board of Governors of the Federal Reserve System, “Report on the Economic Well-Being of US Households in 2017 (May 2018),” June 19, 2018, https://www.federalreserve.gov/publications/2018-economic-well-being-of-us-households-in-2017-employment.htm

According to SHED data, 31 percent of US adults participated in the gig economy in 2017. Only 16 percent of respondents were engaged in gig work as a primary source of income, while nearly 40 percent were using gig work as a supplementary income.25Federal Reserve, “Economic Well Being.” Other survey data have resulted in similarly high participation numbers. A report from the McKinsey Global Institute estimated that 20–30 percent of workers in the United States participate in independent work, and the online freelancing platform Upwork found that 35 percent of the workforce has participated in some way in the freelance or gig economy.26UpWork, “Sixth Annual ‘Freelancing in America’ Study Finds that More People than Ever See Freelancing as a Long-term Career Path,” press release, October 3, 2019, https://www.upwork.com/press/2019/10/03/freelancing-in-america-2019/; James Manyika, Susan Lund, Jacques Bughin, Kelsey Robinson, Jan Mischke, and Deepa Mahajan, Independent Work: Choice, Necessity, and the Gig Economy (McKinsey Global Institute, October 2016).

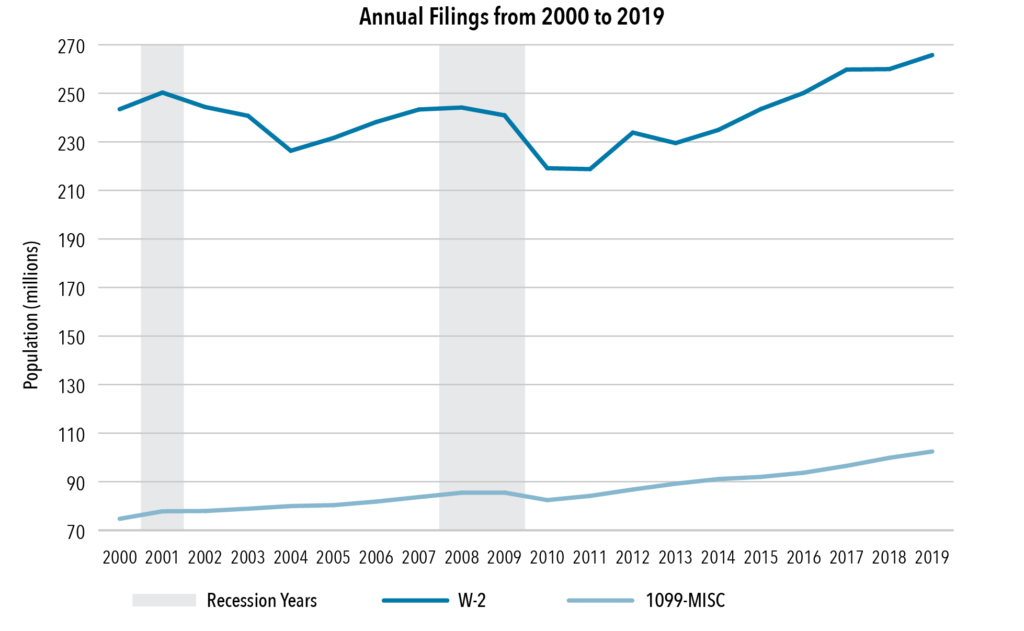

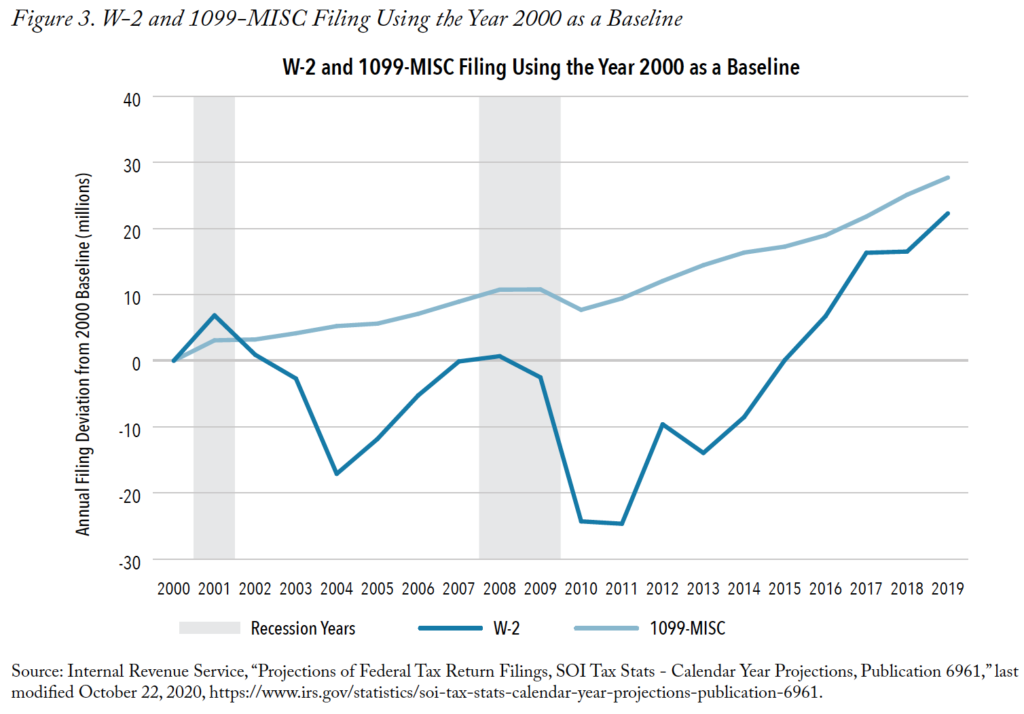

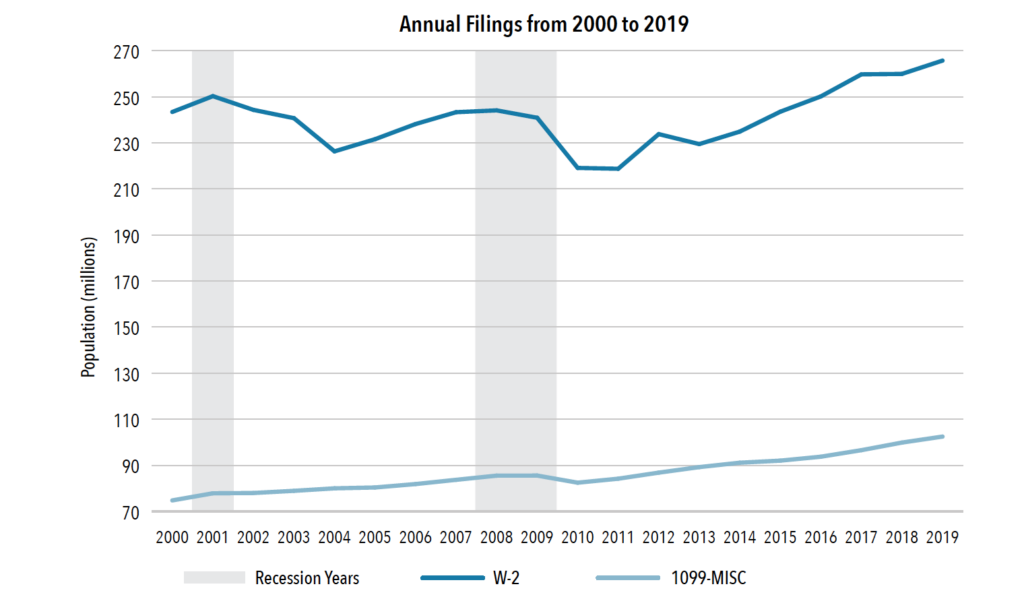

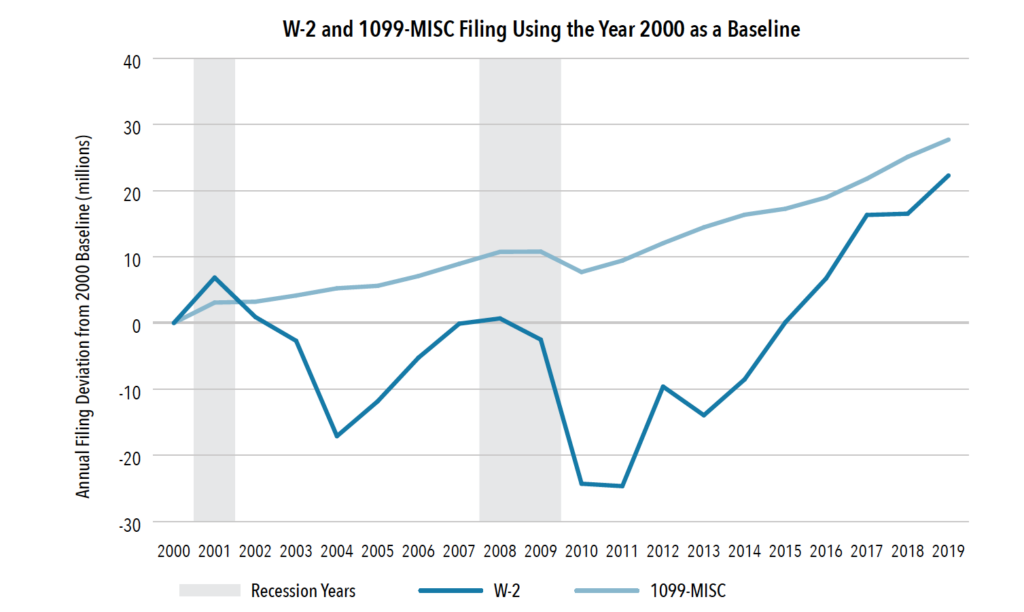

Economists have also attempted to quantify the growth of the gig economy using tax records, comparing the rate of change in W-2 tax forms filed by traditional employees to 1099-MISC forms issued for independent work. A 2015 paper from Dourado and Koopman found that from 2000 to 2014, the total number of 1099-MISC forms issued increased by 22 percent, while the number of W-2 forms fell by 3.5 percent.27Eli Dourado and Christopher Koopman, “Evaluating the Growth of the 1099 Workforce” (Mercatus Policy Brief, Mercatus Center at George Mason University, Arlington, VA, December 2015). Updating those numbers using 2019 data shows continued growth in 1099-MISC filings—nearly 34 percent—and a recovery of W-2 filings surpassing 2000 levels. Figures 2 and 3 provide an updated look at these numbers. It is apparent from figure 2 that W-2 workers still far outnumber 1099-MISC workers. Figure 3, however, uses the year 2000 as a baseline to show how annual filings have fluctuated for each record type in the years since.

Figure 2. Annual Filings from 2000 to 2019

Source: Internal Revenue Service, “Projections of Federal Tax Return Filings, SOI Tax Stats – Calendar Year Projections, Publication 6961,” last modified October 22, 2020, https://www.irs.gov/statistics/soi-tax-stats-calendar-year-projections-publication-6961.

Figure 3. W-2 and 1099-MISC Filing Using the Year 2000 as a Baseline

Source: Internal Revenue Service, “Projections of Federal Tax Return Filings, SOI Tax Stats – Calendar Year Projections, Publication 6961,” last modified October 22, 2020, https://www.irs.gov/statistics/soi-tax-stats-calendar-year-projections-publication-6961.

Over the past two decades, 1099-MISC filings have increased year after year except for a slight dip following the recession in 2008. W-2 filings on the other hand have been much more volatile over the same period, which is not surprising as W-2 employment tends to rise and fall with the economy. The recessions that occurred in 2001 and 2008 are largely to blame for this volatility, but it is worth noting that 1099 work did not suffer the same fate. Economists Robert G. Valletta and Emilie Jackson both provide evidence that in times of rising unemployment, workers will tend to shift toward gig work and tend to remain even after employment opportunities improve.28Robert G. Valletta, Leila Bengali, and Catherine van der List, “Cyclical and Market Determinants of Involuntary Part-time Employment,” Journal of Labor Economics 38, no. 1 ( January 2020): 67–93; Emilie Jackson, “Availability of the Gig Economy and Long Run Labor Supply Effects for the Unemployed” (working paper, December 20, 2020). Susan N. Houseman and Carolyn J. Heinrich found that employers also increase reliance on temporary workers during economic downturns.29Susan N. Houseman and Carolyn J. Heinrich, “Temporary Help Employment in Recession and Recovery” (Upjohn Institute Working Paper 15-227, W. E. Upjohn Institute for Employment Research, Kalamazoo, MI, May 1, 2015).

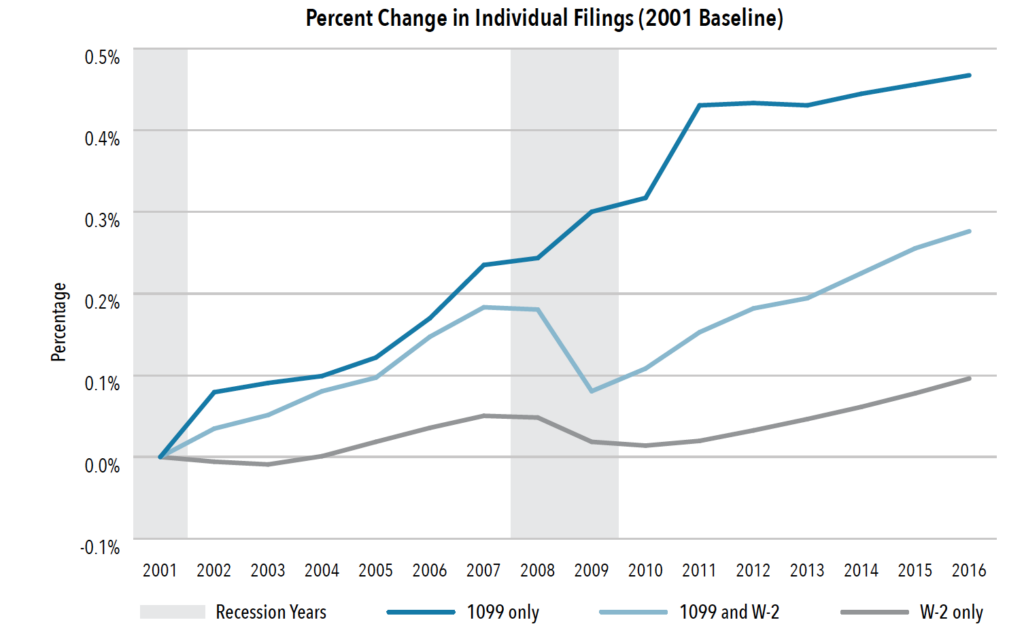

Other scholars have used 1099 filings as metrics for measuring gig-work trends. Katherine Lim and her coauthors used IRS data to identify and separate laborers filing both W-2 and 1099-MISC from those filing only one or the other. Using this more precise identification method they found the share of workers earning income as independent contractors increased 22 percent between 2001 and 2016. They also found that while the largest share of earnings is going to the top quartile of earners who file both W-2 and 1099 forms, the fastest growth in contracting is occurring in the lowest quartile of earnings.30Katherine Lim, Alicia Miller, Max Risch, and Eleanor Wilking, “Independent Contractors in the US: New Trends from 15 Years of Administrative Tax Data,” Internal Revenue Service SOI Joint Statistical Research Program, July 2019, https://www.irs.gov/pub/irs-soi/19rpindcontractorinus.pdf. Figure 4 high- lights the change in individual filings for 1099 earners, W-2 earners, and combined earners using Lim et al.’s identification method.

Figure 4. Percent Change in Individual Filings (2001 Baseline)

Source: Katherine Lim, Alicia Miller, Max Risch, and Eleanor Wilking, “Independent Contractors in the US: New Trends from 15 Years of Administrative Tax Data,” Internal Revenue Service SOI Joint Statistical Research Program, July 2019, https://www.irs.gov/pub/irs-soi/19rpindcontractorinus.pdf.

Brett Collins et al. took a similar approach by identifying 1099 filings tied to earnings made primarily through online platforms. They found that participation in the “1099 workforce” increased by 1.9 percent from 2000 to 2016 and that most of that increase was due to gig workers participating in online platform-mediated work. They also found that most of this growth did not represent a primary source of income; rather, it was small amounts of income generated by people who were not otherwise employed, or additional income generated by people supplementing full-time jobs.31Brett Collins, Andrew Garin, Emilie Jackson, Dmitri Koustas, and Mark Payne, “Is Gig Work Replacing Traditional Employment? Evidence from Two Decades of Tax Returns,” Internal Revenue Service SOI Joint Statistical Research Program, March 25, 2019, https://www.irs.gov/pub/irs-soi/19rpgigworkreplacingtraditionalemployment.pdf.

Although most workers continue to work in W-2 jobs, historical tax data show a trend toward more work in the 1099 economy. Part of this trend is due to increasing opportunities in the gig economy, where many workers are choosing to earn all or part of their income. Many workers are participating in the gig economy, if only to earn additional income on the side. Historical data also help confirm the important role that gig economy jobs play in providing financial stability during an economic downturn. In what follows, we examine key factors behind the trend toward more work in the gig economy.

What’s Shaping the Gig Economy?

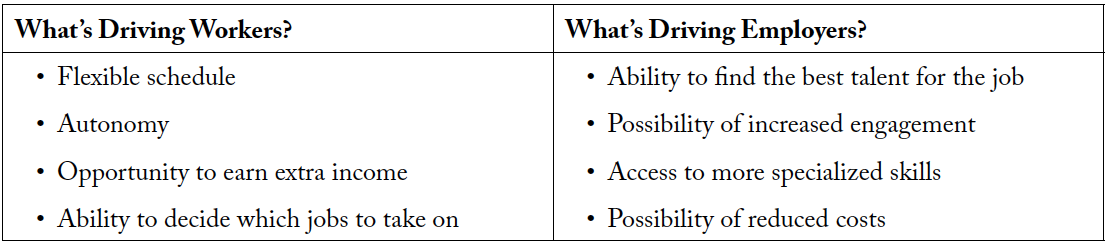

A key question in debates about the gig economy is whether growth is being driven by employers seeking to cut costs by working with contractors, or by workers seeking more flexible job opportunities that fit their preferences better than a traditional job. Surveys of workers and businesses help shed light on key factors shaping the trend toward more flexible work in the online gig economy. They suggest that both are likely playing important roles because both stand to gain in significant ways from the flexibility of gig work.

Much of the movement toward nontraditional work seems to be driven by workers seeking flexibility and the opportunity to earn additional income. The freelancing platform Upwork conducts annual surveys of independent workers across the United States. In 2019, Upwork surveyed over 6,000 workers—2,117 of whom identified as freelancers. Based on the survey, Upwork estimated that 35 percent of Americans freelance and that 60 percent do so out of choice rather than necessity. Flexibility was the top reason given for freelancing, with 46 percent of respondents agreeing that freelancing gives them the flexibility they need, due to health or family obligations—obligations that prevent them from working for a traditional employer. For the first time Upwork also found that as many workers view freelancing as a long-term career choice as those who view it as a temporary way to earn income (a 50-50 split). Over 90 percent agreed with the statement that “the best days are ahead for freelancing.”32Upwork, “Sixth Annual.”

The online marketplace Etsy produces a biannual “Seller Census Report” that highlights motivations and challenges faced by its growing community of over 2 million sellers across the globe who use the platform to market and sell their creative goods. Etsy’s 2019 report surveyed 6,797 sellers across its core markets. The report found that US sellers generated $1.76 billion in gross merchandise sales in 2018. In the United States, 51 percent of sellers work independently and 79 percent are businesses of one.

The survey also examined the key motivations among Etsy sellers for choosing the platform, which is particularly popular among women. Etsy’s survey found that 87 percent of sellers are women, and that 44 percent of women who sell on Etsy are motivated by the desire for flexibility (compared to 36 percent of men). Likewise, 64 percent of women who sell on Etsy believe that doing so “gives them more freedom than general employment.” Women are also twice as likely as men to have begun selling on Etsy while caring for a family member or having other circumstances that prevent them from being able to work outside the home. Finally, a majority of sellers indicated that the platform “gives them the opportunity to do what they love for a living.”33Etsy, Celebrating Creative Entrepreneurship around the Globe, 2019 Global Seller Census Report, Spring 2019, https://extfiles.etsy.com/advocacy/Etsy_GlobalSellerCensus_4.2019.pdf. These results indicate that the desire for flexibility is an important factor motivating workers to seek out nontraditional work arrangements mediated by online platforms like Etsy.

Concerns about the changing workplace and anxiety about being automated out of a job may also be driving more people to explore gig work. In an international survey conducted by the Pew Research Center, a majority of respondents in every country surveyed said that robots and computers will “probably” or “definitely” take over most of the jobs of today.34Richard Wike and Bruce Stokes, “In Advanced and Emerging Economies Alike, Worries about Job Automation,” Global Attitudes Project, Pew Research Center, July 23, 2020, https://www.pewresearch.org/global/2018/09/13/in-advanced-and-emerging-economies-alike-worries-about-job-automation/. In its 2019 survey, Upwork found that freelancers tend to be more proactive in seeking out reskilling opportunities, with 54 percent having participated in the last six months compared to 40 percent of traditional workers.35Upwork, “Sixth Annual.”

Freelancers may have more to lose if their skills become outdated, and they cannot depend on employer-sponsored reskilling programs that are increasingly being offered by companies like Amazon.36 Matthew Bidwell and Ari Ginsberg, “Will Amazon’s Plan to ‘Upskill’ Its Employees Pay Off?,” Wharton Business Daily (podcast), July 22, 2019, https://knowledge.wharton.upenn.edu/article/amazon-retraining-employees/. On the other hand, freelancers may have more to gain, as reskilling could make them more competitive among clients looking for the best and brightest independent talent to help them innovate in a changing market.

Of course, companies are also driving growth in the nontraditional or freelance economy. Many argue that companies are increasingly turning to freelancers or independent contractors to save on costs such as health insurance, paid time off, and 401(k) contributions. For example, scholar Gerald Friedman has expressed concern that moving toward gig work shifts too much of the economic risk away from the firm and onto the worker. He writes that the rise of the gig economy is “driven by the concerns of businesses to lower wages and benefit costs during business downturns while also reducing their vulnerability to unfair dismissal lawsuits.”37Gerald Friedman, “Workers without Employers: Shadow Corporations and the Rise of the Gig Economy,” Review of Keynesian Economics 2, no. 2 (April 2014): 171–88.

While cost factors certainly play a role, companies may also be turning to freelancers so they can employ the best talent for a particular project. A 2018 survey of over 1,000 US managers conducted by Upwork found that 39 percent of managers thought that hiring the right person is becoming more difficult, while 59 percent said skills are becoming more specialized. As a result, companies are increasingly reliant on a more flexible workforce; this includes remote work for traditional employees as well as more contracts with freelancers and temporary workers. Upwork calls this combination of freelancers and temporary workers “flexible talent” and finds that 59 percent of hiring managers in 2018 used flexible talent—a 24 percent increase from 2017. The hiring managers they surveyed predicted that the work done by flexible talent will increase 168 percent in the next decade.38Upwork, “New Report Finds Majority of Companies Are Embracing Remote Teams, Yet More than Half Lack a Remote Work Policy,” press release, February 28, 2018, https://www.upwork.com/press/2018/02/28/future-workforce-report-2018/.

Another reason companies may increasingly be turning to contractors is that worker engagement (and thus productivity) may actually increase with some types of independent work. The consulting and analytics firm Gallup has found that engagement among gig economy workers varies depending on the type of work being done. For example, Gallup’s “Perspective on the Gig Economy and Alternative Work Arrangements” found that gig economy workers who hold more independent roles as independent contractors or participants in online platforms report even higher levels of engagement (36 percent) than traditional workers (27 percent). Gig economy workers who work as temporary workers, however, have lower levels of engagement (19 percent) than traditional workers. Gallup refers to these differences in worker engagement as “a tale of two gig economies,” noting that other differences also exist in terms of creativity, flexibility, feedback, and pay.39Gallup, The Gig Economy and Alternative Work Arrangements (Washington, DC: Gallup, Inc., 2018).

Figure 5. Motivating Factors in the Gig Economy

Figure 5 summarizes some of the motivating factors among workers and employers that play a role in the continued growth of the gig economy.

Although gig workers still make up a small percentage of the overall work done in America, trends in labor market data and workforce surveys suggest flexible work will play an important role in the US economy going forward. As workers in all kinds of employment situations continue to seek out more flexible work arrangements and greater autonomy, changes in current labor regulations may be needed to allow for continued innovation and growth. The next section will briefly discuss how current policy is impacting nontraditional work arrangements and will identify ways to increase flexibility and growth going forward.

Public Policy and the Gig Economy

Despite its benefits, growth in the gig economy has not been without controversy. Workers’ rights advocates have criticized employers for allegedly misclassifying workers as independent contractors to avoid providing benefits to save on costs.40Ephrat Livni, “The Gig Economy Is Quietly Undermining a Century of Worker Protections,” Quartz, February 26, 2019, https://qz.com/1556194/the-gig-economy-is-quietly-undermining-a-century-of-worker-protections/. And in cities across the United States, gig workers themselves have taken to the streets to protest unfair pay and a lack of benefits such as employer-sponsored health insurance and paid time off.41Lauren Feiner, “Uber Drivers Will Go on Strike over Pay and Benefits ahead of the Company’s $90 Billion IPO,” CNBC, May 8, 2019, https://www.cnbc.com/2019/05/07/uber-lyft-drivers-to-go-on-strike-over-low-wages-and-benefits.html.

In response, some cities and states have enacted policies that require companies to treat gig economy workers more like traditional employees. In 2018, for example, New York City enacted a minimum wage of $17.22 per hour for app-based drivers in the city. Many lauded the changes as providing important protections for Uber and Lyft drivers in the city. Uber, however, claimed the requirement would only lead to higher fares for riders.42Peter Holley, “New York City Sets $17 Minimum Wage for Uber, Lyft Drivers,” Chicago Tribune, December 5, 2018, https://www.chicagotribune.com/business/ct-biz-uber-drivers-minimum-wage-20181205-story.html.

States have also taken action. In 2019, California lawmakers passed AB-5, which created a three-part test for determining whether a worker is an employee or an independent contractor. Although it was meant to require ridesharing companies to treat their workers as employees, as written the law ended up classifying broad swaths of workers in the gig economy as employees for whom companies must provide benefits.43Margot Roosevelt, Johana Bhuiyan, and Taryn Luna, “Sweeping Bill Rewriting California Employment Law Sent to Gov. Newsom,” Los Angeles Times, September 11, 2019, https://www.latimes.com/business/story/2019-09-11/sweeping-bill-rewriting-california-employment-law-moves-to-gov-newsom. This raised concerns that those who had traditionally worked with many different clients would not be able to continue their work in the first place. For example, a freelance photojournalist or freelance writer who submitted over 35 contributions to one outlet in a given year was considered an employee rather than a contractor under AB-5. Likewise, freelance musicians who had traditionally played at many different clubs would have to be on the venue’s payroll and receive all the same benefits as an employee.44David Wagner, “California Freelancers May Get Relief from Strict AB5 Employment Law,” LAist.com, September 1, 2020, https://laist.com/2020/09/01/california_legislature_passes_ab2257_freelancers_ab5_exemptions.php.

After significant controversy, in 2020 lawmakers exempted a long list of industries from the requirements of AB-5, including fine artists, freelance writers, photojournalists, musicians that play live shows at various venues, real estate appraisers, and others. Ridesharing companies, however, were not exempt from the requirements of AB-5 until Proposition 22 was passed in the November 2020 election.45Epstein Becker Green, “California Adds More Exemptions to Controversial Independent Contractor Statute,” Lexology, September 8, 2020, https://www.lexology.com/library/detail.aspx?g=b29e6b82-e706-4326-a7c6-f10c9e228b8d. Proposition 22 overrode AB-5 by categorizing rideshare and delivery drivers (“app-based drivers”) as independent contractors. The law also created protections for drivers, including minimum earnings protections for engaged time spent driving, healthcare subsidies for those who drive a minimum number of hours per week, occupational accident insurance and disability payments, as well as accidental death insurance.46“California Proposition 22, App-Based Drivers as Contractors and Labor Policies Initiative (2020),” Ballotpedia, accessed December 29, 2020, https://ballotpedia.org/California_Proposition_22,_App-Based_Drivers_as_Contractors_and_Labor_Policies_Initiative_(2020).

Of course, the controversy did not end with the passage of Prop 22. While ridesharing companies lauded the changes as paving the way toward “new benefits structures that are portable, proportional and flexible,” others, such as unions and workers’ rights groups, expressed concern. Chief Officer of the California Labor Federation Art Pulaski categorized Prop 22 as “another brazen attempt by some of the richest corporations in California to avoid playing by the same rules as all other law-abiding companies in our state It steals protections and pay their employees are entitled to under current law.”47Ibid.

This ongoing controversy demonstrates that there is still significant uncertainty about how to allow continued growth in more flexible nontraditional work arrangements while ensuring basic protections for workers. In the following section we explore two ways to get at the root of this uncertainty to allow for continued innovation and flexibility in the workplace.

Rethinking the Distinction between Employee and Contractor

Most US labor laws today were created to govern the workforce of the early 20th century, and many have been in place for over 100 years.48US Bureau of Labor Statistics, “Labor Law Highlights, 1915–2015,” October 2015, https://www.bls.gov/opub/mlr/2015/article/labor-law-highlights-1915-2015.htm. The current approach to regulating the employer-employee relationship in the United States applies a binary system in which workers are categorized as either an “employee” or an “independent contractor.” But this black and white approach may no longer make sense as work arrangements are taking an increasing number of different forms.

Today’s legal protections for traditional employees were put into place to prevent employees from being exploited by their employer. Law professor and former US Deputy Secretary of Labor Seth Harris ex- plains that many of these protections were created to prevent a situation in which “individual employees do not have sufficient power in their relationships with employers to protect themselves from socially unacceptable and economically disadvantageous outcomes.”49Seth D. Harris, “Workers, Protections, and Benefits in the US Gig Economy” (working paper, July 12, 2018). In a traditional employment arrangement, employees mostly give up control over when and how they will work, making them dependent on their employer. Thus, US labor laws seek to protect traditional employees by offering legal guarantees.

In the other category are independent contractors who are free to decide when, how, and for whom they work. Because they have a higher level of autonomy and are not committed to working for a single employer, these workers are not covered by the same legal protections as traditional employees.

But the growing gig economy of today does not cleanly fit into one or the other of these two binary categories. For example, Uber drivers have the autonomy and freedom to decide when and how much they drive. They can also decide to drive part-time for Uber’s rival Lyft. These characteristics of employment seem to make Uber drivers independent contractors. Another legal criterion for determining whether someone should be categorized as an employee, however, is whether the work they do is considered “integral” to an employer’s business. An argument can be made that the work Uber drivers do is integral to the company’s ability to provide ridesharing services. Seth Harris argues that Uber drivers and other gig economy workers fall into a grey area between traditional workers and independent contractors and that a new regulatory approach is needed.50Harris, “Workers, Protections, and Benefits.”

A fundamental way to address this problem would be to rethink the distinction between employees and independent contractors altogether. Rather than providing multi-part definitions and three-part tests to gauge whether an arrangement will fit the contractor mold or the employee mold, we could allow the parties involved to determine the scope of their contractual arrangement with each other. Such an approach would provide enough flexibility that workers and companies could create a whole new spectrum of relationships. This would expand the realm of what is possible beyond the current employee or independent contractor designations and would allow individuals to enter into agreements that work best for them.

Uncoupling Employment and Benefits

Failing to create a more flexible framework for how we regulate the workplace has the potential to stifle innovation, reduce opportunities for workers seeking more flexible and autonomous work, and make consumers worse off as well. Current policies may even discourage companies from offering some benefits to more independent workers because they risk being categorized as a traditional employer and being subjected to stringent requirements. A more flexible approach is needed that will allow workers and employers to find innovative arrangements that benefit both.

Perhaps the most promising change would be to work toward decoupling employment from the provision of benefits so that workers are not dependent on a single employer for health insurance, retirement contributions, and other benefits. One way to do that would be through portable benefits. Portable benefits are tied to the worker rather than to the employer, and they allow multiple employers to contribute toward the cost. An example of portable benefits in action is the company Trupo, which offers disability insurance on a sliding scale to independent workers. Others include Stride Health and Zego, which ridesharing platforms have partnered with to provide workers with access to insurance.51Lydia Depillis, “Gig Economy Workers Need Benefits. These Companies Are Popping Up to Help,” CNN Business, August 23, 2018, https://money.cnn.com/2018/08/23/technology/gig-economy-worker-benefits/index.html.

Separating the provision of benefits from employment may be politically difficult, but even small steps would allow greater innovation and flexibility in how workers obtain benefits. In a recent policy paper, scholar Liya Palagashvili suggests a first step could be removing the provision of benefits from the criteria for determining whether a worker will be classified as a contractor or an employee. This would remove the current disincentive for platforms and other companies to provide benefits to gig economy workers out of fear they will have to recategorize their workers and provide them with a much more expensive bundle of benefits.52 Palagashvili, “Barriers.”

To truly decouple benefits from employment would also require more fundamental changes in how tax law treats employer-sponsored benefits. Current US tax law has the effect of subsidizing traditional employers who contribute to an employee’s health insurance. In the WWII era of wage and price controls, the IRS determined that employer-paid health insurance premiums were not subject to federal, state, or local income taxes. That includes the federal FICA payroll tax. This policy creates a strong incentive for workers to pursue health insurance through traditional employment because employers who offer it receive a financial benefit.53Palagashvili, “Barriers.”

Some researchers suggest that reducing the tax preference for employer-sponsored health insurance would have benefits in terms of increased government revenue, increased job mobility across job types, and greater freedom in household decision-making around labor force participation.54Palagashvili, “Barriers.” Scholar Jonathan Gruber’s estimates suggest that the exclusion of employer-sponsored insurance should be considered the third-largest tax expenditure by the federal government. He suggests placing a cap on the exclusion that would first be set high and gradually reduced rather than removing the policy altogether, as a first step toward reducing the financial preference for traditional employers that is currently codified in US tax law.55 Jonathan Gruber, “The Tax Exclusion for Employer-Sponsored Health Insurance,” National Tax Journal 64, no. 2 (2011): 511–30.

Removing the incentive for employers to provide health insurance is not the only option, however, and may not be the best way to achieve parity between traditional workers and independent contractors. For example, scholars Jonathan Gruber and Michael Lettau found that removing this tax subsidy would result in employers offering 15 million fewer workers health insurance.56Jonathan Gruber and Michael Lettau, “How Elastic Is the Firm’s Demand for Health Insurance?,” Journal of Public Economics 88, no. 7-8 (2004): 1273–93.

A better way forward would be to maintain the incentive for traditional employers to offer health insurance plans to their workers, and to also create that same incentive for those who work with independent contractors in the gig economy. This policy change would allow those who work with independent contractors to provide insurance without the risk of being recategorized as a traditional employer. It would also provide greater flexibility by allowing employers to compete for workers on the margins that matter most to workers. For example, Uber could compete for rideshare drivers by offering better insurance plans than those available to Lyft drivers. Finally, this change would help move toward greater parity between traditional work arrangements and more flexible ones like contract work in the gig economy.

Other policy options include making it easier for workers to set aside pre-tax dollars toward their own goals. Senator Mark Warner from Virginia has suggested allowing workers to put pre-tax dollars into a “lifelong learning and training account” that could be used for retraining and continual education to help workers stay competitive.57Ruth Reader, “Senator Mark Warner Has a New Plan to Protect Gig Economy Workers,” Fast Company, February 26, 2019, https://www.fastcompany.com/90312184/senator-mark-warner-has-a-new-plan-to-protect-gig-economy-workers. Scholars have also suggested the use of universal savings accounts that would provide the benefits of retirement savings accounts but that allow workers to withdraw money whenever they would like. For example, Adam Michel argues that allowing workers the tax benefits of traditional retirement accounts without as many restrictions would increase incentives to save and give low-income families in particular another vehicle for increasing their financial resilience.58Adam Michel, “Universal Savings Accounts: A Flexible Financial Tool to Support the Gig Economy” (CGO Policy Paper 2020.007, Center for Growth and Opportunity at Utah State University, Logan, UT, August 4, 2020).

Conclusion

The American workplace has gone through many different iterations over time, from the emergence and eventual dominance of the traditional firm in the early 1900s to the many diverse work arrangements visible today. A key factor in that evolution has been transaction costs—the tangible and intangible costs of coming to an agreement about working together. Firms were created, in part, to help reduce transaction costs. By establishing long-term relationships with full-time employees, firms were able to better align their incentives and goals with those of employees. Today, the advancement of technology has made it easier to align these incentives without requiring a traditional work arrangement. Thanks to technology, more information is freely available than ever before. That information makes it easier for employers and employees alike to find the right fit for a project, which may or may not require full-time work.

Technological advances have also resulted in the creation of digital platforms that allow workers to find flexible work in the gig economy. These new technologies have allowed workers to forge new and more flexible work arrangements that work for them, either to replace their income altogether or to supplement income from an existing job. Today’s gig economy in America provides workers autonomy, flexibility, and the ability to earn extra income for themselves and their families. But that flexibility and innovation is not reflected in US labor laws.

Current employment policy in the United States typically categorizes workers as either traditional employees or independent contractors. But the workforce is continuing to change, and many of today’s jobs do not fit neatly into one category or the other. In order to enable continued growth and more innovative employment arrangements, more flexible public policy is needed.

Fundamental changes that decouple benefits from employment provide a promising path forward because they would allow workers to find the arrangements that work best for them. They would also allow employers to compete by offering benefits without the risk of having to recategorize workers. Other options include allowing for portable benefits that travel with the worker rather than with the job. At a more fundamental level, policymakers should consider allowing workers and employers to determine the scope of their contractual arrangement rather than attempting to define it through three-part tests. Such an approach would allow for new and better arrangements between workers and employers that will benefit both innovative companies and entrepreneurial workers of the future.